Trading of Bitcoin (BTC) options listed on Deribit, a crypto asset (virtual currency) exchange, has surged following the US bank failure and the accompanying market volatility.

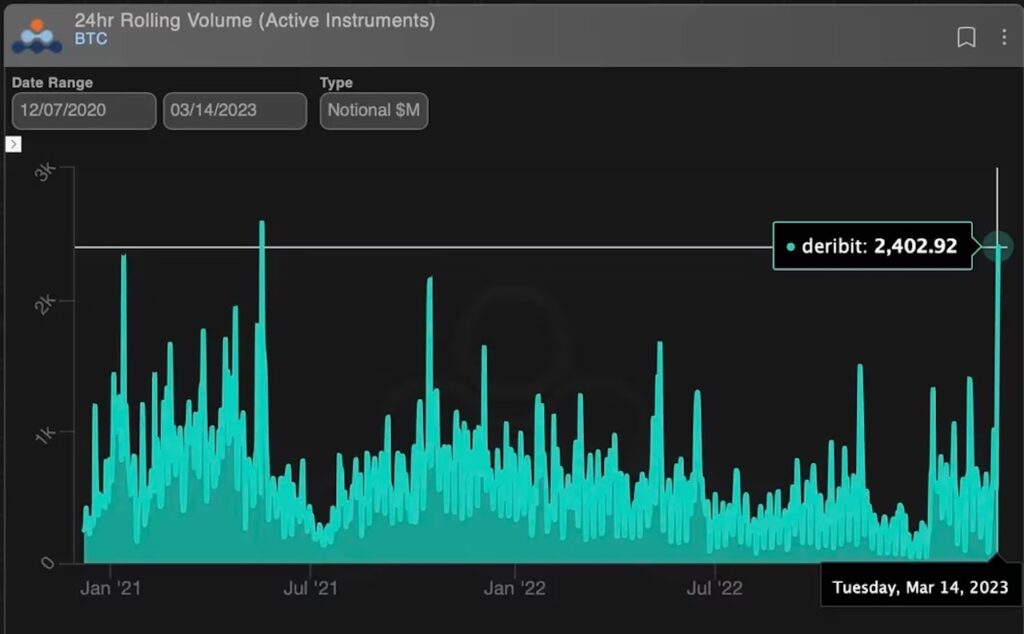

Data from cryptocurrency data provider Amberdata shows that over the past 24 hours, Deribit has traded $2.4 billion worth of bitcoin options, with daily trading volume expected to reach May 2021. It was the highest since the 17th. Bitcoin traded in the last 24 hours hit a record high of 99,195 BTC at the time of writing. The 24-hour notional value of Ethereum (ETH) options totaled $948 million at the time of writing, the highest since November.

In Deribit, one option contract represents 1 BTC and 1 ETH. The exchange accounts for over 80% of the global crypto options market. An option gives a trader the right to buy or sell the underlying asset (BTC in this case) at a specific price by a specified date. A call option gives the right to buy and a put option gives the right to sell.

Bitcoin options 24-hour trading volume surged amid market volatility. (Amberdata)

Bitcoin options 24-hour trading volume surged amid market volatility. (Amberdata)The collapse of three banks in one week has brought volatility to financial markets, forcing both crypto and traditional market traders to seek option hedging. Trading volumes in options linked to Wall Street’s fear index, the VIX, surged last week to a four-year high, according to Reuters.

Bitcoin was initially pressured by the March 10 shutdown of Silicon Valley Bank, but was bought back over the weekend. Prices have risen nearly 25% since midnight Monday, and are up 9% in the past 24 hours, as the banking crisis weakened the case for continued tightening by the Federal Reserve.

Bitcoin’s 7-day annualized implied volatility (IV) climbed to a four-month high of 90% in the early hours of Thursday morning, as the market expected the price to fluctuate in the short term. The 30-day, 60-day, 91-day and 180-day gauges are also rising, indicating increased demand for options. A similar pattern can be seen in the Ethereum options market, where seven-day implied volatility climbed to a two-month high of 77% early Wednesday.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Amberdata

|Original: Bitcoin Options Volume on Deribit Hits Highest Level in 22 Months as Bank Failures Breed Volatility

The post Bitcoin options trading volume hits 22-month high ── Hedging the impact of bank failure | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

179

2 years ago

179

English (US) ·

English (US) ·