Virtual currency market from 1/14 (Sat) to 1/20 (Fri) this week

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

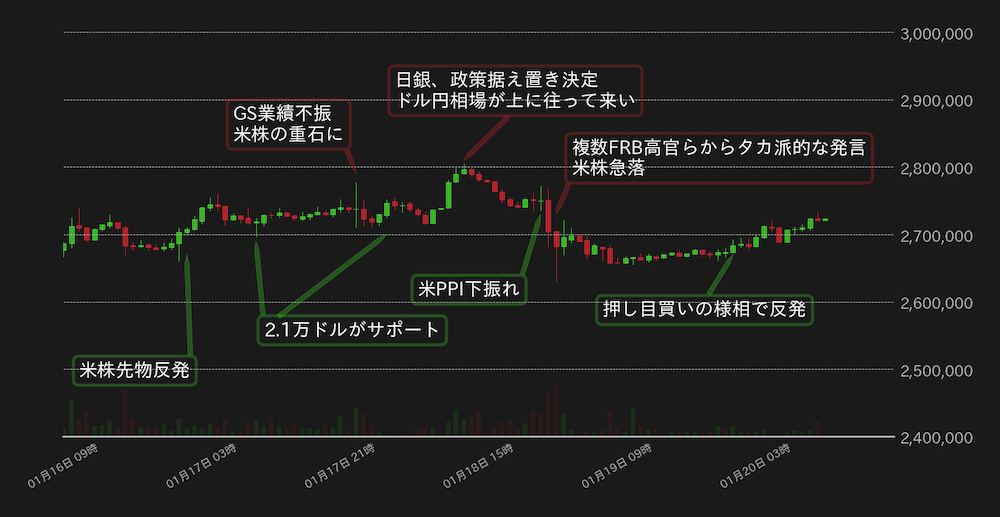

Weekly report from 1/14 (Sat) to 1/20 (Fri):

This week’s bitcoin (BTC) vs. yen exchange rate has been squabbling around 2.7 million yen, which is the dollar-denominated level of $2.1.

BTC recovered to 2.7 million yen in the previous week as the growth of US inflation indicators slowed down, and recovered to 2.7 million yen at the beginning of the week as a tailwind of the rise in US stock futures. After that, the same level became the support of the market, and it played a solid development even with the decline of US stocks.

In the middle of the week, the BTC market was affected by the volatility of the dollar-yen exchange rate following the Bank of Japan’s decision to maintain its easing policy. U.S. stocks plummeted on the announcement. BTC also dropped below 2.7 million yen as a result, but the next day it recovered to 2.7 million yen again with the appearance of bargain buying.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

At the time of writing this article, it was reported that Genesis, a crypto asset (virtual currency) lending company, had finally filed for bankruptcy, and although the market has stalled somewhat, the impact has been limited as it has already been factored in. ing.

The three major US indices pushed strongly from the middle of the week, and BTC was also slightly affected, but the market has maintained its high price range this month, giving the impression that it is fairly solid. We had assumed that the US Producer Price Index (PPI) would rise further in December, but the Fed’s verbal intervention, which expressed concern last week, put a damper on the rise in BTC and stock prices since the beginning of the year. It looks like it was showered with

The S&P Global Purchasing Managers Index (PMI) and Gross Domestic Product (GDP) will be released next week as well. Recently, high-ranking FRB officials have made hawkish remarks one after another, and the US stock market has softened even if economic indicators have deteriorated (previously, it was speculated that the FRB would slow down its tightening pace when there were signs of a deterioration in the economy). was often risk-on).

Next week will be the media blackout period before the US Open Market Committee (FOMC) meeting, and it can be said that Fed officials will not make any statements to restrain the market. , will this week affect risk appetite as well?

However, as mentioned above, the BTC market is unusually firm. With the market returning to the level just before the FTX shock for the first time in two months, it is also pointed out that trend-following market participants may have gradually returned.

In the first place, the BTC market was in a tight spot around $20,000 from June to early November last year, and $18,000 (approximately ¥2,325,000), the lower end of the range at that time, is likely to provide strong support for the market. Before that, we are waiting for the psychological milestone of $20,000 and the 200-day moving average ($19,500), so we think that the market will be relatively shallow even if it makes a dip.

[Fig. 2: BTC vs. USD chart (daily)]Source: Created from Glassnode

Relation:bitbank_markets official website

Last report:Bitcoin is technically bullish this week, including three-way turnaround

The post Bitcoin maintains a solid high price range, and is the formation of a push point limited | Contribution by bitbank analyst appeared first on Our Bitcoin News.

2 years ago

147

2 years ago

147

English (US) ·

English (US) ·