Macroeconomics and financial markets

In the US NY stock market on the 9th, the Dow closed at $249.13 (0.73%) lower than the previous day and the Nasdaq at $120.94 (1.02%) lower.

As the results of the employment statistics of the other day greatly exceeded the market expectations, the closing selling preceded the release of the CPI (US Consumer Price Index) on the 14th Japan time. If the CPI is also expected to rise above, a yellow light will be lit on inflation control, and financial markets may once again turn risk-off.

connection:Nasdaq, virtual currency overall decline Coinbase stocks plunge | 10th financial tankan

Virtual currency market

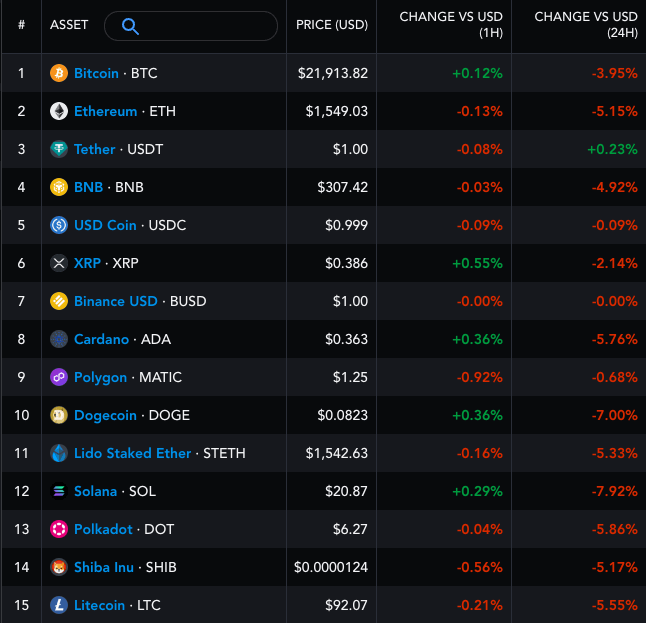

In the crypto asset (virtual currency) market, Bitcoin fell 3.95% from the previous day to $21,907.

BTC/USD daily

While the stock price index has been declining against the background of the bearish stock index, it cut the neckline and strengthened the downward trend.

In addition to the overheating of the altcoin market, OI (open interest) and funding rate (funding rate) trends are running out of additional fuel that pushed the significant rebound last month. There is also a view of

connection:A professional commentary on the Bitcoin derivatives market at the beginning of 2023 | Contributed by virtual NISHI

Ethereum (ETH) also fell 5.15% from the previous day, and many stocks fell sharply even in the alt market, which had been overheated recently.

Messari

In addition to the deterioration in sentiment, the cryptocurrency market was disgusted by increased uncertainty regarding staking and proof-of-stake (PoS) currencies.

The long-established cryptocurrency exchange Kraken, which was indicted by the U.S. SEC (Securities and Exchange Commission) for violating securities laws (sale of unregistered securities), stopped providing staking services for U.S. users and paid $30 million (about 3.9 billion dollars). yen).

The SEC pointed out that the entrusted crypto asset staking service provided by the company falls under an investment contract with securities. Considering the bankruptcy of major exchange FTX in November last year and the fact that the platform is in a state of continuation and coexistence during the deposit period of staking assets, it is said that the viewpoint of user protection is also behind it.

Today @SECGov Charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program.

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

—Gary Gensler (@GaryGensler) February 9, 2023

What is staking

A system in which rewards are obtained by depositing a certain amount of virtual currency for a specified period of time. By contributing to the operation of the blockchain, you can get rewards as compensation.

CoinPost: Virtual Currency Glossary

CoinPost: Virtual Currency Glossary

Along with this, we have notified US residents who received rewards for staking Ethereum (ETH), Polkadot (DOT), and Ada (ADA) provided by Kraken of the start of forced unstaking. . Unstakes can create some selling pressure.

However, there will be a grace period for Ethereum, which cannot be withdrawn due to the system until the implementation of the Shanghai upgrade scheduled for March this year. It will also continue to offer staking services through its subsidiary to non-U.S. users who are subject to securities laws.

connection:What impact will the Shanghai upgrade scheduled for March have on the Ethereum market?

SEC Commissioner Hester Peirce issued a statement dissenting from the SEC’s decision.

The SEC claims it should have been registered as an offering of securities, but was it pre-registered to apply for a staking service in the first place? Is registration required for each brand? After raising several questions, he pointed out that regulatory policies, such as disclosure methods and accounting issues, are immature.

“Increasing transparency itself is a good thing, but before regulatory authorities present guidance and require companies to comply, forceful ‘enforcement measures’ precede and cause confusion in emerging industries,” he argued. . He criticized the SEC’s stance for being ahead of its hardline behavior despite lack of clarity in its regulatory guidance.

detail:US SEC: Kraken’s cryptocurrency staking service violates securities laws

The SEC has taken a clear stance on crackdowns, triggered by the Terra (LUNA) shock that followed the collapse of the algorithmic stablecoin “UST (TerraUSD)” last year and the major exchange FTX scandal.

On the other hand, in this case, the lack of SEC registration and information disclosure regarding Kraken’s staking mechanism was pointed out, and it is debatable whether all existing staking services violate US securities laws. , and some are skeptical about whether Coinbase, the largest U.S. exchange, will be banned from staking services.

altcoin market

Individual stocks in the alt market fell sharply due to temporary selling pressure from the Optimism Network (OP).

Optimism has conducted a surprise Token Airdrop #2 under the initiative of phasing out 19% of the total supply.

Today Optimism is announcing OP Airdrop #2.

11.7M OP distributed to over 300k unique addresses to reward positive-sum governance participation and power users of Optimism Mainnet.

Read on for details on eligibility criteria and distribution. https://t.co/lgLMHqli26

— Optimism (

_

_

) (@optimismFND) February 9, 2023

) (@optimismFND) February 9, 2023

Participation in plus-sum governance on the mainnet and as part of heavy user return measures using Optimism, in addition to addresses that have delegated voting rights, users who have spent a certain amount of gas bills after March 25, 2010 are eligible. rice field.

Optimism Network’s governance token, OP, is conducting airdrop #1 in May 2022, distributing 5% of the total token supply.

Optimism is one of the Layer 2 scaling solutions developed for transaction mitigation on Ethereum (ETH), which has ever-increasing load, and employs Optimistic Rollup technology.

connection:Ethereum L2 Demand Increases, Optimism Token Hits Record High

If the proposal passes the governance vote, the first protocol upgrade, Bedrock, is scheduled for March this year.

connection:Ethereum L2 ‘Optimism’, first upgrade ‘Bedrock’ proposed to be implemented in March

Click here for a list of market reports published in the past

The post Bitcoin plummets into adjustment phase, new challenge for stakeable PoS currency appeared first on Our Bitcoin News.

2 years ago

162

2 years ago

162

English (US) ·

English (US) ·