Macroeconomics and financial markets

In the US NY stock market on the 25th, the Dow Jones Industrial Average fell 35 dollars (0.11%) from the previous day, and the Nasdaq Index closed at 213 points (1.7%) higher.

Markets have been weighed down by a dispute between President Biden and House Speaker McCarthy over the U.S. debt ceiling. Fitch Ratings, a major rating agency, downgraded the outlook for the US credit rating to negative on June 24, as there is a view that the government’s cash flow will be at a standstill as early as June 1.

connection:“Day X” approaching U.S. debt ceiling problem, possible scenarios and their impact

In the unlikely event that the United States defaults, the bond market and the world economy will inevitably be in turmoil. Even if the debt is lifted, it is highly likely that liquidity will decrease due to the issuance of new US Treasury bonds, so optimism is not allowed.

Assets in money market funds — investment funds aimed at managing short-term money — hit a record $5.8 trillion this week as interest in short-term bonds surged, Reuters reported. bottom.

Among individual stocks, NVIDIA, which showed a bullish outlook in its financial results, surged sharply due to the rapid expansion of AI (artificial intelligence) demand following the ChatGPT trend. Circular hunts intensified across the sector, pushing the Semiconductor Index (SOX) higher.

connection:AI / semiconductor related stocks soar, NY Dow down for 5 days | 26th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.09% from the previous day to $26,413.

