Macroeconomics and financial markets

The US stock market is closed.

On the Tokyo stock market, there was slight price movement on the previous day, down 17 yen from the previous day. As the end of the year approaches, sales are weak.

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

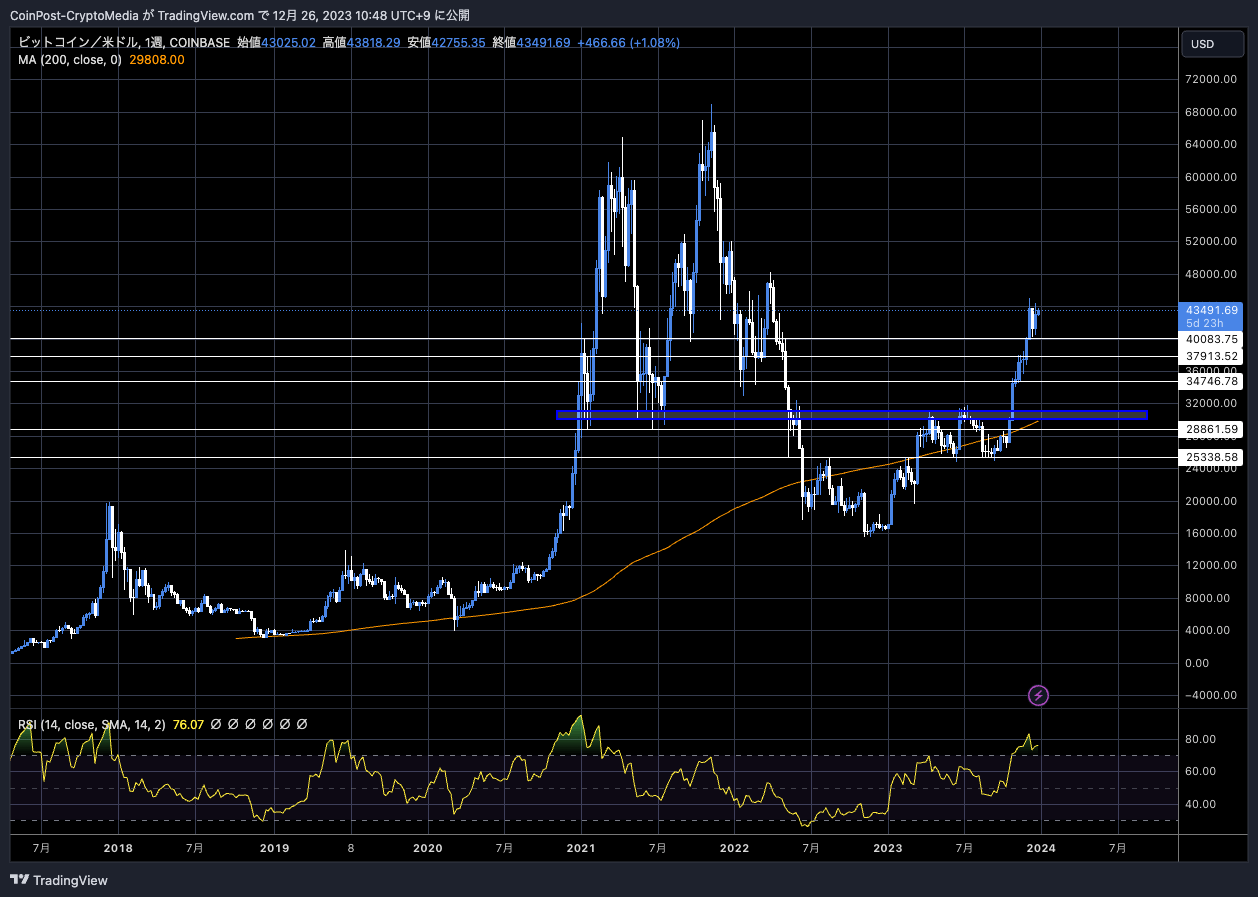

In the crypto asset (virtual currency) market, the Bitcoin price fell 0.2% from the previous day to 1 BTC = $43,491.

BTC/USD weekly

Behind the soaring prices of crypto assets (virtual currencies) are expectations for an early interest rate cut by the Federal Reserve (Federal Reserve System) and the Bitcoin Spot ETF (listed exchange traded ETF), which is expected to be a major driving force behind the long-term rise in Bitcoin. These expectations are increasing day by day.

