The Bitcoin (BTC) exchange rate against the dollar in February ended with a high price scramble from beginning to end, stalling from the strong advance in January.

The BTC market in January gained momentum on expectations of a slowdown in inflation in the United States, but once it passed the US Federal Open Market Committee (FOMC) meeting held from January 31 to February 1, it temporarily dropped to $24,000. Even if you put it on, it stalls. As expected by the market, the FOMC decided to reduce the rate hike from 50 basis points (bp) to 25bp, and US Federal Reserve (Fed) Chairman Jerome Powell said positively, “For the first time, we can say that the process of disinflation has begun.” There was a remark, but the feeling that the material was exhausted spread. In addition, the US employment statistics released on the 3rd showed that the increase in the number of monthly employees far exceeded the market expectations, which spread the risk-off mood and weighed down the BTC price.

On the 9th, Kraken suspended its staking service, which was suspected of violating the U.S. Securities and Exchange Law, after reconciling with the U.S. Securities and Exchange Commission (SEC) and paying a fine, and sales of altcoins accelerated. Then, BTC also dropped below $22,000. After that, it became clear that the SEC had sent a notice to Paxos, the issuer of Binance USD (BUSD), notifying him of suspicion of securities law violations, and the NY State Department of Financial Services (NYDFS) issued a notice to Paxos regarding BUSD. Accelerating regulation has become a headwind for the industry, such as issuing a ban on issuance, but there is a movement to escape to BTC, which is outside the jurisdiction of the SEC, and the impact of the Ordinals protocol, which records NFT in 1sats, the smallest unit of Bitcoin. Then the BTC market rebounded.

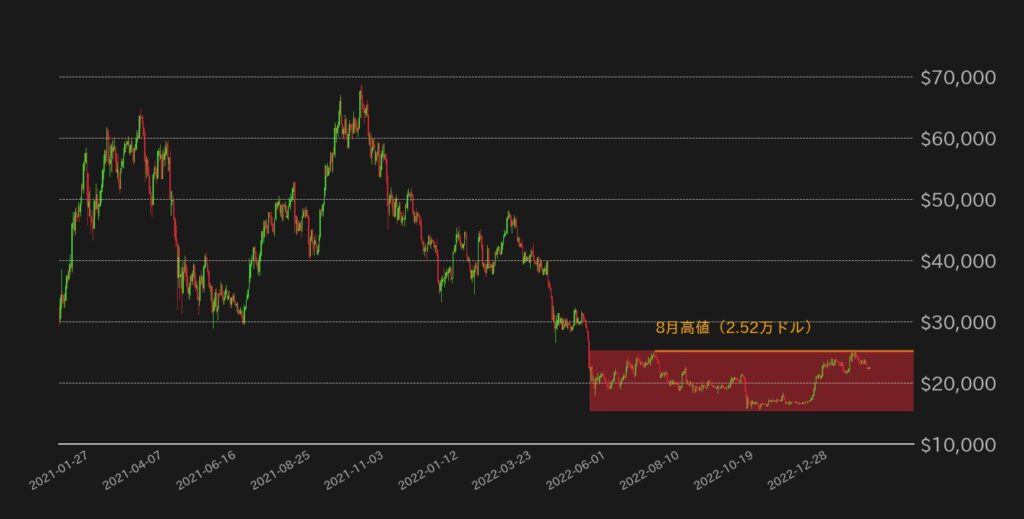

On the other hand, the high price in August last year (approximately $25,200) acted as market resistance, and the BTC market stalled again in the second half of February. Furthermore, as the pace of deceleration in the U.S. consumer price index (CPI) and producer price index (PPI) slowed in January, several U.S. Fed presidents and others expressed concern about the scope for further rate hikes at the FOMC in March. There was a speech, and risk appetite atrophied.

