Macroeconomics and financial markets

In the US NY stock market on the 19th, the Dow Jones Industrial Average rose 109 dollars (0.31%) from the previous day, and the Nasdaq Index closed 4.3 points (0.03%) higher.

On the Tokyo stock market, it dropped 383 yen (1.17%) from the previous day. In response to the flow of the US stock market, semiconductor stocks, which rose yesterday, have fallen.

On the other hand, remarks by BOJ Governor Kazuo Ueda have dampened speculation about a monetary policy revision at the BOJ’s policy meeting scheduled to be held next week.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

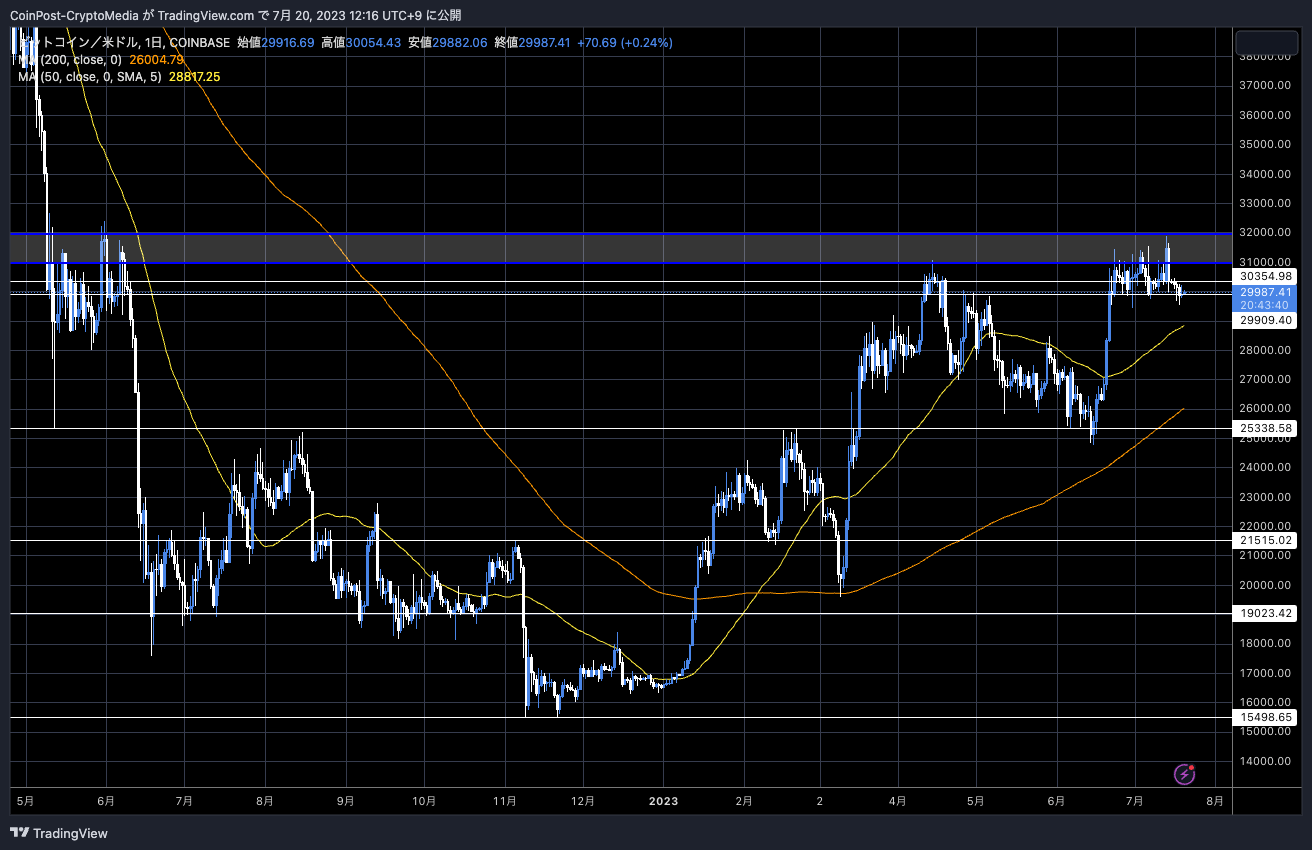

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.03% from the previous day to 1 BTC = $ 29,985.

BTC/USD daily

In addition to refraining from the US Federal Open Market Committee (FOMC), which is expected to resume interest rate hikes, there was also a temporary warning of a huge remittance to Binance by a whale (major investor).

A whale deposited 4,451 $BTC ($133.7M) to #Binance an hour ago.

The last time the whale deposited a large amount of $BTC(5,000 $BTCworth $118M) to #Binance was on Jan 30, and the price of $BTC dropped by ~4.2% after depositing. pic.twitter.com/v5YzDKXYIC

— Lookonchain (@lookonchain) July 19, 2023

Around 16:00 on the 19th, 4451 BTC equivalent to 18 billion yen was transferred. In January this year, 5,000 BTC was sent to Binance, and after that, the market fell by 4.2% due to the worsening market conditions.

