Macroeconomics and financial markets

In the US NY stock market on the 15th, the Dow Jones Industrial Average rose by $428 (1.26%) from the previous day, reaching a new year-to-date high. The Nasdaq Index closed 156 points (1.15%) higher.

Markets were also boosted by speculation that the Fed would not reach the long-awaited recession, even though it expects two more rate hikes by the end of the year.

Goldman Sachs on the 6th, regarding the possibility that the US economy will fall into a recession within a year, based on the receding of the risk of credit instability triggered by the bankruptcy of the US bank and the bipartisan agreement on the US debt ceiling issue. It has been revised downward to 25%.

With the Nikkei Stock Average rising to the ¥33,000 level, the first level in 33 years since the bubble economy, the Bank of Japan meeting held today called for the maintenance of large-scale monetary easing and no revision of the Yield Curve Control (YCC). Decided.

The government will continue to support the economy by continuing its negative interest rate policy and purchasing exchange-traded funds (ETFs).

connection:US stocks rebound nearing end of rate hike cycle, Bank of Japan meeting expected to continue monetary easing | 16th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

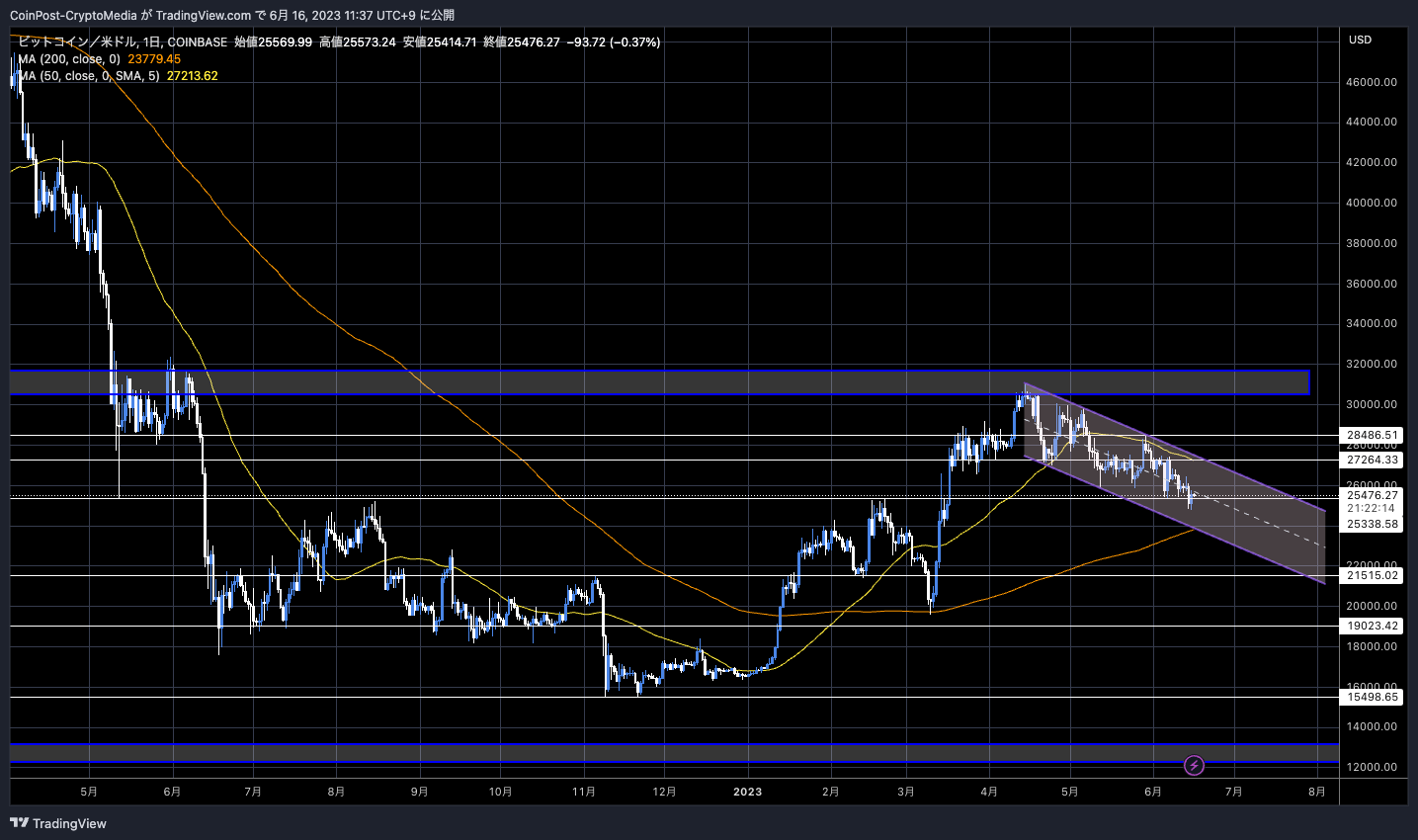

In the crypto asset (virtual currency) market, Bitcoin rebounded to $25,473, up 1.64% from the previous day.

BTC/USD daily

In addition to the rebound in the US index, the world’s largest asset management company, BlackRock, reportedly applied for the handling of “Bitcoin ETF (Exchange Traded Fund)”, which was well received.

JUST IN – $10 trillion BlackRock officially files for spot #Bitcoin ETFs pic.twitter.com/RgXxzlzTOY

— Bitcoin Magazine (@BitcoinMagazine) June 15, 2023

connection:BlackRock Submits Bitcoin ETF

The name of the Bitcoin ETF applied through the BlackRock Group’s ETF (Exchange Traded Fund) top brand “iShares” division, which manages more than $9 trillion in assets, is “iShares Bitcoin Trust.” Coinbase Custody Trust was appointed as the custodian responsible for the management and custody of assets under management, and BNY Mellon was appointed as the trust custodian of bitcoin holdings.

With the US Securities and Exchange Commission (SEC) hardening and regulatory pressure headwinds mounting in the US, it’s worth noting that BlackRock has shown high interest in the future of the cryptocurrency industry.

