Macroeconomics and financial markets

In the US NY stock market on the 18th, the Dow Jones Industrial Average rose 115 dollars (0.34%) from the previous day, and the Nasdaq Index closed at 188 points (1.51%) higher.

On the Tokyo stock market, the Nikkei Stock Average rose by 318 yen from the previous day to 30,892 yen, the highest since the bubble burst for the first time in 33 years.

In addition to the sense of security that the new governor of the Bank of Japan, Ueda, will continue with the monetary easing policy, the impact of the yen’s depreciation and the strength of the dollar, and concerns about a recession in Europe and the United States are growing, Japanese stocks, especially large-cap stocks, are becoming undervalued. There is also a tendency to point out the transfer of funds.

Foreign investors have been net buyers of Japanese stocks for seven consecutive weeks, leading the market in both spot and futures markets. In April of this year, Warren Buffett announced his intention to buy more shares (increase the ownership ratio) of the five major trading companies, which seems to be one of the reasons for the heightened interest in the Japanese market.

connection:U.S. stocks continue to rise USD/JPY hits year-to-date high | 19th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.09% from the previous day to $26,795.

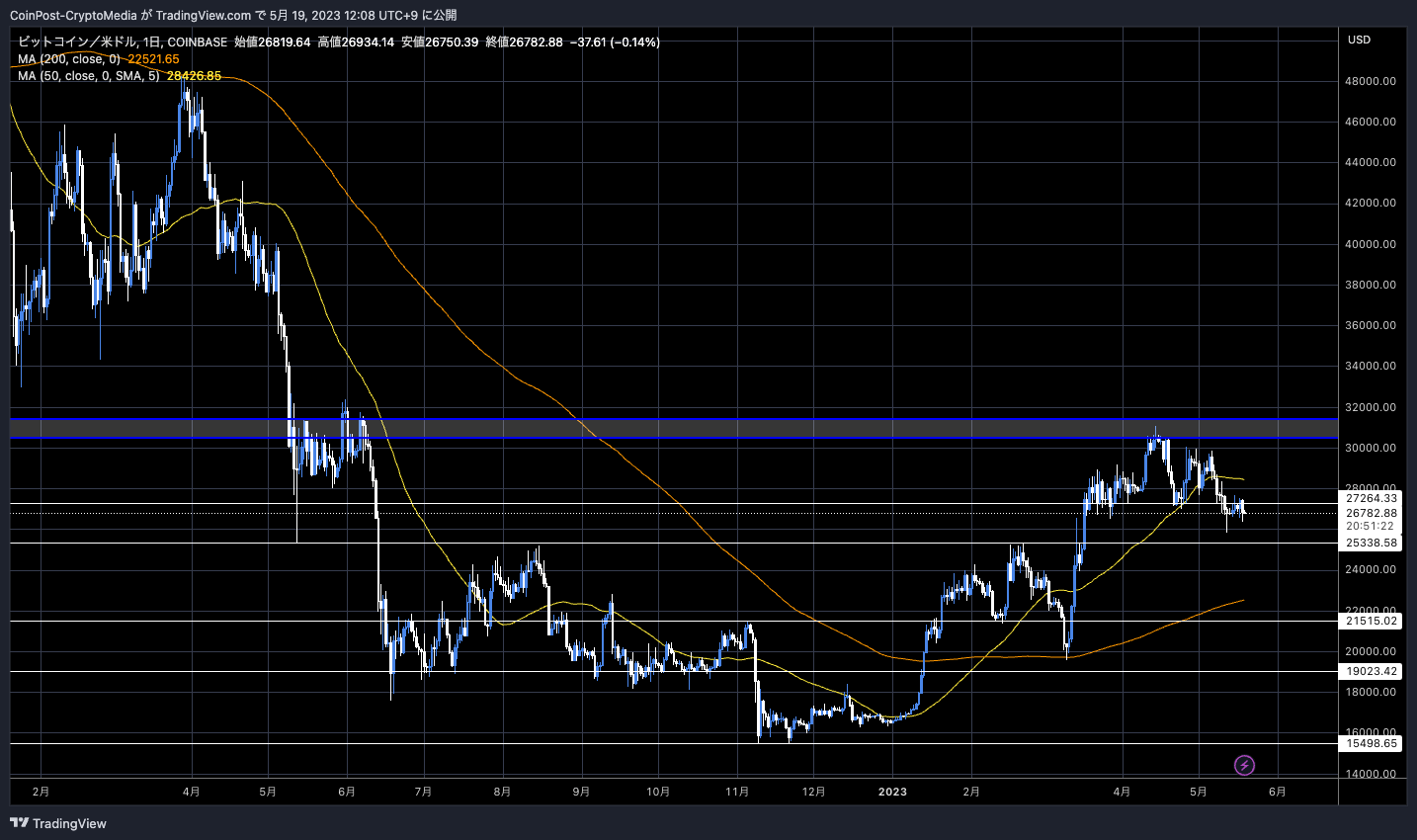

BTC/USD daily

After falling below the 50-day moving average line, the weight of the upper price is exposed, and it follows a weak trend such as falling back near the Sanson neckline.

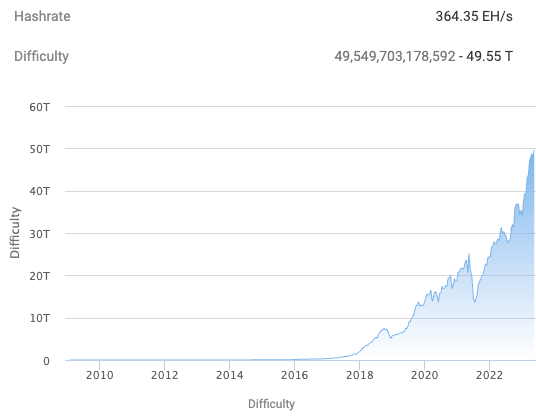

Bitcoin’s difficulty (mining difficulty) increased by 3.22% compared to the previous time, setting a new record high.

blockchain.com

connection:Selling pressure from bitcoin miners increases, Lido V2 launches to implement Ethereum withdrawal function

The mining difficulty level is adjusted approximately once every two weeks, and the time required to mine one block is approximately 10 minutes, depending on the increase or decrease in the hash rate (mining speed), which is the computing power on the network. automatically adjusted.

If the hashrate rises rapidly, the difficulty of mining increases and it takes longer to create new blocks, and if the hashrate drops, the difficulty of mining decreases and blocks are easier to create. By keeping the block generation pace constant, it acts as a balancer to control the Bitcoin supply and maintain network stability and security.