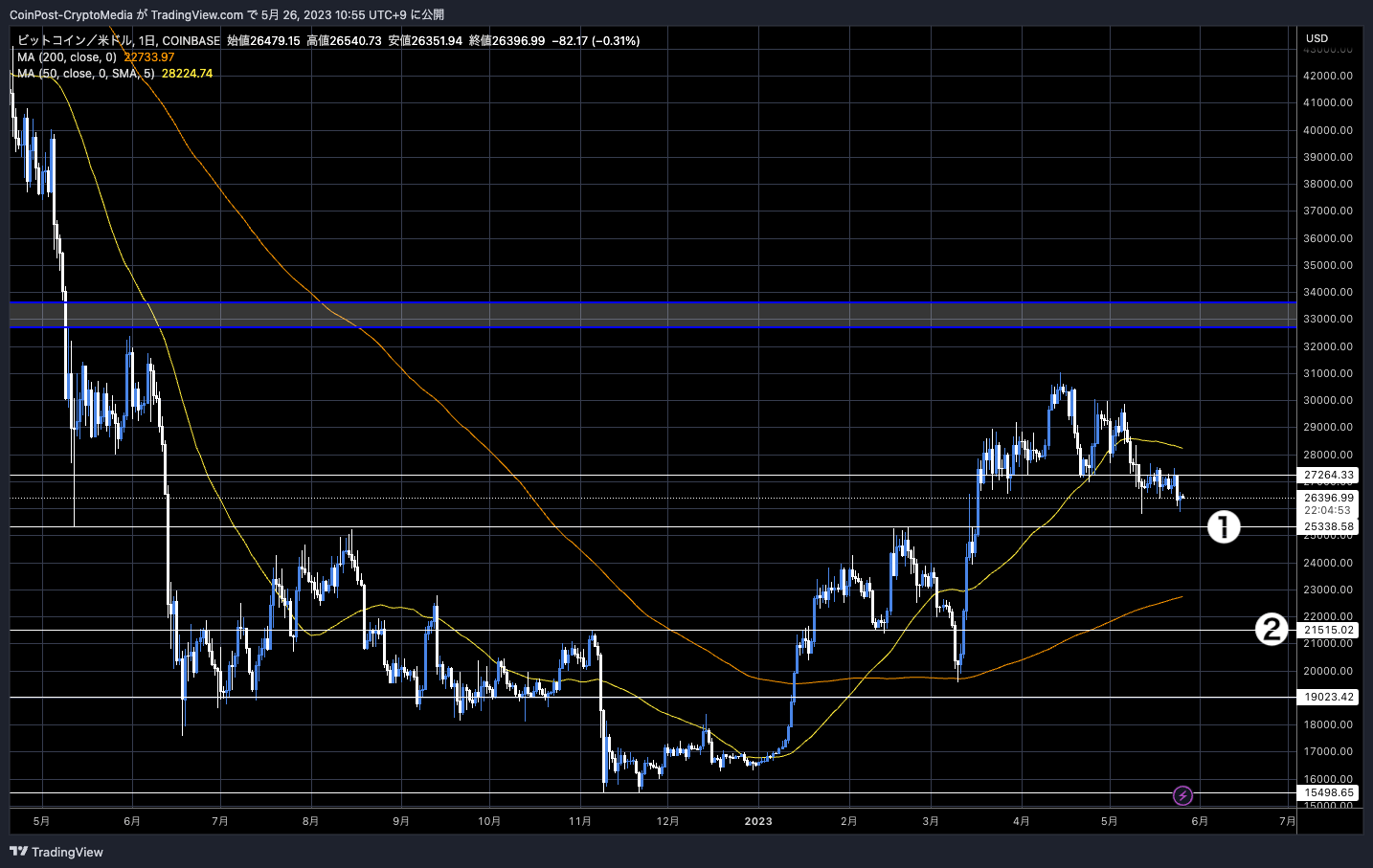

BTC/USD daily

With the debt ceiling problem weighing on the entire financial market, increasing spot selling by bitcoin miners and declining liquidity are confirmed, whether the bitcoin will rebound and resurface near the $25,200 support line (①). is the immediate focus?

If a reversal is confirmed and the US debt problem is resolved and the risk-on mood rises, the pair may aim for the most recent highs.

On major derivatives exchange Deribit, option contracts worth approximately $3.6 billion, equivalent to 26% of BTC and ETH open interest, will expire around 17:00 today (Japan time). The put/call ratio for Bitcoin options contracts is 0.38. Shows that the call option reaches 2.63 times the put option.

26 May, Mega Monthly Expiry

This Friday a total value of USD 3.6 billion will expire, which equals approximately 26% of Deribit’s open interest.

BTC USD 2.3 billion or ±85k contracts with a put call ratio of 0.38 which implies there are >2.5x more calls outstanding than puts.… pic.twitter.com/xnqzb0wkrM

— Deribit Insights (@DeribitInsights) May 23, 2023

The max payin is around $27,000, the price level at which most option contracts are voided in the options market. Market participants tend to try to maximize the payoff of options, and it is possible that they are conscious of the same price range.

On the other hand, Implied Volatility (IV), which indicates expected volatility, is at a record low level. When it hit a similar IV level in January this year, it led to a significant rise in the market price after that, he said.

Deribit Insights noted that it was also extremely rare for the “delta volatility” between different currencies such as Bitcoin and Ethereum to line up at low levels.

DCG in trouble

The Digital Currency Group (DCG) has decided to offer its prime brokerage services to institutional investors such as hedge funds and asset managers, citing the deterioration of the macro economy and regulatory uncertainty by the U.S. SEC (Securities and Exchange Commission). announced the closure of its subsidiary, Trade Block.

Bloomberg reports that the closure will begin at the end of this month.

Barry Silbert’s crypto conglomerate, Digital Currency Group, is shuttering its TradeBlock institutional trading platform https://t.co/duE4YnknrR

—Bloomberg Crypto (@crypto) May 25, 2023

Digital Currency Group (DCG) has paid $630 million in debt to cryptocurrency exchange Gemini, which holds the debt of Genesis Global Capital, a small company that has filed for bankruptcy in the wake of the collapse of Three Arrows Capital (3AC) and the collapse of FTX. Delayed and facing default and bankruptcy risk.

connection:DCG to close institutional trading services

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin on a Wait-and-See Basis, Deribit Expires $3.6 Billion Crypto Option Contracts appeared first on Our Bitcoin News.

2 years ago

123

2 years ago

123

English (US) ·

English (US) ·