Outperform Berkshire Hathaway

The market size (market capitalization) of the crypto asset (virtual currency) Bitcoin (BTC) exceeds $850 billion (12.5 billion yen), ranking ninth in the world compared to traded assets including listed companies, precious metals, and ETFs. reached.

Although it is not possible to make a simple comparison with the market capitalization of companies, this is larger than Berkshire Hathaway, Meta (formerly Facebook), and Tesla, which are led by famous American investor Warren Buffett, and is second only to Nvidia.

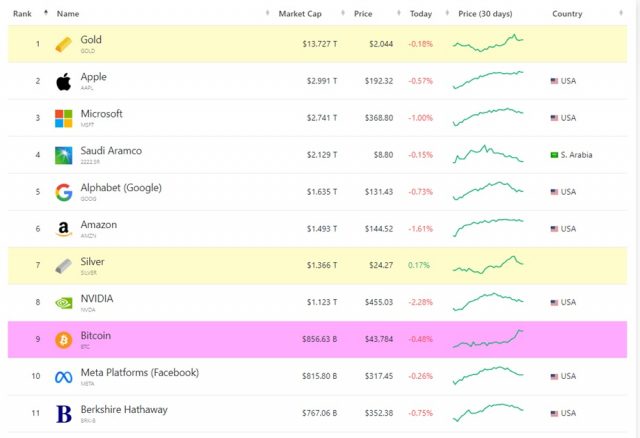

Top assets by market capitalization, listed companies, assets including precious metals, cryptocurrencies, and ETFs Source: CompaniesMarketCap

On the other hand, if you compare the market size (market capitalization) of gold, which ranks first in market capitalization, it is about 1/16th the size. Bitcoin (BTC) has an issuance limit of 21 million BTC, and the supply is subject to adjustment due to halving, so due to its scarcity, it is called “digital gold” as a means of storing value that also serves as an inflation hedge. Sometimes.

connection:What is Bitcoin halving?

The market price of Bitcoin exceeded the $41,000 level for the first time since April 2022, trading at $43,800 (6.44 million yen) on the 7th. It is up 25% in the past month and 163.9% year-to-date and is aiming for an all-time high of $69,000 in November 2021.

As of Dec. 7, Meta has $815 billion, Tesla has $760.9 billion, Berkshire Hathaway has $767 billion, while Bitcoin is second only to Nvidia’s $1.12 trillion. In order for Bitcoin to surpass the top company Apple (market capitalization of $3 trillion), it will need to exceed 1 BTC = $153,000.

Source: @BTC_Archive

The move is “typical of a bull market,” analysts said, and is similar to the 2020 bull market. Some believe that the fact that the RSI (relative strength index), which indicates a feeling of overheating in the market, exceeded 70 on the two-week chart is a “signal of the start of the fourth bull market in Bitcoin history.”

connection:BlackRock and others submit revised version of Bitcoin ETF application, expectations increase for simultaneous SEC approval

Stronger view of a bull market

This growth shows that Bitcoin is recognized as one of the world’s most valuable assets. Berkshire Hathaway Vice Chairman Charlie Munger and CEO Warren Buffett have previously described Bitcoin as “rat poison,” but crypto lawyer John Deaton said, “It’s a pretty big bottle of rat poison.”

The crypto industry is hoping that the approval of the first Bitcoin spot ETF will usher in an unprecedented bull run. British financial giant Standard Chartered Bank predicts that the price of Bitcoin could rise to $50,000 by the end of 2023 and $120,000 by the end of 2024.

Bitcoin ETF review list

Source: Bloomberg Intelligence

connection:Prediction of Bitcoin reaching $125,000 in 2024, Matrixport analysis based on halving

Half-life special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Bitcoin market capitalization rises to 9th place, surpassing Tesla and Berkshire, approaching 1/16th of the gold market appeared first on Our Bitcoin News.

1 year ago

116

1 year ago

116

English (US) ·

English (US) ·