Bitcoin (BTC) entered a slightly downtrend range just below $27,000 on May 16 as investors focused on the Biden administration’s negotiations over the debt ceiling.

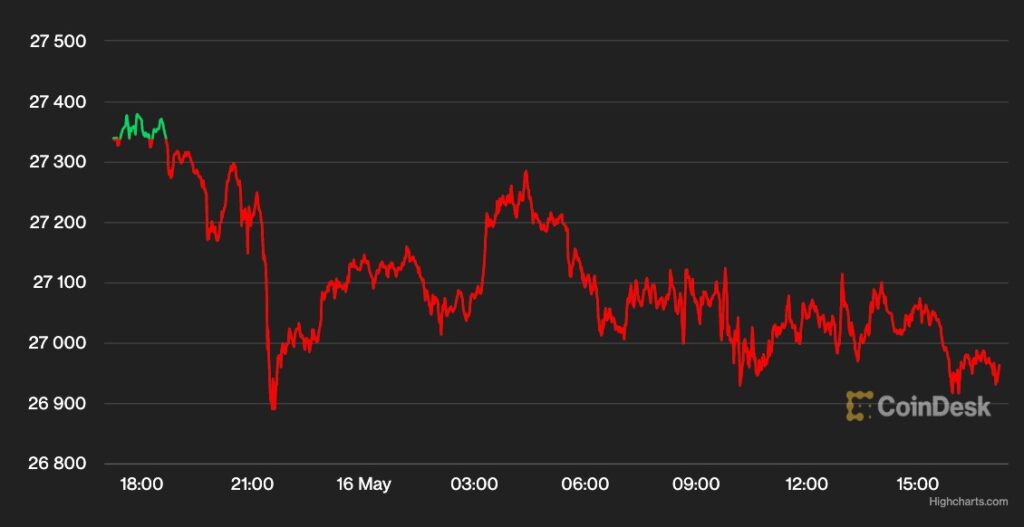

According to CoinDesk data, bitcoin is range-bound between $26,800 and $27,400 at the time of writing near $26,950, down about 1.3% in 24 hours.

CoinDesk

CoinDeskUS Treasury Secretary Yellen has warned that the US could break the debt ceiling as early as June 1, saying a default “could lead to a recession.” Some analysts also believe that the resolution of the debt ceiling issue could lead to Bitcoin’s rally.

Joe DiPasquale, CEO of crypto asset management firm BitBull Capital, told CoinDesk, “We believe the current macroeconomic conditions will facilitate the adoption of crypto assets.”

“Raising the debt ceiling works well for risk assets as market participants seek to secure wealth.”

Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, said that “bitcoin buying is likely” regardless of whether there is a debt ceiling deal.

Automulo believes the debt ceiling negotiations will have a similar impact to the ongoing banking crisis.

“Both have highlighted weaknesses in the system and raised doubts about its long-term sustainability, thus creating demand for possible alternative options such as cryptocurrencies.”

Ethereum (ETH) fell 0.2% on the 16th to close to $1,820. Among other altcoins, liquid staking platform Lido DAO (LDO) continues its 15-day gain, gaining another 3%. Layer 2 blockchain Polygon (MATIC) dropped 2.8%, hovering around 0.82 cents.

The CoinDesk Market Index (CMI), which measures the performance of the entire cryptocurrency market, fell 1.1%.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: CoinDesk

|Original: Bitcoin Slides Below $27K as Investors Eye Debt Ceiling Negotiations

The post Bitcoin moves around $27,000 ─ Investors pay attention to the US debt ceiling issue | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·