- Bitcoin is unusually flat for July.

- 74% of Bitcoin addresses are profitable.

- The market will next focus on the CPI on the 12th.

- CoinDesk’s Bitcoin Trend Indicator Continues to Show ‘Significant Uptrend’

Bitcoin (BTC) remains flat, which is unusual for July. It shows that investors are reluctant to follow last month’s 21% gain. The Consumer Price Index (CPI), due out on Wednesday, is the first significant inflation data since mid-June and could determine whether range trading continues. If the CPI continues to fall, it can be positive for investors, but if it stays the same or rises, it could work negatively.

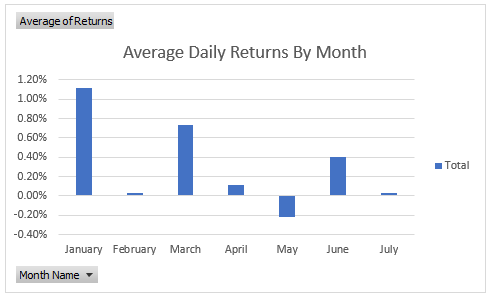

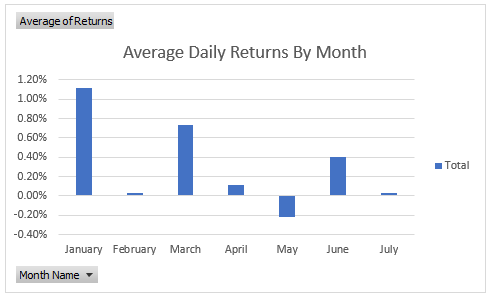

Bitcoin is doing well this year

Bitcoin is doing well this year, up 84% year-to-date. However, monthly data show that much of the increase occurs in winter. The average daily increases in January and March were 1.11% and 0.73% respectively.

June’s performance was similarly strong, averaging a daily gain of 0.41%, largely due to the announcement of BlackRock’s Bitcoin exchange-traded fund (ETF) filing, the world’s largest asset manager. February and April were relatively flat, but May saw the only negative performance of the year.

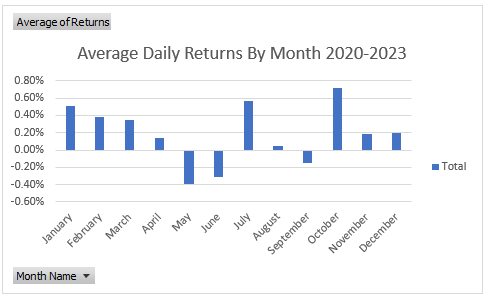

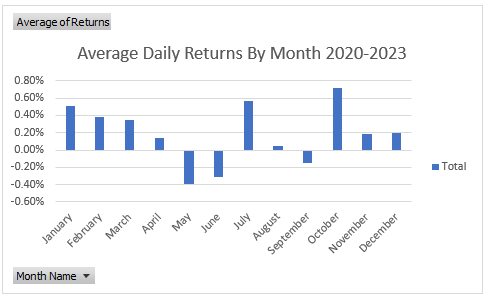

Unusually slow in July

Historically, July was a strong month for Bitcoin. Since 2014, Bitcoin has averaged 0.39% gains in July, the third highest of all months. Calculating from 2020 onwards, July saw an average daily increase of 0.57%, second only to October. Calculated over a 30-day period, the monthly increases were about 19% and 12%, respectively.

However, this will not be the case in 2023. The average daily rate of increase in July was only 0.03%, or about 0.93% when calculated over 30 days.

Bitcoin’s price has been on an upward trend throughout 2023, but the monthly daily rate of increase is on a downward trend. Despite the excitement around Bitcoin’s rise, it remains an early-year phenomenon.

Pessimistic investors will consider Bitcoin price trends. Optimistic investors, on the other hand, may weigh in on the fact that Bitcoin is continuing its year-to-date rally.

74% of Bitcoin addresses are profitable

According to on-chain data from research firm Glassnode, 74% of Bitcoin addresses are profitable, which should back up the bulls. High profit margins for bitcoin holders mean that investors are likely to hold their current positions, especially after a sharp rally in 2023.

Markets are pricing in a rate hike in July

The CPI release, the first significant inflation data since mid-June, may face headwinds. The price is expected to rise by 0.3% from the previous month, but if it rises significantly, it could push down the price. Still, the market is already pricing in the Federal Open Market Committee’s (FOMC) rate hike in July, so it is likely that a significant rate hike will be needed to move prices significantly.

Finally, CoinDesk Indices’ Bitcoin Trend Indicator (BTI) shows that Bitcoin is on a significant uptrend, meaning the short-term moving averages are above the long-term moving averages.

|Translation: CoinDeskJAPAN

|Editing: Rinan Hayashi

|Image: Shutterstock

|Original: Bitcoin Quiets Down in July After a Tumultuous First Half of 2023

The post Bitcoin, moderate price movements in July ── the rapid rise in the first half did not continue | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

92

2 years ago

92

English (US) ·

English (US) ·