The post Bitcoin Market Outlook: Can Recent Demand Surge Lead to a Trend Reversal and Higher BTC Prices? appeared first on Coinpedia Fintech News

Bitcoin’s demand is showing early signs of recovery, according to an on-chain analytics chart. In the last seven days, the Bitcoin market has surged by nearly 8%. While some investors are hopeful that this could mark the start of a bullish trend, crypto analysts like Teddy caution against premature optimism. Here is a closer look at what the data really means.

Analysis Flags a Bounce In Apparent Bitcoin Demand

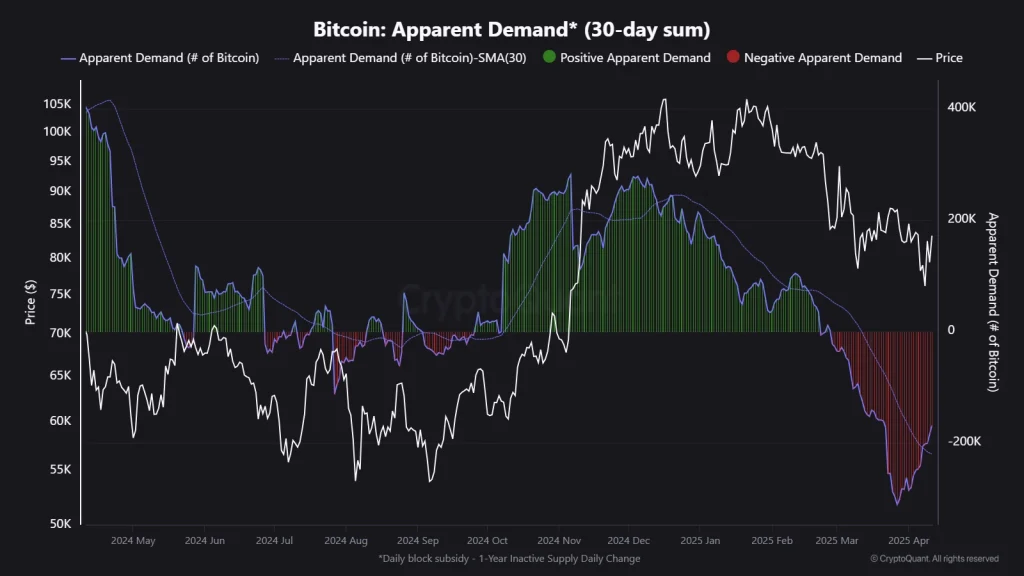

According to the Bitcoin Apparent Demand (30-day sum) chart, the demand for Bitcoin is starting to bounce back from negative territory.

Source: CryptoQuant

Source: CryptoQuantApparent Demand is a metric used to measure the overall demand for an asset. The BTC Apparent Demand index compares the amount of new Bitcoin being created through mining and the changes in the amount of the crypto held for long periods.

A positive apparent demand means that more Bitcoin is being removed from available supply than is being created by mining.

The recently observed pattern of the apparent demand (30-day sum) of BTC attempting to bounce back to positive territory implies that the market could witness a bullish rally in the near future.

What Happened in 2021: Lessons from the Last BTC Cycle

Analysts claim that they observed a similar pattern in 2021. According to analysts, during that cycle, demand stayed low for months even though prices looked stable, and a true recovery only came after a long period of consolidation.

This implies that the latest bounce may just be a temporary relief, not a sign of a strong recovery or accumulation yet.

Teddy’s Take: Market Tests, Not Cheers

Experts like Teddy acknowledge that demand for BTC has improved significantly, emphasising that some buyers have returned to the market.

However, he expresses his worry about the potential of unfriendly macroeconomic events, like tariffs, interest rate shocks and geopolitical problems, to eliminate the newly acquired optimism.

US President Donald Trump recently introduced an aggressive tariff policy. It has affected almost all the major asset classes, including the cryptocurrency sector.

A couple of days ago, the Trump administration offered brief relief to non-retaliating countries through a 90-day pause in the implementation of the tariff policy. However, the US President vowed to go ahead strongly with his policy, denouncing rumours that expressed doubts about Trump’s capability to push the policy to success.

A question that bothers BTC enthusiasts, including Teddy, is: Will long-term holders continue to hold or will they start selling in panic if a destructive macroeconomic event occurs in the future?

Teddy emphasises that this market does not reward early optimism but rather tests patience and resilience.

BTC Market Overview: Is a Trend Reversal Really Happening?

At the start of this year, the Bitcoin market was at $93,623.09. Just before Trump’s inauguration, the market touched an all-time high of 109,595.64. In January, the market grew by over 9.54%.

Bitcoin Price Analysis Source: Trading View

Bitcoin Price Analysis Source: Trading ViewSince February, the market has declined by over 16.15%. In February alone, the market dropped by 17.5%. In March, with a -2.19% change, the market performed better than the previous month.

At the start of this month, the market was at $82,541.66. Since then, the market has grown by over 4.05%. At one point on April 7, the market plummeted as low as $74,517. However, since April 9, the market has rebounded strongly by over 12.49%. In the last 24 hours, the BTC price has increased by 1.4%.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

3 months ago

42

3 months ago

42

English (US) ·

English (US) ·