Macroeconomics and financial markets

On the US NY stock market on the 19th of the previous weekend, the Dow Jones Industrial Average closed at $109 (0.3%) lower than the previous day.

Talks on the U.S. debt ceiling agreement, which had been hoped to make progress following positive comments by President Biden and Speaker of the House of Representatives McCarthy the other day, were reportedly suspended. In terms of the structure, it is necessary to obtain the approval of the US Congress in order to remove the debt ceiling.

In the unlikely event of a default on US Treasury bonds, credibility in the United States and the US dollar would be greatly damaged, and financial market turmoil such as panic selling of stocks and bonds would be inevitable.

A default that could have devastating global financial and economic consequences is extremely unlikely, at least not priced in by the stock market. The ruling and opposition parties, which are looking ahead to the presidential election, are of the opinion that they will eventually reach an agreement.

On the other hand, if interest payments on JGBs are prioritized and temporary measures such as postponing the default deadline are taken, or if negotiations run into difficulties until the deadline, it could lead to confusion such as the risk of a “downgrade of JGBs” as in 2011. is in a situation where there is no

With Treasury Secretary Yellen’s speech and the publication of the minutes of the US Federal Open Market Committee (FOMC) on the 24th, US time, it seems likely that the market will take a wait-and-see approach.

connection:U.S. stocks continue to rise USD/JPY hits year-to-date high | 19th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.89% from the previous day to $26,665.

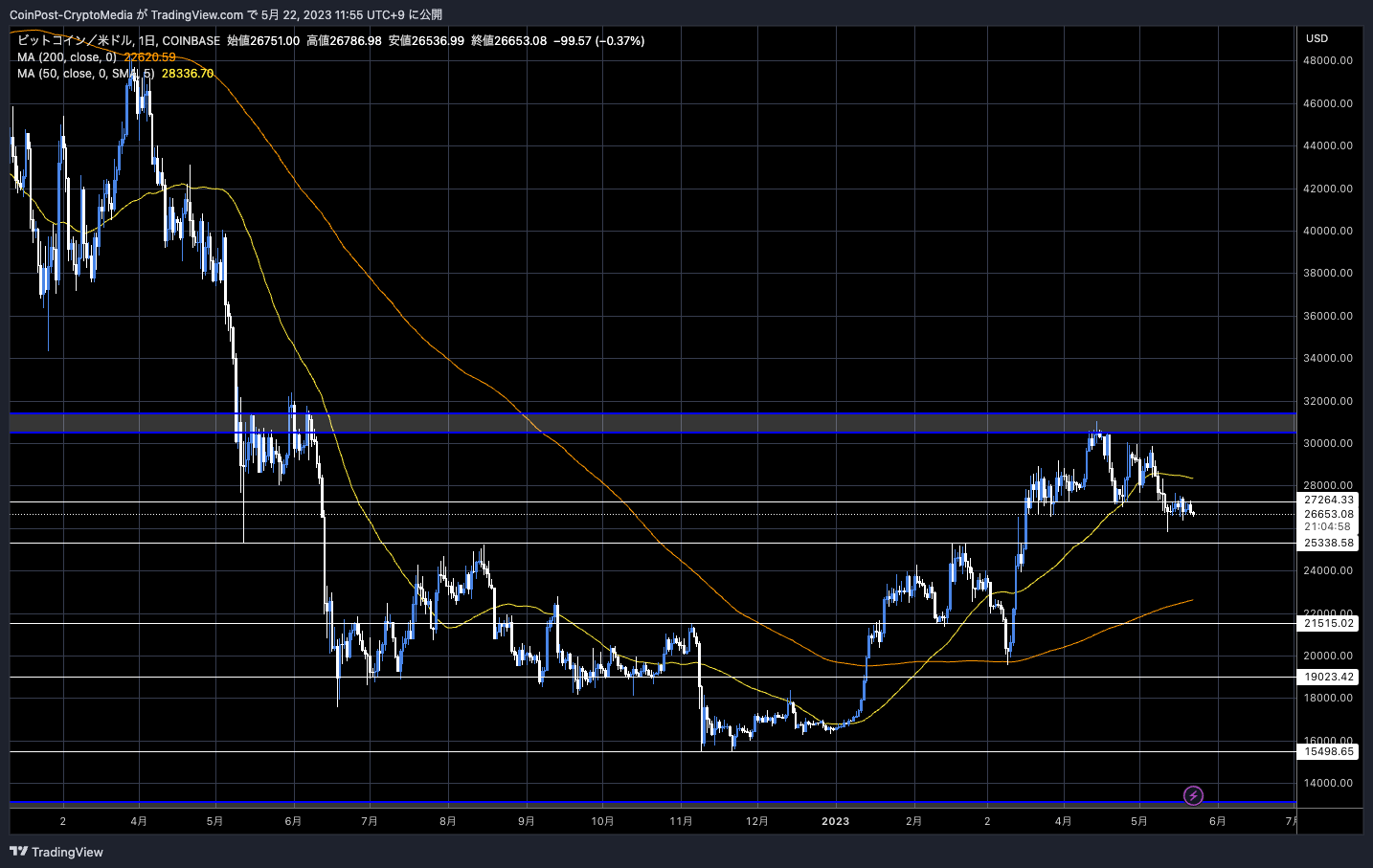

BTC/USD daily

connection:Bitcoin price is heavy but solid, expect progress on US debt problems next week | bitbank analyst contribution

While the Tokyo stock market (Nikkei Stock Average) is attracting foreign buyers, the crypto asset (virtual currency) market, where funds are concentrated on meme coins and selling pressure on miners (miners) is increasing, has been dull recently. Due to the pressure from the US SEC (Securities and Exchange Commission) and the uncertainty of the market, such as the US debt ceiling problem, there are few clues to buy, and it is in a poor state.

connection:Selling pressure from bitcoin miners increases, Lido V2 launches to implement Ethereum withdrawal function

As noted by Stockmoney Lizards (@StockmoneyL) et al., the technical analysis shows that the head and shoulders neckline has been interrupted. The $25,000 range will be conscious.

