Macroeconomics and financial markets

In the US NY stock market on the 3rd, the Dow closed at $341.73 (1.05%) higher than the previous day and the Nasdaq at $83.49 (0.73%) higher.

The Dow Jones Industrial Average has been boosted by sales force, a major information service company, which has shown a bullish forecast that surpasses market expectations for this year’s performance, while Silvergate Capital, the parent company of Silvergate Bank and a US bank holding company, is in a difficult situation. . The company’s stock price plunged 58% from the previous day.

connection:US Silvergate stock price plunge Following suspension of trading with US Coinbase and others

In addition to the announcement that “the annual report (Form 10-K) for the fiscal year in terms of financial statements, etc. cannot be submitted by the deadline,” major US exchange Coinbase, stablecoin issuer Paxos, Crypto.com It was disappointing that major crypto-asset-related companies, such as, have terminated remittance transactions and fund settlement partnerships one after another.

Silvergate Bank, which is listed on the New York Stock Exchange in the United States, was affected by the collapse of the major crypto asset (virtual currency) exchange FTX in November last year, and its financial situation has deteriorated rapidly as customer deposit withdrawals have accelerated. Bankruptcy risk is a concern.

In addition to collateralized lending services and custody services for institutional investors, Silvergate Bank of the United States has provided its own payment network “Silvergate Exchange Network (SEN)” as a service that can raise US dollars using Bitcoin as collateral. In October 2020, remittances via SEN are believed to have ballooned to $100 billion (approximately ¥10.6 trillion).

In this regard, Adam Cochran, partner at Cinneamhain Ventures, said: “How many market makers were providing liquidity through Silvergate and SEN, how many cryptocurrency exchanges were trading with banks, and how many market participants were participating. people don’t understand enough,” he warned.

Silvergate’s death spiral is going to be rough for crypto.

I don’t think retail investors realize how much market maker money moved around quickly via SEN, and how many crypto exchanges were/are banking with them.

Stock almost down to its ATL after hours.

—Adam Cochran (adamscochran.eth) (@adamscochran) March 1, 2023

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 4.91% from the previous day to $22,347.

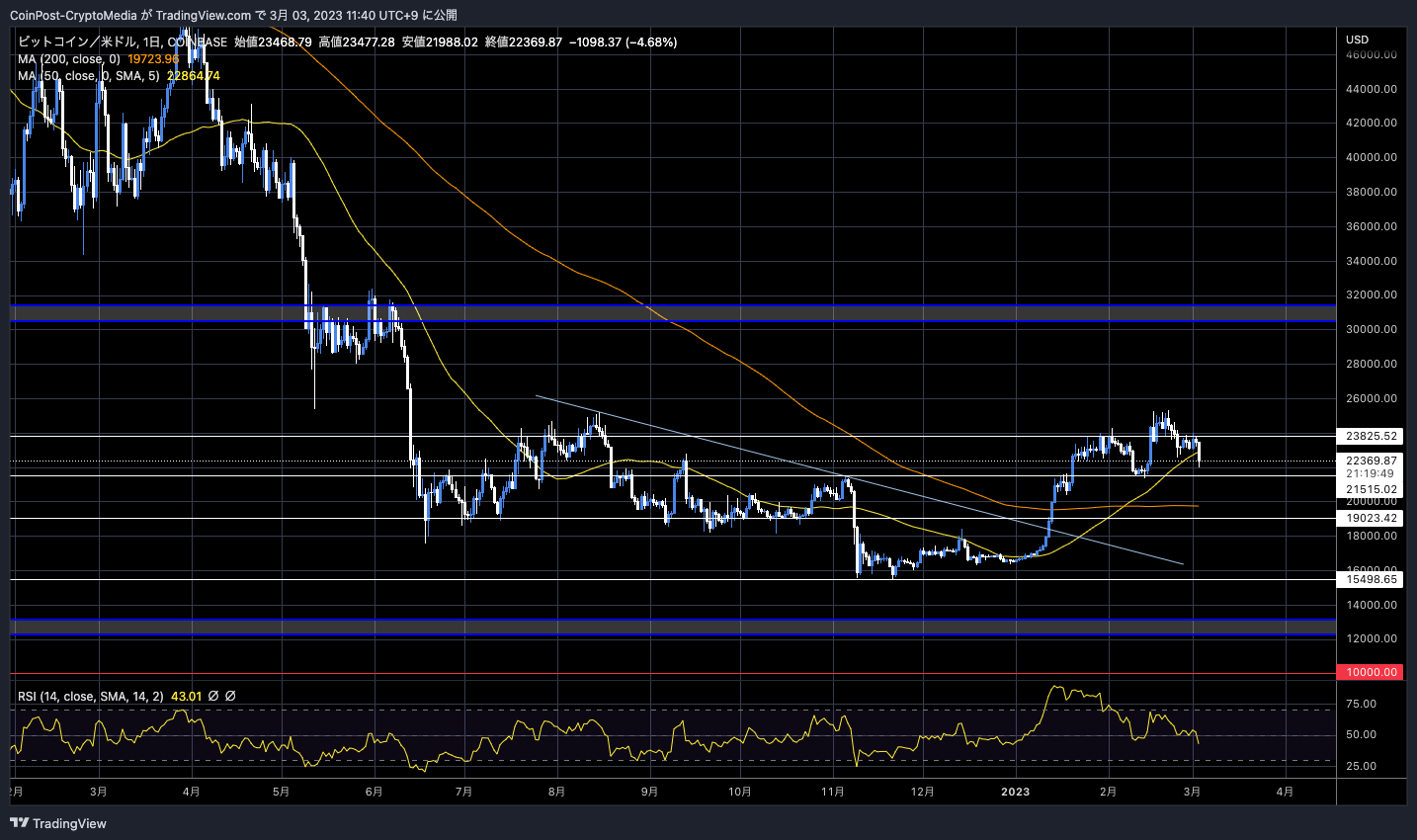

BTC/USD daily

After 10:00 Japan time, the price plummeted to about $1,500. As a result, the price has fallen below the resistance line of $24,000, and if it breaks the support line of $21,500, a further drop is expected.

