Macroeconomics and financial markets

In the US NY stock market last weekend, the Dow closed at $2.5 (0.01%) higher and the Nasdaq at 0.76% higher than the previous day.

The U.S. employment report released on the 7th showed that the number of nonfarm workers was in line with expectations, but the unemployment rate was lower than expected.

While the US Federal Open Market Committee (FOMC) in May is expected to raise interest rates by 0.25bp, the market is already pricing in a phase of suspension of interest rate hikes thereafter. If long-term interest rates fall and the dollar continues to fall, risky assets such as stocks and Bitcoin (BTC) will benefit.

connection:Nasdaq/AI Stock Rebound Tomorrow Closed | 7th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 0.68% from the previous day to $28,267.

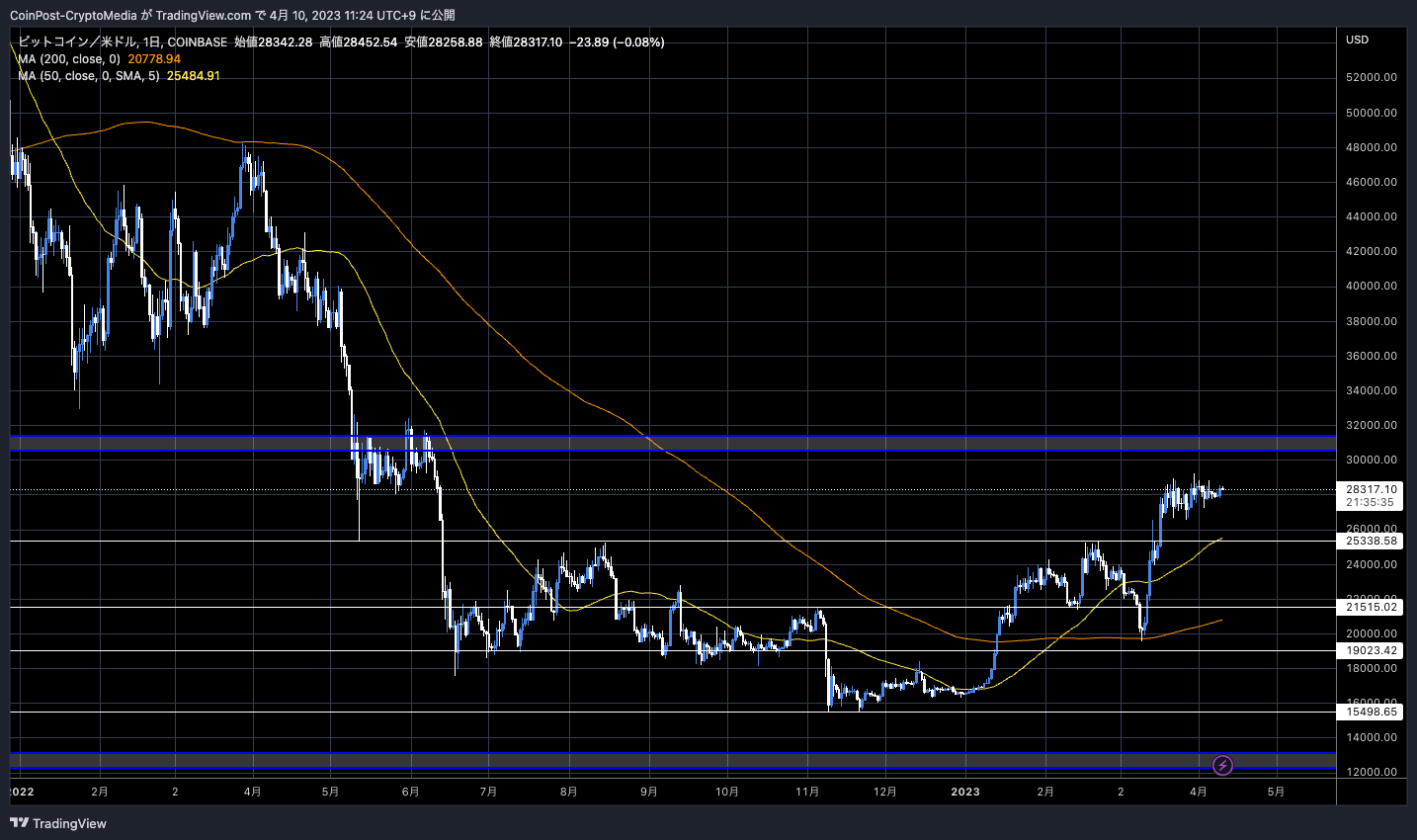

BTC/USD daily

Last weekend, it was revealed that a vulnerability in a smart contract was exploited at SushiSwap, a major decentralized exchange, resulting in $3.3 million worth of hacking damage (equivalent to 400 million yen).

connection:Hacking worth 400 million yen on decentralized exchange SushiSwap

Blockchain security firm PeckShield has called for “revoke” digital wallet connections to SushiSwap and related contracts.

