Macroeconomics and financial markets

On the 18th, in the US New York stock market, the Dow Jones Industrial Average closed 201.9 points (0.54%) higher than the previous day, and the Nasdaq Index closed 200 points (1.35%) higher.

In the Tokyo stock market, the Nikkei Stock Average rose 583.7 yen (1.64%) from the previous day.

As Bitcoin (BTC) plummets, US stocks related to crypto assets (virtual currency) have also been weak.

Coinbase fell 7.6% from the previous day, and Hut8 Mining plummeted 30.06% from the previous day.

CoinPost app (heat map function)

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 3.78% from the previous day to 1 BTC = $41,096.

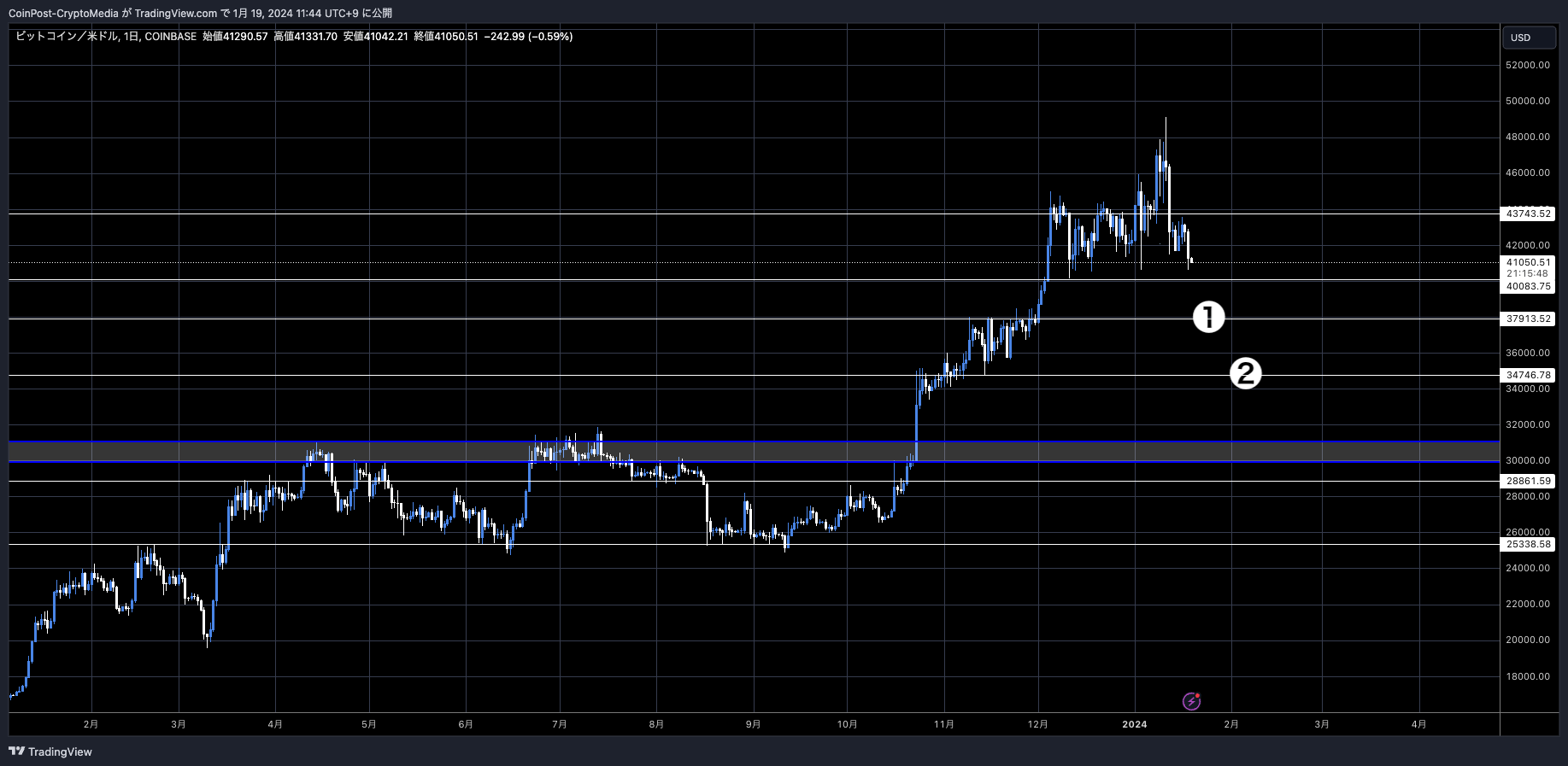

BTC/USD daily

The daily chart is deteriorating, and there is a risk that the correction phase will be prolonged.

In the event that 1BTC = $40,000, the likely downside support would be around $38,000 (①) or $34,700 (②).

