Virtual currency market this week (4/1 (Sat) – 4/7 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 4/1 (Sat) to 4/7 (Fri):

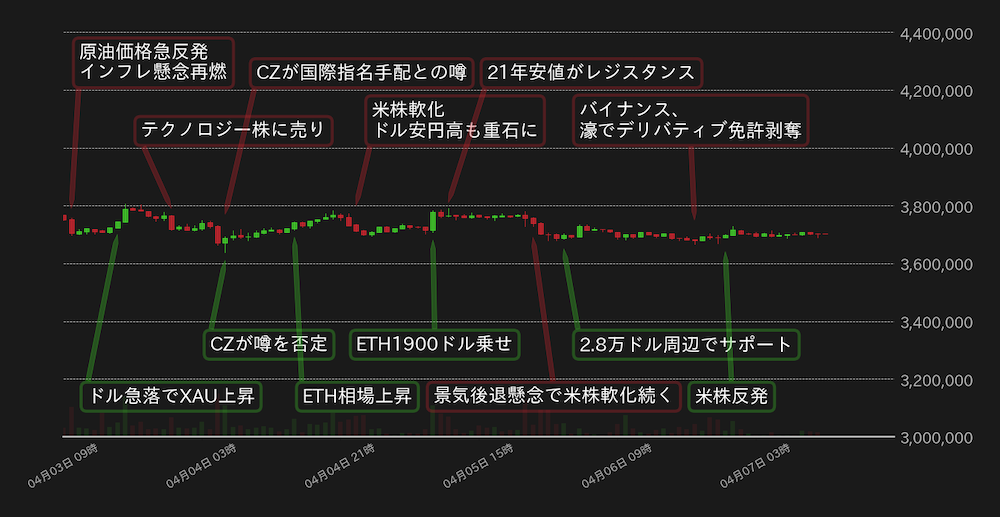

This week’s bitcoin (BTC) vs. yen exchange rate is 3,700,000 yen, and it has been in a struggle from beginning to end.

Oil prices soared after OPEC+ announced a sudden production cut, and the dollar’s strength put pressure on the BTC market at the beginning of the week due to fears of accelerating inflation. With the rise of , BTC was expected to recover by 3.8 million yen.

On the other hand, in the US stock market at the beginning of the week, technology stocks sold, and the BTC market fell back. In addition, Binance’s CZ fell below 3.7 million yen when rumors spread on Twitter that Interpol wanted CZ internationally.

However, when CZ immediately denied the rumors, BTC was repurchased and turned high, recovering 3.7 million yen as the Ether (ETH) market rose. In the middle of the week, when ETH topped $1,900 for the first time in nine months, BTC was looking to hit 3.8 million yen again, but the dollar-denominated 21-year low became resistance and stalled.

After that, the March ADP employment report showed that the monthly increase in private sector employment was below the market’s expectations, and BTC briefly tried its upper side, but recession fears weighed on U.S. stocks. (ISM)’s service industry PMI is also downswing, putting further pressure on US stocks. BTC weighed its topside as stock prices fell, pushing it to the $28,000 level, a milestone in dollar terms.

Recently, Binance has been stripped of its derivatives (financial derivative products) trading license in Australia, and negative news has been confirmed, but the price is in a slight struggle at the $28,000 level.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

This week, ISM’s manufacturing PMI, services PMI, JOLTs job openings, and ADP employment data all deteriorated, while US Treasury yields fell for all maturities, while US stocks weakened on the back of recession fears, leading to BTC. Is it a tug-of-war situation? However, tonight’s (7th) US employment statistics will have a large impact on the policy of the US Federal Reserve Board (FRB), so if it looks weak following JOLTs and ADP, we will factor in the postponement of the interest rate hike in May. The move will accelerate, which will be positive for the BTC market.

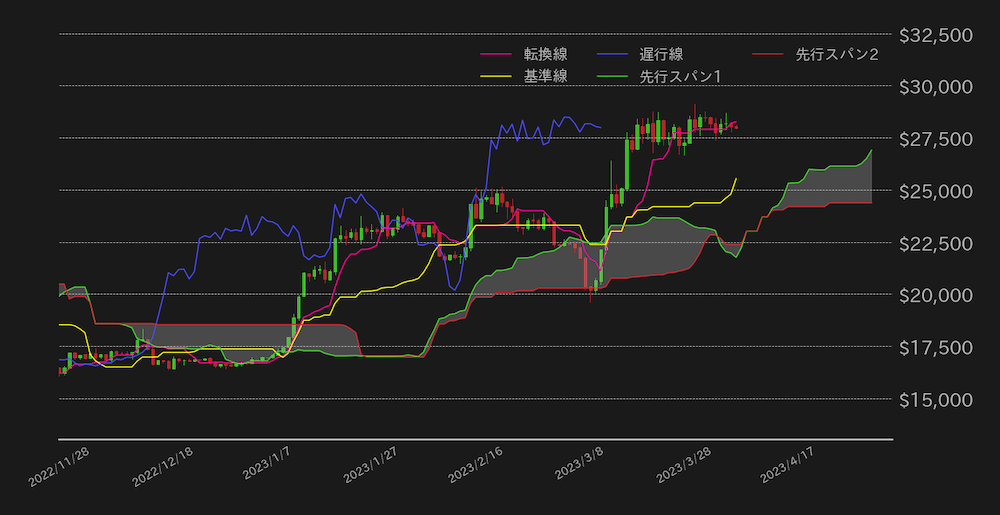

It’s been about three weeks since the BTC market hit a high, but technically, it wouldn’t be surprising to see some movement next week. In the Ichimoku Kinko Hyo, there is a time theory that indicates when the market trend is likely to change, and it is said that the current trend is likely to change after the “first period”, that is, 26 days.

The current BTC vs. dollar chart has been squabbling around $28,000 since the 18th of last month. It shows that one term has passed.

[Fig. 2: BTC vs. USD and Ichimoku Balance Table (Daily)]Source: Created from Glassnode

Oddly enough, the US Consumer Price Index (CPI) in March is coming up just before the first period has passed since the high price rally, and the Shanghai upgrade of Ethereum is scheduled to be implemented, so next week the market will be large from the middle of the week. I’d say it’s likely to move.

In the Ichimoku Kinko Hyo, there is a strong buy signal of “three-way upturn”, and a “perfect order” (a phenomenon in which the short-, medium- and long-term lines move in order from the top), which is considered a buy signal even in the moving average line, and the RSI. There is no sign of overheating from the market, and technically, an upward breakout is expected.

connection:bitbank_markets official website

Last report:Altcoin, with XRP at the top of the list, is Bitcoin still bullish?

The post Bitcoin market may move significantly from the middle of next week | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

128

2 years ago

128

![Zcash [ZEC]: Open Interest hits multi-month high – Is a price move coming?](https://ambcrypto.com/wp-content/uploads/2025/08/Kelvin-_90_.webp)

English (US) ·

English (US) ·