Bitcoin and altcoins rallied through the early trading hours on Monday, though the rally showed signs of slowing down at the time of writing.

Most of the top 99 altcoins traded flat after last week’s gains, still holding onto double-digit increases on the weekly timeframe, though only four remained in double digits on the daily.

Memecoins were the biggest gainers and most of the retail hype seemed concentrated towards this rapidly expanding subset of digital assets.

The combined value of assets in the sector rose by more than 22% on the day, topping $97 billion.

Memecoins have become one of the best-performing niches this season and consistently rallied alongside Bitcoin.

The top performing memecoins today were:

- ACT, a Solana-based token deployed via Pump.fun that seeks to support Artificial Intelligence adoption. Following its Binance listing the token had surged over 2090% at press time.

- PNUT, themed after the social media sensation Peanut the Squirrel, also got listed on Binance and rallied over 338%.

- RabBitcoin, Happy Cat, Memes AI, and BAN were up over 100%.

Why is Bitcoin (BTC) rising today?

Bitcoin started just below $80,000 and recorded an intraday high of $84,785, before pulling back slightly to $83,850 at press time, marking a 6.5% gain over the past day. The rally was ongoing.

BTC bulls managed to hold above $81,000 throughout the day as the market seemed to be in a sense of FOMO (Fear of Missing Out), even though technical indicators were warning that some correction was due.

The latest catalyst for the sustained uptrend came from MicroStrategy, the largest corporate holder of Bitcoin, which recently acquired $2 billion worth of the so-called digital gold.

This acquisition followed the company’s announcement of its ambitious 21/21 Plan, aiming to raise $21 billion through both equity and fixed-income securities over the next three years to fuel its expansion and investment strategy.

45th and now 47th US President Donald Trump’s victory remained the primary catalyst, while the historical trend of November being the most profitable month for the bellwether also helped inject optimism among traders.

Meanwhile, the influx of Wall Street capital provided further momentum, with over $1.61 billion flowing into spot Bitcoin ETFs over the past week.

Will Bitcoin crash?

With the current hype around the overall cryptocurrency market which is expected to gain massively under the Trump administration, the chances of a major BTC crash are unlikely.

However, there are some signs that the current rally could be cooling off for a while before beginning its next leg up towards the $100,000 market which many experts say is highly likely by the end of the year.

Firstly, according to Greg Magadini, Director of Derivatives at Amberdata, market makers are holding a high positive gamma exposure, meaning they’ve taken long positions in Bitcoin through options sold around the $90,000 and $100,000 levels.

To keep their exposure neutral, they’re likely to sell when prices rise and buy if prices dip, effectively acting as a brake on sharp movements.

This hedging activity could keep Bitcoin rangebound, limiting the potential for immediate gains unless bullish sentiment intensifies.

Second, CryptoQuant CEO Ki Young Ju has warned that the futures market is currently overheated and said BTC could see notable corrections soon.

Moreover, on the 24-hour BTC/USDT chart, Bitcoin’s price is showing strong upward momentum, but with the RSI now above 80, it’s officially in overbought territory.

This high RSI suggests the rally might be losing a bit of steam, so a pullback or some consolidation could be around the corner.

On top of that, the price is well above the 50-day and 200-day moving averages, which reinforces the bullish trend.

However, with these overbought conditions, there’s a chance we could see some short-term profit-taking.

Top altcoins today

Bitcoin’s market dominance stood at over 55%, indicating that alt season is yet to arrive.

Historically, Bitcoin dominance has dropped to the low 40s during alt seasons.

Nevertheless, the current market sentiment remains in a state of extreme greed, according to the Crypto Fear & Greed Index, which has led to notable profits for some of the top altcoins.

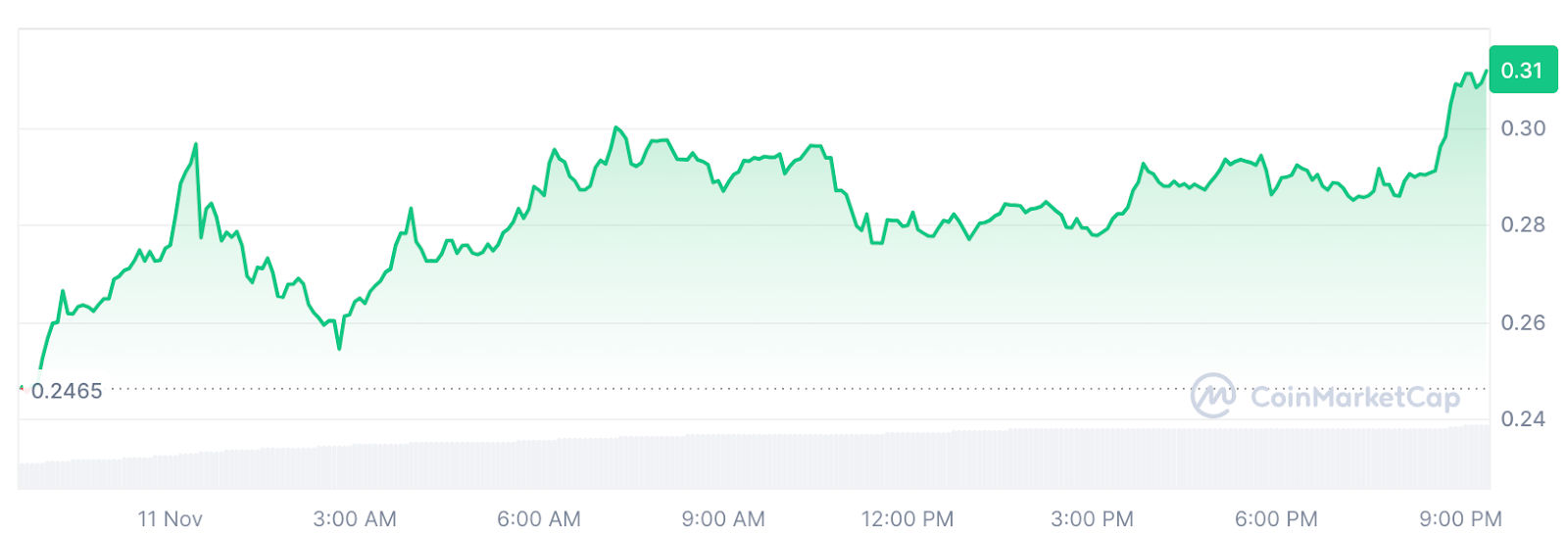

Cronos

CRO, the native token of Crypto.com’s Cronos blockchain, was up over 27% at the time of writing.

The gains were driven by the project’s recent roadmap announcement and a new partnership with Google Cloud.

Source: CoinMarketCap

Dogecoin

DOGE, the only memecoin in the top three, was up 25.8% in the past 24 hours.

The original memecoin surged following Trump’s victory, which has raised the chances of establishing Elon Musk’s proposed Department of Government Efficiency, or D.O.G.E. for short.

With a market capitalization of over $45 billion, DOGE is one of the most valuable meme coins and is notably less volatile compared to its peers, which also adds to its appeal among meme coin traders.

Source: CoinMarketCap

Ethena

ENA was up over 15%, continuing its rally that began after Wintermute, one of the project’s designated market makers, proposed a new fee switch framework for the Ethena protocol.

The latest proposal, submitted to the Risk Committee, suggests future revenue allocation to sENA, aligning incentives for stakers with Ethena’s financial performance.

Source: CoinMarketCap

The post Bitcoin nears $85K amid overbought conditions; CRO, DOGE, and ENA lead altcoin gains appeared first on Invezz

English (US) ·

English (US) ·