As if to accelerate these concerns, S&P Global’s improvement in the US PMI in February and the rise in the Personal Consumption Expenditure (PCE) price index in January overlapped, and BTC temporarily renewed its August high, but fell back to 24,000. broke the dollar In March, U.S. bank holding company Silvergate Capital (SI) filed an application to postpone the submission of its 2022 report (Form 10-k) to the SEC on the 1st. In response to the possibility that Silvergate Bank’s capital adequacy ratio may deteriorate, on the 2nd, famous virtual currency-related businesses that had transactions with the bank announced the termination of partnerships one after another. Then, on the 3rd, Tokyo time, the BTC market price plummeted and fell below $23,000, but it has managed to stop falling in the mid-$22,000 range.

The tightening of regulations on the cryptocurrency industry by the SEC and the still-lingering risk of contagion from the FTX shock In the last month, the market has suffered a loss of about 1 billion dollars, which has been a concern for some time). The mood changed.

However, with the rise of speculation that the FRB will accelerate interest rate hikes and the softening of the three major U.S. stock indices, the BTC market is somehow maintaining a high price range. It has stopped at the uptrend line.

Bitcoin vs. dollar daily chart (created by Glassnode/bitbank)

Bitcoin vs. dollar daily chart (created by Glassnode/bitbank)The flight from altcoins to BTC in mid-February can be cited as a reason for the market’s resilience, but it can be said that testing an important chart milestone, the August high, also contributed to the market’s resilience. This level is the upper limit of the low price range since the Celsius shock in June last year, and if the breakout succeeds, it will break out of the low price range that lasts for about 9 months and the market will enter an upward trend, which is a technically important chart point. I can say. For that reason, a breakout of the same level was imminent, and the market was supported by expectations.

Bitcoin vs. dollar daily chart (created by Glassnode/bitbank)

Bitcoin vs. dollar daily chart (created by Glassnode/bitbank)The minutes of the January FOMC meeting revealed that only a minority of meeting participants supported accelerating the pace of rate hikes, the possibility that January’s upside in inflation indicators was still temporary, Considering that we will see the delayed effect of last year’s aggressive rate hikes, we believe that the Fed is likely to maintain a cautious pace of rate hikes in March as well, but how the market factors in the risk of further rate hikes is likely to continue. It can be said that it depends on the indicators ahead.

This is why I am concerned about the manufacturing industry trend survey report released in February by the Institute for Supply Management (ISM). Not only did the Purchasing Managers Index (PMI) improve from January, the report also found that the price paid index rose above 50, the boundary between downward and upward trends, for the first time in four months. On the other hand, the same service industry trend report showed that the payment price index, which had been a cause for concern, fell slightly from January. However, given that both are above 50, there are concerns that the February inflation index may continue to show the tenacity of upward pressure on prices, which is likely to result in unfavorable results for the market.

It has been pointed out that if Fed Chairman Jerome Powell’s testimony before both houses of Congress, which will take place on the 7th and 8th, mentions the possibility of maintaining the pace of interest rate hikes at 25 basis points, it will lead to a sense of security for the market. Employment data, CPI, PPI and many hurdles remain until the FOMC to be held.

From a technical point of view, whether or not BTC can bounce back from the uptrend line (Fig. 2) that supports the current market is important for future direction, and the current market is bifurcating in the medium term. Let’s say it’s on point.

Yuya Hasegawa: Bitbank Market Analyst ── After completing a graduate school in the UK, he worked as an analyst in the FinTech industry and the virtual currency market at a venture consisting of people from financial institutions. Market analyst at Bitbank Co., Ltd. since 2019. He has a track record of providing comments to major domestic financial media and contributing to overseas media.

|Editing and composition: Takayuki Masuda

| Top image: bitbank

The post Bitcoin maintains a high price range despite a change in mood ─ Can it protect the trend line?[bitbank monthly report] appeared first on Our Bitcoin News.

2 years ago

116

2 years ago

116

English (US) ·

English (US) ·