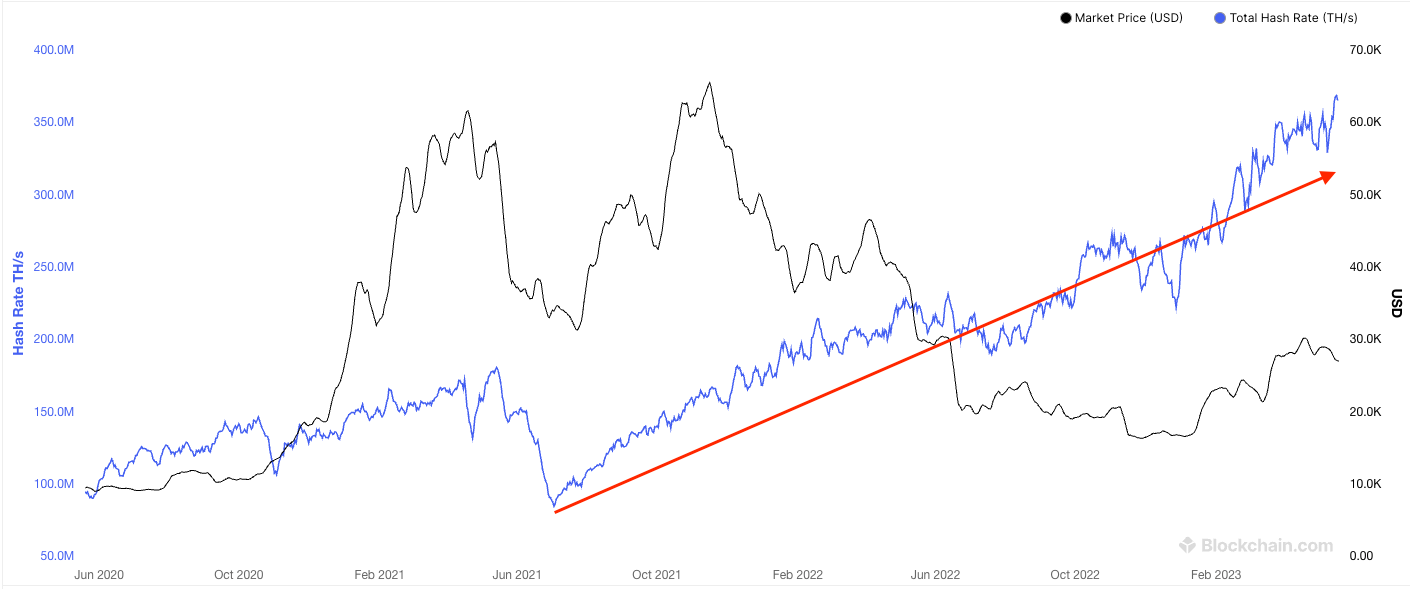

Over the past few weeks, we have seen increasing competition among miners, with the hashrate continuing to grow despite the sluggish Bitcoin price.

blockchain.com

The recent average hash rate (mining speed) remains above 350 EH/s, which is 40% higher than the average hash rate of 250 EH/s seven months ago (October 2022), 16 months Compared to 190 EH/s in the previous year (January 2010), it has increased by 86%, and the momentum of miners knows no end.

In the background, in addition to the improvement in machine performance, the soaring transaction fees accompanying the reaction of the BRC-20 token acted as an incentive.

From 2022 onwards, the price drop of mining equipment for performing advanced calculations, “mining rigs,” will also serve as a tailwind.

The price of high-performance GPUs installed in personal computers has dropped as the global supply shortage of semiconductor chips due to the corona crisis has been resolved, leading to a reduction in operating costs for miners (mining companies) and upgrading of mining equipment.

U.S. President Biden, on the other hand, is proposing to increase the tax on miners operating in the U.S. A tax equivalent to 30% will be imposed on the cost of electricity used for mining.

connection:Biden Administration Proposes 30% Tax on Crypto Mining Companies

In response, Fred Thiel, CEO of Marathon Digital, a major US mining company, said, “If such a policy is enacted, it will only lead to the outflow of businesses, and it seems to be the government’s intention. It will not necessarily lead to an increase in tax revenue or an increase in the utilization rate of renewable energy.”

Around May 2024, the “half-life” is expected to occur, and the mining rewards for miners and the market supply, which are pressure to sell Bitcoin, are expected to be halved.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

altcoin

Lookonchain’s on-chain data analysis confirms the resumption of activity of whales (major investors) who participated in Ethereum’s initial coin offering (ICO) in 2015.

A whale that had been dormant for 2.4 years created a contract 3 hrs ago and staked 4,032 $ETH ($7.4M).

The whale is an Ethereum ICO participant and received 60K $ETH at Genesis. https://t.co/qmVlopOXke pic.twitter.com/eUVWJHyXAJ

— Lookonchain (@lookonchain) May 18, 2023

After a two-year dormant period, funds were transferred, and 4,032 ETH (equivalent to 1 billion yen) was staked.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Mining Difficulty Hits Record High, Hash Rate Continues to Rise appeared first on Our Bitcoin News.

2 years ago

131

2 years ago

131

English (US) ·

English (US) ·