It seems the @SushiSwap RouterProcessor2 contact has an approve-related bug, which leads to the loss of >$3.3M loss (about 1800 eth) from @0xSifu.

If you have approved https://t.co/E1YvC6VZsP, please *REVOKE* ASAP!

One example hack tx: https://t.co/ldg0ww3hAN pic.twitter.com/OauLbIgE0Q

— PeckShield Inc. (@peckshield) April 9, 2023

The recovery procedure is explained in the article below.

connection:Explanation of points to note when using Web3 wallet Metamask

The number of wallet addresses holding 1 BTC or more has reached a record high.

#Bitcoin $BTC Number of Addresses Holding 1+ Coins just reached an ATH of 993,856

#Bitcoin $BTC Number of Addresses Holding 1+ Coins just reached an ATH of 993,856

View metric: https://t.co/s7tx1xxyz3 pic.twitter.com/g0ka6ksGOY

—glassnode alerts (@glassnodealerts) April 9, 2023

In addition, in contrast to the rise in the Bitcoin price since the beginning of the year, an intermittent decrease in the average trading volume (weekly average) has been confirmed. suggesting that they avoid buying or selling.

In the next half-life, the mining reward for the new supply will decrease from 6.25 BTC to 3.125 BTC, and its scarcity value will increase further.

connection:What is Bitcoin Halving?Explain the impact on virtual currency prices and caution points

Tapiero, co-founder of 10t Holdings, a growth equity fund that invests in companies in the digital asset ecosystem, pointed out that the recent Bitcoin market is “increasing interest from institutional investors.”

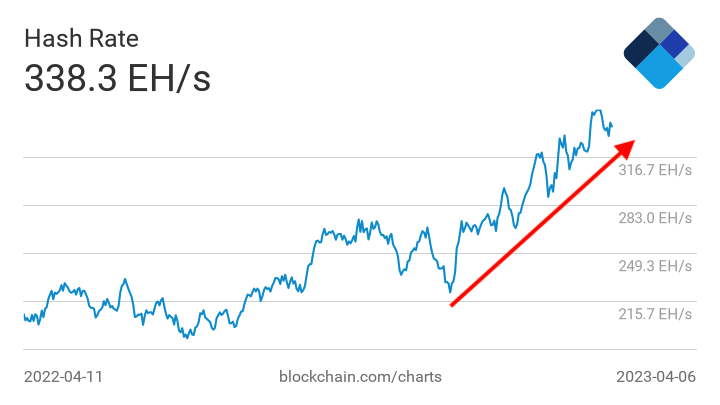

The reasons for this are the rapid increase in hash rate (mining speed), the expansion of the market size of Ordinals NFTs, and the increase in the number of developers.

With the advent of the Ordinals Protocol, it became possible to record image data in satoshi, the smallest unit of bitcoin. rose to prominence.

The Ordinals Protocol uses the “Taproot” function implemented in the Bitcoin major upgrade in November 2021, the first time in about four years since SegWit in 2017.

connection:Considering the Token Issuance Protocol on Bitcoin and the Ideas Behind It|Contributed to Bitcoin Research Institute

Regarding the merits and demerits of Ordinals, there are pros and cons, such as the decrease in convenience due to the increase in fees and the view that it conflicts with the main purpose of using payments. However, the impact is limited at the moment, and we can see an increase in the number of active users who hold a small amount of BTC.”

If the robustness of the network improves and the number of developers increases, it will lead to the activation of miners (mining companies). Bitcoin’s hash rate continues to hit record highs thanks to the reversal rise since the beginning of the year.

