Although bitcoin price correlates directly with the BTC mining industry, miners’ revenues have reached an all-time low since November 2020.

According to data from Blockchain.com, total bitcoin mining revenue fell to $14.35M, last seen on Nov. 6, 2020, when bitcoin was trading at around $13,5K.

Although bitcoin is currently trading around $16,5K, which suggests an apparent increase in mining revenues, factors including greater mining difficulty, rising energy prices, and overall depressing market conditions are contributing to the decline.

Blockchain.com data for Network difficulty

Blockchain.com data for Network difficulty In the chart above, the network difficulty skyrocketed since the end of July 2020, which impacted the lower mining revenues mentioned before.

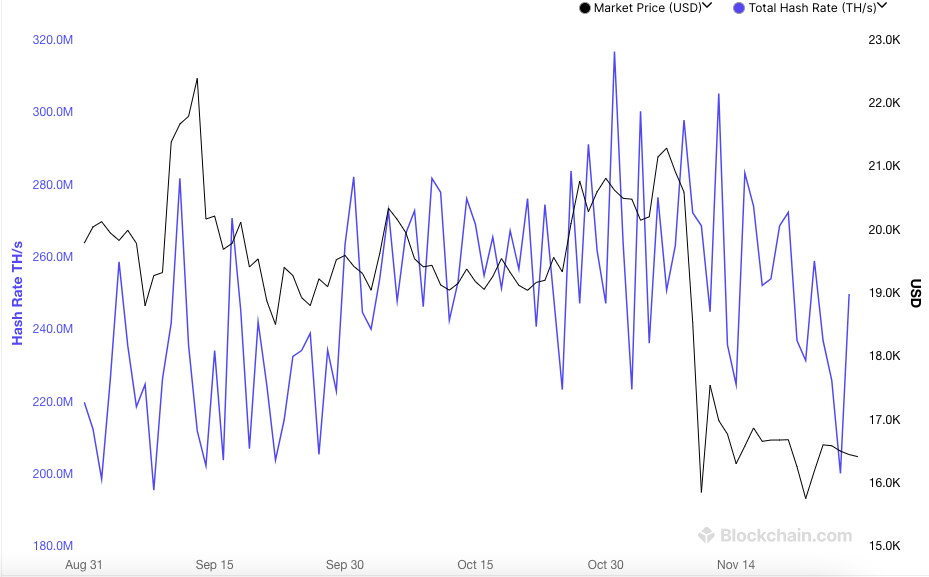

The hash rate, a security metric to protect the network from double-spending, stands at three month low, 249 EH/s, which fell around 29% from its all-time high of 316,7 EH/s on Oct. 31, 2022.

Blockchain.com Total Hash Rate (TH/s) data

Blockchain.com Total Hash Rate (TH/s) dataIt should be taken into account that now miners buy cheaper hardware equipment and migrate to states with low energy prices.

Although bitcoin mining remains a debatable topic, it is increasingly common to hear how miners can help balance electricity demand. This is demonstrated in Texas, where bitcoin miners can participate in demand response programs, encouraging miners to shut down their operations during peak demand.

Related: NY PoW mining ban comes into force

NY mayor Eric Adams shared that the goal is to make New York a crypto hub, simultaneously reducing the environmental costs of mining:

“I’m going to work with the legislators who are in support and those who have concerns, and I believe we are going to come to a great meeting place.”

Related: Bitcoin Mining Difficulty Rising

The mayor said the city would work with lawmakers to find a balance between the development of the crypto industry and legislative needs.

2 years ago

132

2 years ago

132

English (US) ·

English (US) ·