Macroeconomics and financial markets

The NY stock market will be closed on the 4th for Independence Day. While the Tokyo stock market lacks clues, the Nikkei Stock Average (early session) is preceded by profit-taking selling. The price continued to decline by 119 yen from the previous day.

UNIQLO’s same store sales in Japan (June) fell for the first time in seven months, and the stock price of Fast Retailing, which has a high index contribution, fell.

Some people are cautious about the impact of “ETF sales” by asset management companies, but some point out that it will continue until around early July, when the closing dates are concentrated.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price fell 1.25% from the previous day to 1 BTC = $ 30,834.

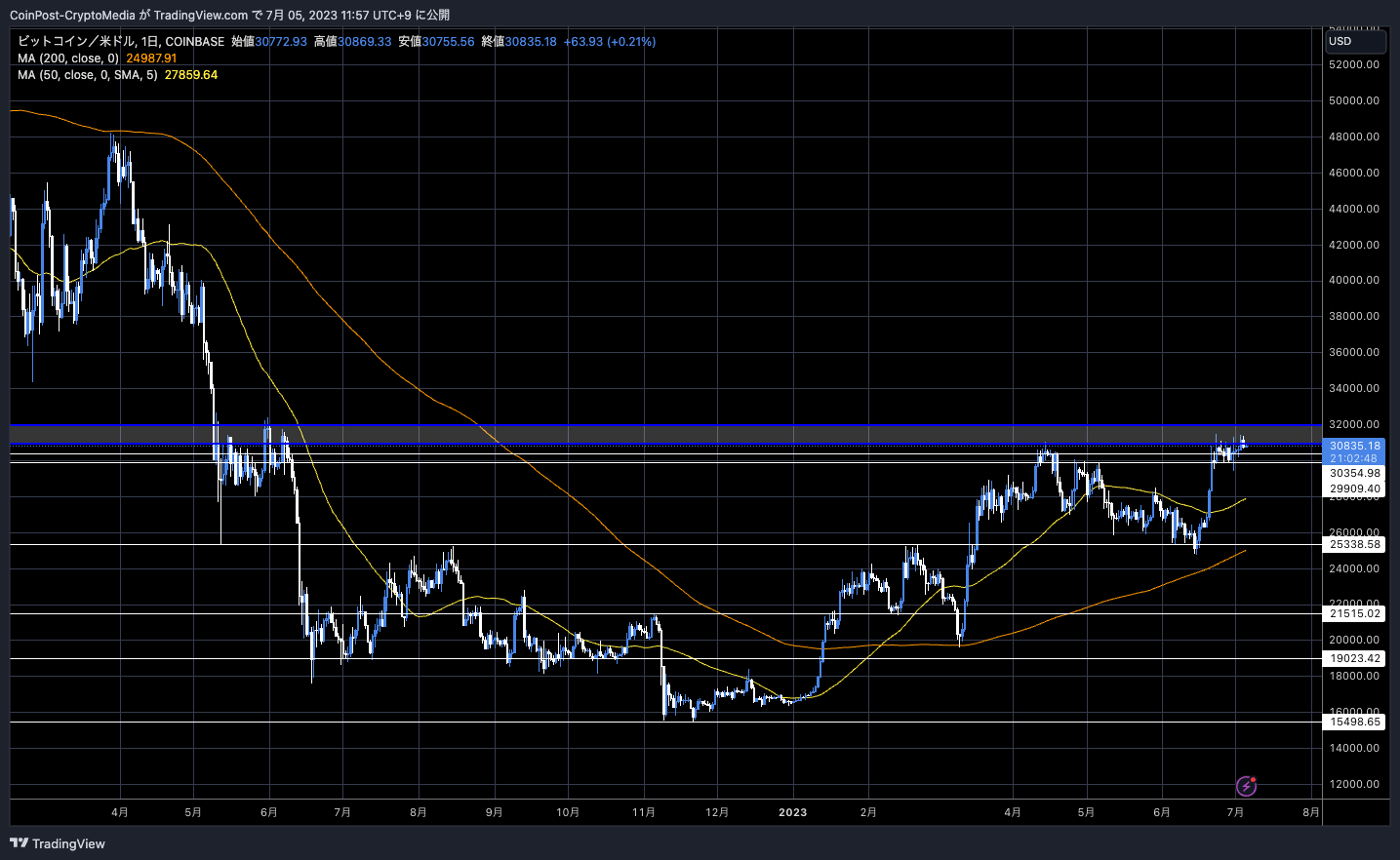

BTC/USD daily

Bitcoin has rebounded sharply after the largest asset management company BlackRock’s Bitcoin ETF (exchange traded fund) application, but the near-term price movement is stagnating as it is blocked by the major resistance line between $31,000 and $32,000, where selling pressure is likely to increase. .

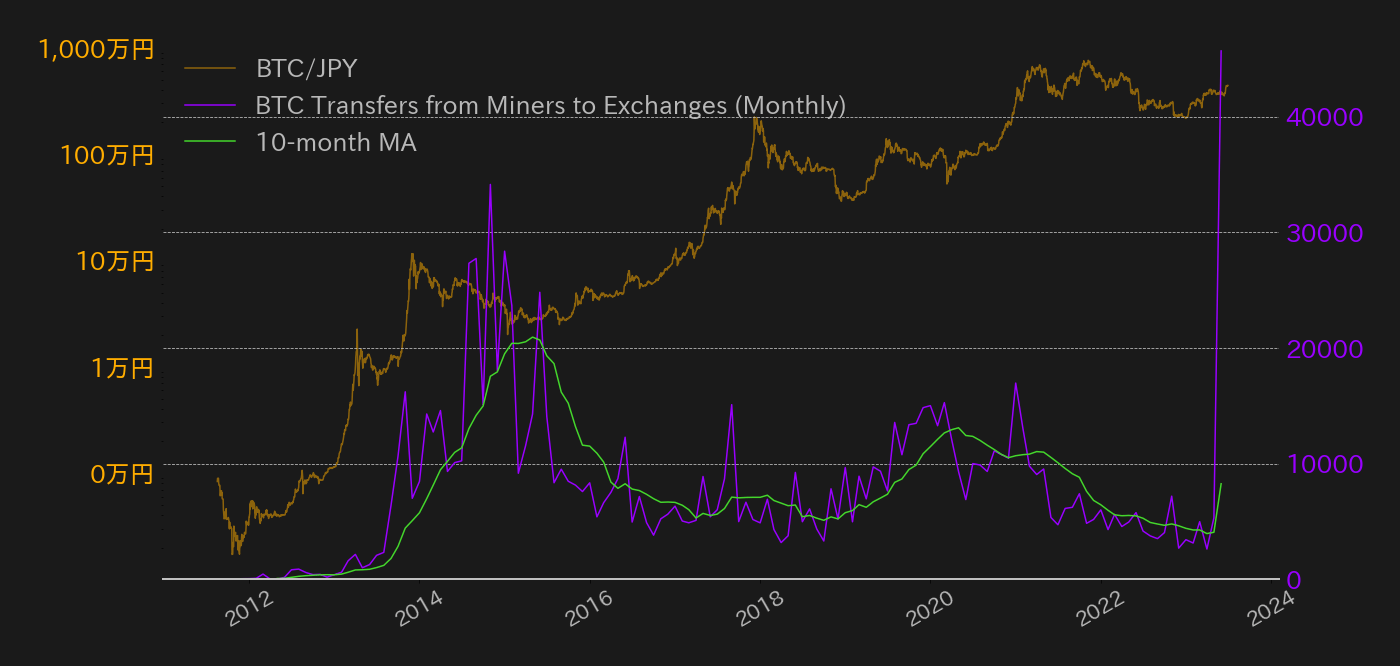

According to Glassnode, Bitcoin (BTC) miners have confirmed transfers worth $105 million. It will be the second largest in history.

Following the ascension in spot price above the psychologically key $30K level, #Bitcoin Miners have continued to send large clips of BTC to exchanges.