Correction in play pic.twitter.com/AG1cKjcbXu

— Stockmoney Lizards (@StockmoneyL) May 20, 2023

On the other hand, if you look at the rate of rise and fall of Bitcoin since the beginning of the year, it has risen significantly from the bottom. If the price dips, it will be a form of testing the neckline of the reverse triple, so if the price can rebound strongly at the appropriate support line (lower price support line), it will likely increase buyback momentum.

is attempting to retest the neckline in this well-known chart pattern. pic.twitter.com/e6YtBYBRvt

— Stockmoney Lizards (@StockmoneyL) May 17, 2023

A little note about the obvious head and shoulders on #BTC

It is only confirmed when price breaks and stays below 26000$. Secondly, the break has to be sharp with full bearish candle closes.

In the absence of that, I stick with scenario 1, targeting 34k – 35k$. pic.twitter.com/SgdRsxgA8D

— Mikybull  Crypto

Crypto  (@MikybullCrypto) May 20, 2023

(@MikybullCrypto) May 20, 2023

on-chain data

On-chain data provider Santiment noted that “Bitcoin’s (200-hour average) unique addresses have fallen below 800,000 for the first time since July 2021.”

#Bitcoin‘s utility has shown some serious dropoff here in May, as prices have corrected market-wide. For the first time since July, 2021, we’re seeing less than 800k daily unique $BTC addresses transacting on the network. https://t.co/ZDzKhjqNeZ pic.twitter.com/jd8y4vuSCE

#Bitcoin‘s utility has shown some serious dropoff here in May, as prices have corrected market-wide. For the first time since July, 2021, we’re seeing less than 800k daily unique $BTC addresses transacting on the network. https://t.co/ZDzKhjqNeZ pic.twitter.com/jd8y4vuSCE

—Santiment (@santimentfeed) May 17, 2023

A unique address is a wallet address used to send and receive bitcoins. It acts as a unique identifier and is interpreted as an indicator of activity and interest in the Bitcoin network.

A decrease in the number of unique addresses suggests a decrease in the number of participants and a decline in market interest, but Santiment, on the other hand, focuses on an increase in social dominance. He pointed out the increasing number of posts, discussions, and interest related to Bitcoin.

With #Bitcoin revisiting the $26k level, traders are showing increased worries of prices falling back to the $20k to $25k range. $BTC social dominance has jumped high again, typically a sign of fear. Fear signals increase the probability of a rebound. https://t.co/hwDaEwsmLf pic.twitter.com/zj6j9HKfN9

With #Bitcoin revisiting the $26k level, traders are showing increased worries of prices falling back to the $20k to $25k range. $BTC social dominance has jumped high again, typically a sign of fear. Fear signals increase the probability of a rebound. https://t.co/hwDaEwsmLf pic.twitter.com/zj6j9HKfN9

—Santiment (@santimentfeed) May 18, 2023

The significant increase in interest level is believed to be affected by the deterioration of sentiment (market sentiment) accompanying a bearish trend change, as well as the soaring BRC-20 token and speculative demand.

connection:What is BRC-20?Possibilities and Challenges of Bitcoin Token Standard

The situation where fear psychology is triggered and FUD (bad rumors) spreads is seen as a bottoming signal similar to that immediately after the FTX bankruptcy in November last year.

However, in July 2009, when unique addresses dropped to the same level, 1 BTC = $29,000, bottoming out and then rising to a record high of $69,000. It was on par. This is in contrast to the current Fed (Federal Reserve) monetary tightening.

The second reason cited by Santiment is the decrease in the supply of BTC and ETH on virtual currency exchanges.

#Bitcoin & #Ethereum both continue to quietly see more and more of their existing supplies move into self custody. Though not a perfect indicator, declining coins on exchanges generally hint at future bull runs, given enough time playing out. https://t.co/N1Icon7U19 pic.twitter.com/f5YXzqmZNf

#Bitcoin & #Ethereum both continue to quietly see more and more of their existing supplies move into self custody. Though not a perfect indicator, declining coins on exchanges generally hint at future bull runs, given enough time playing out. https://t.co/N1Icon7U19 pic.twitter.com/f5YXzqmZNf

—Santiment (@santimentfeed) May 20, 2023

While the price of crypto assets is unstable, he pointed out that the supply in the exchange is at a historically low level. This suggests that investors are withdrawing assets from exchanges and shifting to self-custody (self-custody) on the premise of medium- to long-term holding, and market liquidity is declining.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Market Continues to Poor, and U.S. Debt Ceiling Problem appeared first on Our Bitcoin News.

2 years ago

133

2 years ago

133

English (US) ·

English (US) ·