In the futures market, about $200 million of long positions were liquidated, but this is a little less than the $590 million on the 3rd.

Among major altcoins, Ethereum (ETH) is down 3.07%, Solana (SOL) is down 8.01%, and Avalanche (AVAX) is down 7.7%, leading to a withdrawal of funds from altcoins that were soaring in the Bitcoin ETF market. stands out.

connection:A professional explains the market price at the beginning of the year after Bitcoin ETF approval | Contribution: Virtual NISHI

According to data from on-chain analysis firm Santiment, as of 1 a.m. on the 17th, a transfer of $665 million worth of crypto assets (virtual currency) was confirmed.

The largest #Bitcoin transaction thus far in 2024, worth $665.3M, occurred ~6 hours ago. Between 3pm and 4pm UTC, this transaction contributed to a total of 42,870 $BTC moved in 1 hour, the highest level of hourly movement in nearly 6 months. https://t.co/LigU0fVgYm pic.twitter.com/m2YPbgy7EG

The largest #Bitcoin transaction thus far in 2024, worth $665.3M, occurred ~6 hours ago. Between 3pm and 4pm UTC, this transaction contributed to a total of 42,870 $BTC moved in 1 hour, the highest level of hourly movement in nearly 6 months. https://t.co/LigU0fVgYm pic.twitter.com/m2YPbgy7EG

— Santiment (@santimentfeed) January 16, 2024

Analysts at JPMorgan also stated on the 17th that “Bitcoin could face further downward pressure in the coming weeks if investors holding GBTC continue to take profits.” .

connection:Cryptocurrency market has fallen sharply after approval of Bitcoin ETF, selling pressure due to Grayscale’s GBTC etc.

Although Grayscale’s investment trust GBTC has achieved its long-cherished desire to convert into an exchange-traded fund (Bitcoin ETF), more than $1.5 billion of funds have already been lost as of the 18th due to high trust fees. It is leaking due to transfer.

LATEST: Day Four was a good one, the ROLLING NET FLOWS grew to +$1.2b after the Newborn Nine pulled in $914b on Wed, by far their best day yet, overwhelming the $450 out of $GBTC. The ‘Nine’ have now taken in $3b and traded $5.4b in first four days (abnormally high #s). $IBIT is… pic.twitter.com/mYBLggYlYK

— Eric Balchunas (@EricBalchunas) January 18, 2024

According to Alex Thorn, the amount of money Grayscale sent to Coinbase Prime for redemption settlements slowed into the 19th.

grayscale transferred 9,839 BTC ($417m) onchain to coinbase prime this morning to settle yesterday’s redemptions (T+1 settlement).

notably less than the day before when they moved 18k BTC ($770m) to coinbase prime to settle tuesday’s redemptions

— Alex Thorn (@intangiblecoins) January 18, 2024

It decreased from 18,000 BTC ($770 million) to 9,839 BTC ($417 million).

BTC inflows have increased since the launch of the Bitcoin ETF, and the “Coinbase Premium Gap” has turned negative, indicating strong selling pressure on Coinbase.

To add some data to @CL207‘s statement:

The current negative Coinbase Premium Gap indicates strong selling pressure on Coinbase, which has led to lower BTC prices in the past.

Therefore, it is important to monitor positive flows coming in. It’s waiting time until this metric… https://t.co/ldytpnIVtQ pic.twitter.com/HbIcR8CgR0

— Maartunn (@JA_Maartun) January 18, 2024

The index represents the gap between the Coinbase Pro price (USD currency pair) and the Binance price (USDT currency pair), and is the gap between US institutional investors and whales (large investors) relative to global standards. It is useful for analyzing sentiment and position trends.

During the 2021 bull market, when Bitcoin was at an all-time high, “Coinbase Premium” reached a premium (upward deviation) of more than $50.

Bitcoin ETF demand exceeds market expectations

Demand for Bitcoin spot ETFs (exchange traded funds) exceeded market expectations, with total trading volume reaching $11.95 billion.

Before the U.S. SEC (Securities and Exchange Commission) approved Bitcoin spot exchange-traded funds (ETFs), some analysts had predicted that they would reach $10 billion a year, which is significantly higher.

However, JPMorgan analysts are also skeptical of Ethereum ETF approval.

“Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS) has had a negative impact on decentralization” “Cryptography sued by US SEC (Securities and Exchange Commission) for being considered securities There is also an asset staking service, and it may be difficult to approve it unless it is resolved in court.”

connection:Bitcoin ETF surpasses silver ETF to become second place commodity ETF

“WebX2024” New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023” pic.twitter.com/vHZmFbNjwM

— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin plummets to $40,000 level again as grayscale GBTC sell-off continues appeared first on Our Bitcoin News.

1 year ago

112

1 year ago

112

English (US) ·

English (US) ·