Currently, Miners are sending $105M to exchanges, the second largest USD denominated transfer on record. pic.twitter.com/D0T9XxBfBY

—glassnode (@glassnode) July 1, 2023

Hasegawa, a bitbank analyst who contributes to CoinPost, also commented on the fact that the actual demand and sales of miners are on the rise, saying, “The amount of BTC remittances by miners to cryptocurrency exchanges is a record level of over 45,000 BTC per month. It has become,” he pointed out.

[BTC vs. Yen and monthly BTC remittances from miners to exchanges]Source: bitbank.cc, Glassnode

connection:Rise in US bond yields puts pressure on BTC’s top price, and there is a sense of caution about profit taking by real demand sources | Contribution by bitbank analyst

In the first half of 2024, with the bitcoin halving that occurs once every four years, it is possible that the liquidity of the cash on hand is being secured with the capital increase in mind.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Mass liquidation of NFTs

The worst-ever mass liquidation of NFTs (non-fungible tokens) that had been used as collateral occurred. According to Cirrus (@CirrusNFT), there have been over 1200 liquidations in four days.

NFTFi loans such as BendDAO are services that lend crypto assets (virtual currencies) such as Ethereum (ETH) against high-quality digital assets (blue chip NFTs) recognized as collateral.

Over the last few days, we’ve seen the worst liquidation cascade in the history of NFTs and its not really close

There were 1244 Liquidations in the last 96 hours (This excludes forced sellers that sold their collateral to repay loans before they were underwater)

For reference… pic.twitter.com/3cpy8tDHi5

— Cirrus (@CirrusNFT) July 3, 2023

Last year, the average number of liquidations was around 10 to 15 per day. The most affected by the liquidation seems to be the mascot collection “BEANZ” derived from the animation art “Azuki NFT” which is in the midst of the turmoil. 3% of the supply was in danger of being liquidated.

connection:Awareness of “negative chain”, risk of liquidation increases with NFT collateralized loans

The low-priced new collection “Elementals” derived from Azuki NFT, which was sold out in 15 minutes after the pre-sale started on June 28 and recorded sales of about 5 billion yen, has an original sales method and design after the reveal. Criticism flooded in because it was very similar to the series. The official account was forced to apologize and explain.

Azuki,

It’s always both challenging & exciting opening the gate to the Garden.

This time, we missed the mark.

We hear you – the mint process was hectic, the PFPs feel similar and, even worse, dilutive to Azuki.

— Azuki (@Azuki) June 28, 2023

As a result of losing the trust and support of the community, the original Azuki’s floor price (the lowest price in the market) also plummeted. The floor, which stood at around 14 ETH as of June 28, dropped to 5.5 ETH in less than a week.

OpenSeaan Analytics

connection:NFT collection Azuki’s price drop, what is the relationship with the new Elementals?

The temporary NFT boom has passed, and it is undeniable that there is now an oversupply of demand, and it is pointed out that the market as a whole is saturated.

In addition to the “negative chain” that occurred around last summer with the liquidation of NFTs that were used as collateral for loans, and from 2023 onwards, risky assets such as US stocks and bitcoin will turn around and rise, making it difficult to raise funds. It is believed that the demand for liquidation for cash is also driving the sale of NFTs that it holds.

“Bored Ape Yacht Club (BAYC)”, a representative luxury collectible, is no exception to the aftermath of the cooling of the NFT market. The value has fallen to about 30 ETH, which is half the price level in the past three months, partly because large investors have sold it one after another. Still, it maintains a value of about 8.4 million yen when converted to Japanese yen.

On the other hand, there is a view that the peak of forced liquidation of NFTs has passed and the near-term bottom has been hit.

According to SnowGenesis, with the sharp drop in the NFT market, more than 1,200 NFTs have been liquidated in the past three days, which is the largest liquidation in the history of NFTs. There are more than 630 Beanz, and about 3% of total Beanz NFTs have been liquidated. At…

— Wu Blockchain (@WuBlockchain) July 4, 2023

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin miner may be the second largest remittance in history Large-scale liquidation of collateral assets occurs in the NFT market appeared first on Our Bitcoin News.

1 year ago

167

1 year ago

167

English (US) ·

English (US) ·