Confirming the date for final amendments to all S-1s by Friday the 29th. @SECGov has told issuers that applications that are fully finished and filed by Friday will be considered in the first wave. Anyone who is not will not be considered. In addition, the filings cannot… https://t.co/syyINu1BEI

— Eleanor Terrett (@EleanorTerrett) December 24, 2023

The US SEC (Securities and Exchange Commission) is required to make a final decision on the joint proposal by ARK and 21Shares by January 10th, which is attracting a lot of attention from the market.

Furthermore, a decision on the ETF conversion of Grayscale’s proposed Bitcoin fund GBTC is expected to be made by January 25th. Data from Deribit’s derivatives exchange clearly shows that institutional investor activity has increased since October 2023.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

James Butterfill, head of research at Coinshares, highlighted that inflows into crypto funds rose again last week, a sharp contrast to the week before last, which saw net outflows for the first time in 11 weeks.

US$103m inflows in digital assets last week, no report on Monday. Merry Christmas! pic.twitter.com/xAVzCrPPkQ

— James Butterfill (@jbutterfill) December 23, 2023

By investment product, Bitcoin (BTC) accounted for 85% of the $103 million inflow, while Ethereum (ETH) received $7.9 million. Interest in altcoins is also growing, with total inflows into Solana (SOL), Cardano (ADA), XRP, and Chainlink (LINK) reaching $21 million.

Looking at the amount of inflows by region, it seems interesting that Germany came out on top with over 40% of the total. Following in second place were Canada, the United States, and Switzerland.