However, in the past, several companies, including major US asset management companies Fidelity and VanEck, have applied for physical Bitcoin ETFs, but they have never been approved by the US SEC (Securities and Exchange Commission). do not have.

Now Kathy Wood-led Ark Invest and Swiss asset manager 21Shares are also seeking approval for a physical Bitcoin ETF. In June 2022, 21Shares launched “ETP (listed trading financial product)” in anticipation of a down market.

On October 15, 2021, the US investment company ProShares’ Bitcoin futures ETF was approved by the SEC and listed on the New York Stock Exchange Arca. Following this, the Bitcoin (BTC) price reached a record high of $69,000 (about 8 million yen).

connection:US SEC Approves First Bitcoin Futures ETF

In the aftermath of the FTX bankruptcy in November last year, Binance and Coinbase, the largest crypto asset (virtual currency) exchanges, were sued by the US SEC (Securities and Exchange Commission), and BNB, Solana (SOL), Polygon (MATIC) ), Ada (ADA) and other altcoins with high market capitalization have been designated as securities one after another, and Robinhood, a major US securities app, has decided to delist the corresponding issue, and the alt market is in a difficult situation.

Under such circumstances, the expansion of “Bitcoin Dominance”, which indicates market share, suggests that altcoins with poor performance are being sold, withdrawn from the market, and funds are being transferred to Bitcoin. do.

In past market cycles, bear markets have tended to attract money to Bitcoin due to its relative durability. BTC dominance is now up to about 50%, its first level in about three years.

#Bitcoin Dominance continues to climb to a current value of 47.6%, a YTD increase of 7.6%.

This suggests a persistent rotation of capital from Altcoins to the Majors assets, as capital begins to concentrate in the most liquid Crypto assets. pic.twitter.com/rrEBd0xqyf

—glassnode (@glassnode) June 15, 2023

That said, the odds of a Bitcoin ETF being approved are low at this point, which is far from an improvement in sentiment that has fallen to record lows. Technically, the weekly MACD crossed dead and broke the zero line for the first time in August 22, indicating the weakness of the trend, and the difficult situation is not out of the way. *Figure below

BTC/USD Weekly

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Market Favors BlackRock ETF Application, Bank of Japan Policy Meeting Maintains Large-scale Monetary Easing appeared first on Our Bitcoin News.

2 years ago

128

2 years ago

128

English (US) ·

English (US) ·