According to Lookonchain’s on-chain data analysis, the wallet added about 25,000 BTC (equivalent to 67 billion yen) from early October to mid-December last year, with an average purchase price of $19,059.

In November last year, he bought more than 5,000 BTC in the bottom price zone immediately after the FTX shock, and it is pointed out that he may have moved to take profits for the second time since the beginning of the year.

Look on chain

WuBlockchain, on the other hand, pointed out the possibility that it was “just an internal transfer of the Binance wallet.”

The rumor that “today’s giant whale address transferred 4,451 bitcoins to Binance” should be an internal transfer of Binance wallet.

The bitcoins of this address (31pCdkyF6Ep8UkzpkWpv3SMbY3C5s7VhXL) all originated from a transfer on May 25 by 3LoAAJN3tbMCEXWjGNeiyG2TtzLJYXcG5R,…

— Wu Blockchain (@WuBlockchain) July 19, 2023

XRP And XLM Go High In Retrograde

Among individual altcoin stocks, XRP and XLM have been in a reverse trend following yesterday.

Since December 2020, while the U.S. SEC (Securities and Exchange Commission) and Ripple have been fighting over securities issues, a district court judge has issued a summary judgment that “XRP is not a security (personal sales are not an investment contract that violates the Securities Act).”

connection:“The virtual currency XRP itself is not a security,” US district court rules

U.S. District Judge Analisa Torres then referred the case to Justice Sarah Netburn, who ordered the release of the “Hinman Papers.” If the U.S. SEC (Securities and Exchange Commission) appeals against the first-instance decision, it may take a long time to review the evidence and review the evidence in a higher court, and revise the content of the district court’s decision.

NEW: District Judge Torres has referred to the @Ripple case to Magistrate Judge Netburn for General Pretrial (includes scheduling, discovery, non-dispositive pre-trial motions and settlement). pic.twitter.com/EyrA3flpXC

NEW: District Judge Torres has referred to the @Ripple case to Magistrate Judge Netburn for General Pretrial (includes scheduling, discovery, non-dispositive pre-trial motions and settlement). pic.twitter.com/EyrA3flpXC

—Eleanor Terrett (@EleanorTerrett) July 17, 2023

The district court ruled that the SEC’s allegation that the $700 million worth of XRP sales to institutional investors violated U.S. securities laws was accepted, but there is also a view that it is highly likely that Ripple will pay a fine and proceed to a settlement.

SEC Chairman Gensler has expressed disappointment with the verdict, but has reserved regulatory stance on the possibility of a moratorium on the lawsuit against the disputed cryptocurrency companies and an appeal.

connection:SEC Chairman Gensler Makes First Comments on Ripple Trial Ruling

The issue of Chairman Gensler’s term (reappointment) could also play a role if the appeal takes several more years to be heard. He assumed office on June 14, 2021, and is expected to serve until around June 2026.

In response to a judicial decision that the sale of crypto assets through exchanges does not constitute securities, many exchanges such as Coinbase, Kraken, and Bitstamp relisted XRP, which had been delisted since the filing of the SEC lawsuit. This seems to have led to the increase in liquidity of XRP and the rapid increase in OI (open interest) in the futures market.

Immediately after the ruling, XRP accounted for 21% of all cryptocurrency trading volume, according to data analytics firm Kaiko.

#XRP has surpassed #BTC as the highest volume asset

Since last week’s court ruling, 21% of all crypto trade volume has been for XRP. pic.twitter.com/OLdTQrk1kO

—Kaiko (@KaikoData) July 17, 2023

Liechtenstein-based European cryptocurrency exchange LCX Exchange also announced the listing of XRP.

connection:European Liechtenstein cryptocurrency exchange LCX, XRP newly listed

Stellar Lumens (XLM), which had a strong correlation with XRP in past cryptocurrency bubbles, has also soared by 20% compared to the previous day.

Stellar (XLM), which is also listed on the domestic crypto asset (virtual currency) exchange, was developed mainly by Jed McCaleb, co-founder of Ripple, and is intended for use in the fields of personal remittance and international remittance and settlement.

On the 19th, it announced a partnership with Latin American financial services giant Bitso to power international payments to Colombia, Argentina and Mexico using the USDC stablecoin.

350 million people in Africa don’t have access to bank accounts, and only 20% of families have formal bank accounts.@fonbnk1 provides a real-world solution to this problem by turning 8 billion active prepaid SIM cards globally into virtual debit cards with Stellar.

—Stellar (@StellarOrg) July 18, 2023

Integrated Stellar’s Anchor network to expand its payment network. This will make it easier and cheaper to send money internationally to businesses in Argentina, Colombia and Mexico.

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin moves softly at the 30,000 dollar milestone, and Stellar with XRP rises 20% compared to the previous day appeared first on Our Bitcoin News.

1 year ago

156

1 year ago

156

English (US) ·

English (US) ·