connection:“Cash ETFs could destroy the Bitcoin network” Arthur Hayes’ thoughts

altcoin market

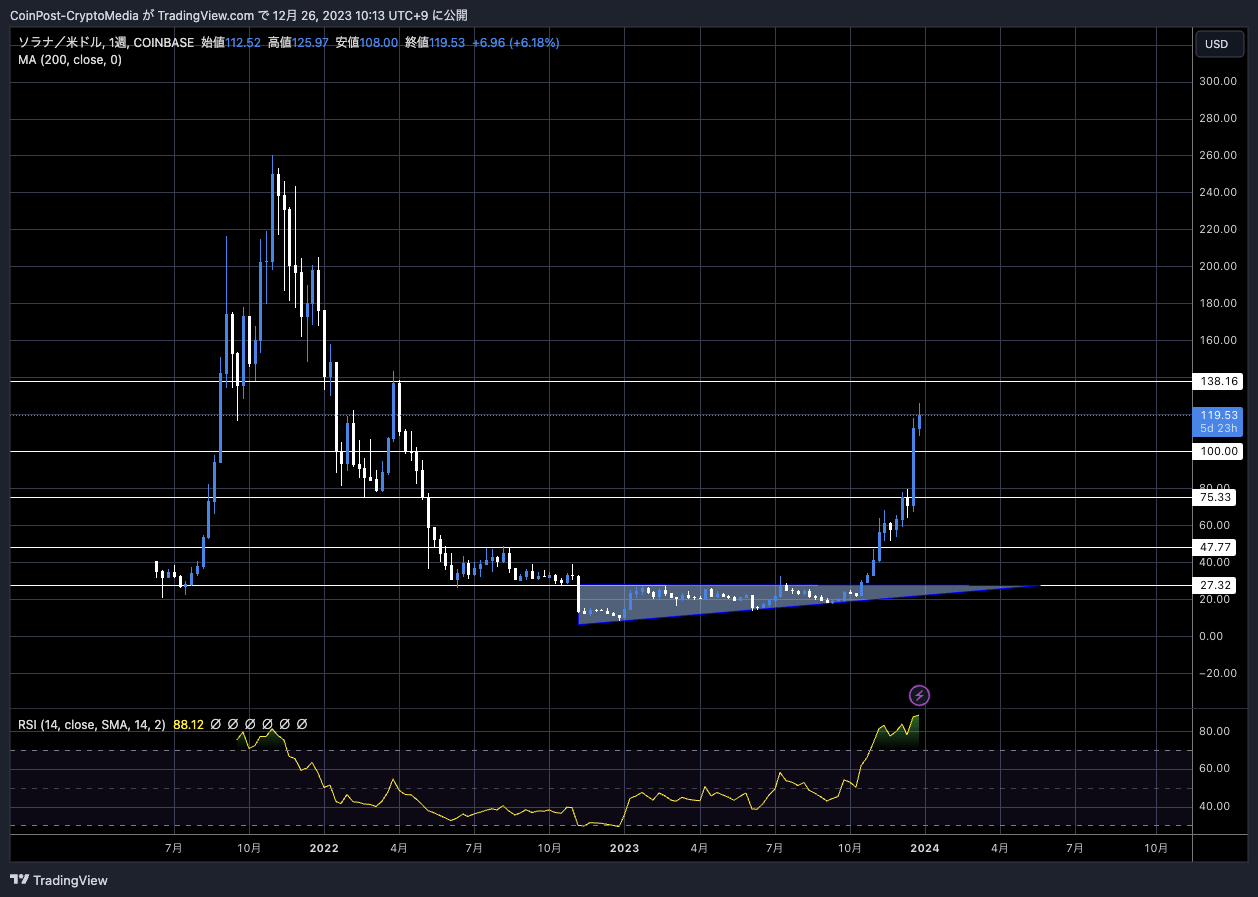

Solana (SOL), which ranks fourth in market capitalization, continued to rise to $119, up 7.9% from the previous day. The year-to-date rate of increase/decrease was 954%.

SOL/USD weekly

Expectations for ecosystem airdrops, such as the soaring JITO example, also boosted the market, and as a result, Total Value Locked (TVL), which indicates the total amount deposited into DeFi protocols, has increased from $654 million to $1.28 billion in the past three weeks. rapidly increasing to the dollar.

connection:Solana Blockchain’s record-breaking index seen through data Background of SOL’s new year-to-date high price

Due to the current sense of overheating, selling pressure is expected at the upper resistance level at the 1SOL = $140 level, but if it breaks upwards, we will be aware of the $200 milestone and the record high of 1SOL = $260 recorded in November 2021. It turns out. The stock has maintained its upward momentum through profit-taking selling, but the weekly RSI has exceeded 80, and many are wary of overheating.

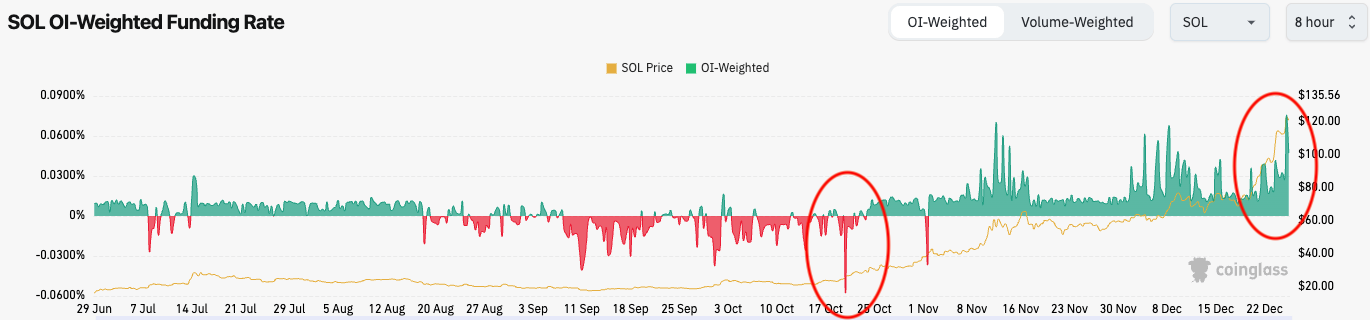

Looking at the futures market’s funding rate, it plummeted and the negative deviation increased due to the strong impact of the “FTX shock” that occurred in November last year, but it has since made a spectacular comeback and is currently undergoing a complete turnaround. There is a growing sense of overheating, with the positive deviation of FR increasing.

coinglass

Additionally, RAY, the native token of Solana-based automated market maker (AMM) and liquidity provider Raydium, continued to rise by 9.5% from the previous day. The year-to-date rate of increase/decrease has reached +1,059%, exceeding SOL.

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin maintains high price range, approaching Solana (SOL) year-to-date rise/fall rate of +1000% appeared first on Our Bitcoin News.

1 year ago

116

1 year ago

116

![Story [IP] gains over 10% amid liquidity surge, but is a reversal here?](https://ambcrypto.com/wp-content/uploads/2025/07/Abdul-1.webp)

English (US) ·

English (US) ·