7/1 (Sat) morning market trends (compared to the previous day)

- NY Dow: $34,407 +0.8%

- Nasdaq: $13,787 +1.4%

- Nikkei Stock Average: ¥33,189 +0.1%

- USD/JPY: 144.2 -0.3%

- USD Index: 102.9 -0.4%

- 10-year US Treasury yield: 3.8 +0.5% annual yield

- Gold Futures: $1,927 +0.5%

- Bitcoin: $30,490 +0.1%

- Ethereum: $1,938 +4.6%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow continues to rise to +285 dollars. The Nasdaq closed at +$196.5. Hopes of a soft landing seem to have supported the stock market.

Last night’s May US Personal Consumption Expenditure (PCE deflator) slowed slightly, but it doesn’t look weak enough to change the Fed’s recent hawkish stance.

connection: Bitcoin remains solid, and Bitcoin Cash, which is suddenly moving, more than doubled from the previous month

US Personal Consumption Expenditure Slows in May

The US PCE deflator for May is as follows.

- Overall change from previous month: Forecast 0.2% Result 0.1% Previous 0.4%

- Overall YoY change: Expected 3.8% Result 3.8% Previous 4.4%

- Core YoY: Forecast 0.5% Result 0.3% Previous 0.4%

- Core YoY change: Forecast 4.7% Result 4.6% Previous 4.7%

- Personal income month-on-month: forecast 0.3% result 0.4% last time 0.4%

- Personal spending month-on-month: forecast 0.2% result 0.1% last time 0.6%

The PCE Composite Price Index in May showed the lowest growth in about two years, and consumer spending remained almost flat in real terms from February to May. On the other hand, the year-on-year growth rate of the core price index has remained at roughly the same level since the end of 2022. It suggested that the momentum of US economic growth slowed significantly in the second quarter.

The savings rate rose to 4.6% from 4.3% in April. Consumers are becoming more cautious about spending due to concerns about a recession.

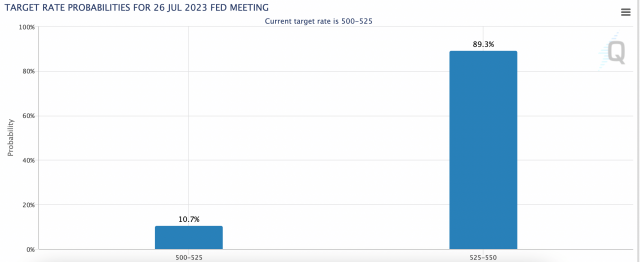

The PCE price index is an inflation indicator that the US Federal Reserve and others emphasize, and the indicated continuous slowdown in inflation serves as a guideline for judging the need for additional interest rate hikes in the future.

According to Bloomberg, Bloomberg Economics’ Stuart Paul et al., “Personal income and spending data for May show that the relationship between income growth and inflation is gradually loosening, according to the FOMC dot released in June.・It is doubtful whether another 0.5% rate hike is necessary, as suggested by the plot (interest rate forecast distribution chart).

Source: CME

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

dollar yen

The dollar/yen exchange rate temporarily rose to the 145 yen level against the dollar, but then fell back to the low 144 yen level.

U.S. Treasury Secretary Yellen announced on the 30th that she is coordinating with the Japanese government on the pros and cons of the Bank of Japan’s foreign exchange intervention in response to the weakening yen.

economic indicators

- July 3 (Monday) 8:50: April-June Quarterly Bank of Japan Tankan Forecasts for Large Enterprises in Manufacturing

- Monday, July 3, 23:00: June US ISM Manufacturing Index

- Thursday, July 6, 3:00: Federal Open Market Committee (FOMC) Minutes

- Thursday, July 6, 21:15: June US ADP employment data (m/m)

- Friday, July 7, 21:30: June U.S. Unemployment Rate

US stocks

Tech stocks such as artificial intelligence (AI) stocks continued to rise on the back of U.S. consumer spending data. The Nasdaq 100 index rose about 38% in the first half of this year (January-June) on the back of the AI boom.

Source: Tradingview

Since the release of ChatGPT, the market has had high hopes for generative AI. Strong expectations continued despite pressure from recession fears, geopolitical risks, the debt ceiling issue and the bankruptcy of some regional banks. For example, Nvidia’s market capitalization reached $1 trillion in May.

Individual stocks compared to the previous day: Nvidia +3.6%, c3.ai +1.4%, AMD +2.4%, Tesla +1.6%, Microsoft +1.6%, Alphabet +0.5%, Amazon +1.9%, Apple +2.3%, Meta + 1.9%.

Apple’s market capitalization topped $3 trillion for the first time on a closing price basis. The $3 trillion mark is reached for the first time since January last year. It trailed second place Microsoft by almost $500 billion. Since the announcement of “Apple Vision Pro” in June, expectations for new fields such as AI and XR have spread.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Bitcoin plunge

- Coinbase|$71.5 (-1.2%/+16.4%)

- MicroStrategy | $342.4 (+0.6%/+4%)

- Marathon Digital | $13.8 (+0.2%/+9%)

Cryptocurrency stocks such as bitcoin plunged last night after the US SEC commented that the application for a bitcoin ETF was insufficient. It seems that expectations for the approval of spot-type Bitcoin ETF have temporarily receded.

Source: Binance

On the other hand, some stocks such as Litecoin (LTC) and Solana (SOL) had a V-shaped recovery.

connection: SEC “Insufficient application for spot-type Bitcoin ETF”, Cboe updates documents such as Fidelity | Summary of important bulletins on the morning of the 1st

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post Bitcoin plummets on SEC comment, US Apple’s market capitalization tops $3 trillion for the first time at closing | 1st Financial Tankan appeared first on Our Bitcoin News.

2 years ago

113

2 years ago

113

English (US) ·

English (US) ·