blockchain.com

altcoin

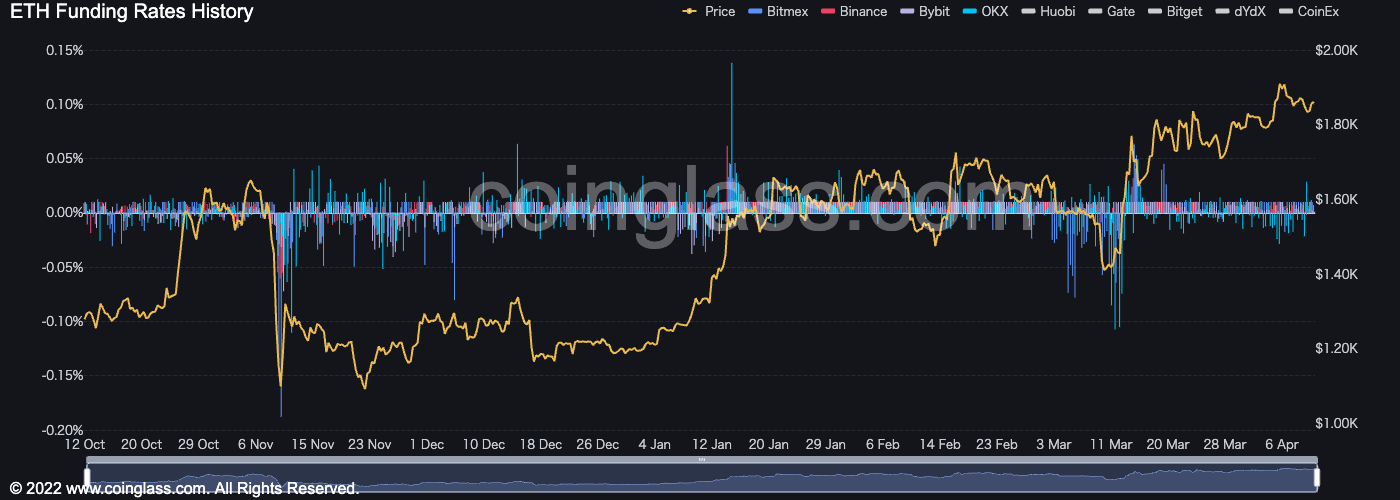

Regarding Ethereum (ETH), which is about to upgrade in Shanghai (Shanghai–Capella), there was no significant change in the FundingRate in the futures market, and long/short futures rates were almost flat.

With the implementation of the validator’s withdrawal function, the staking reward of the beacon chain that has been locked up to now will be released, so some selling pressure is expected, but some believe that the current trading volume will be enough to absorb it.

connection:What is the ETH “Shanghai” upgrade?Summary of each company’s view on staking cancellation and ETH selling pressure

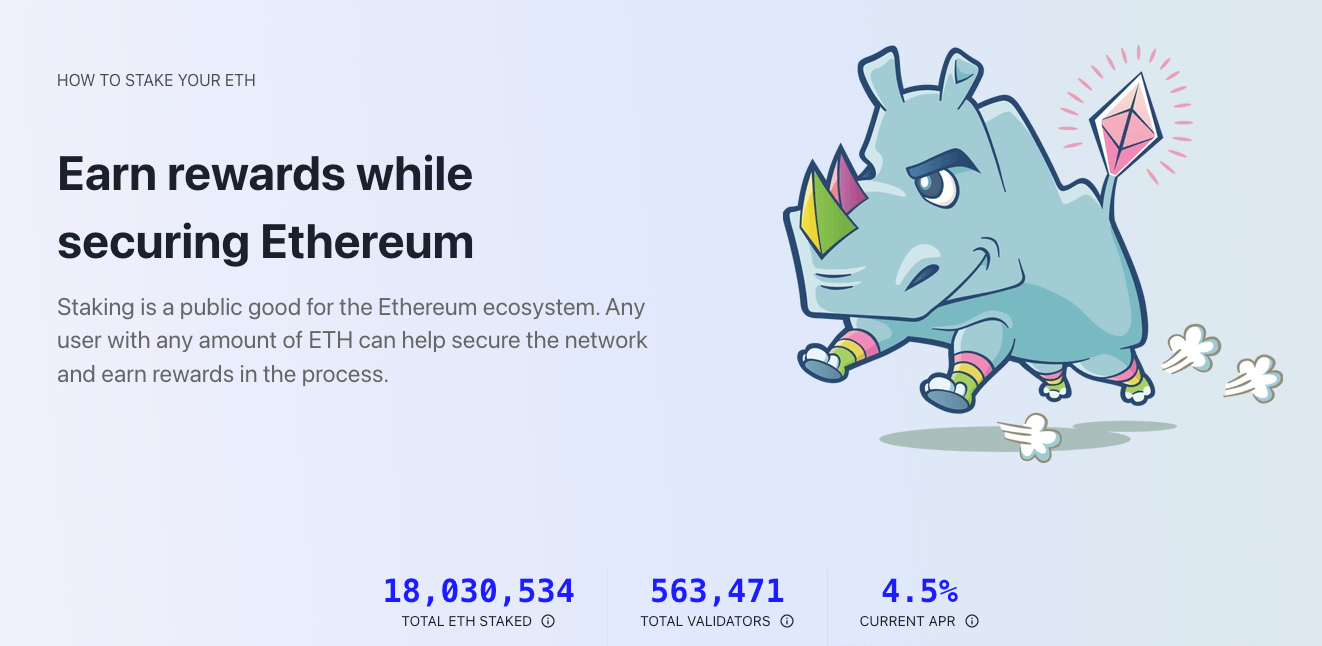

The amount locked in the contract amounts to 18 million ETH, and over 1 million ETH has been accumulated as validator rewards.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin On-Chain Data Multiple Bullish Signals, Market Equilibrium appeared first on Our Bitcoin News.

2 years ago

135

2 years ago

135

English (US) ·

English (US) ·