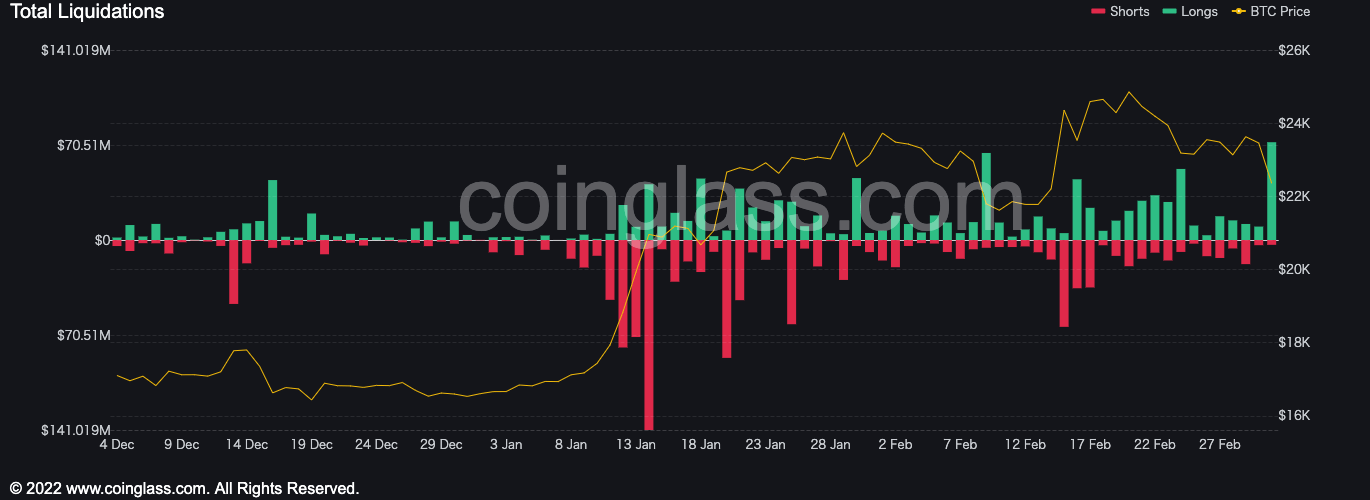

The loss cut (forced liquidation) of long positions worth $200 million (¥27 billion), including $72 million in Bitcoin, in the derivatives (futures) market also accelerated the decline. It will be the largest in recent times.

Total Liquidations (coinglass)

It is also pointed out that the fire selling by large investors may have caused a chain of stop selling and loss cuts.

Over $120,000,000 #Bitcoin longs have just been liquidated in the matter of seconds after 1 mega whale sold.

Maxis always talks about “decentralization” and “store or value”, yet reality is the exact opposite.

— Mr. Whale (@WhaleWire) March 3, 2023

Recently, several inflation indicators such as the employment statistics and the CPI (U.S. Consumer Price Index) have exceeded market expectations. At the US Federal Open Market Committee (FOMC) meeting in March, the scenario of raising the interest rate to 50 basis points strengthened, and the dollar index and US Treasury yields rose, and the overall financial market was in a risk-off trend.

It is also pointed out that selling pressure due to the huge repayment of the crypto asset exchange Mt.Gox, which went bankrupt in 2014, is also a factor in rising volatility. Some creditors are expected to receive payment as early as this month.

connection:Mt. Gox to start paying off bitcoin, etc. soon

altcoin market

With Bitcoin (BTC) plummeting, major alts such as Ethereum (ETH) also fell across the board.

As for Ethereum, it turns out that the implementation of the “Shanghai” upgrade may be delayed by several weeks. Ethereum core developers confirmed at a developer conference on the 2nd that the upgrade is likely to take place “the first or second week of April.”

As of February 8, the public testnet “Zhejiang” has been successful, and around the 14th of this month, the “Testnet “Goerli””, a dress rehearsal for the final test stage, will be implemented. The consensus is that a hard fork will be implemented around two weeks later.

Client teams felt comfortable moving forward with Goerli, which we agreed to fork on March 14, 10:25pm UTC. I’ve opened a PR to update the specs accordingly: https://t.co/tvcFBCidx5

Expect client releases & an announcement early next week

— timbeiko.eth (@TimBeiko) March 2, 2023

The Shanghai upgrade is attracting a lot of interest from the market, as it will be possible to withdraw the lockup portion of the withdrawal function of validators after several years. About 14.5% of all ETH in circulation, equivalent to $29 billion (4 trillion yen), is staked.

The largest staking entities are intermediary staking service Lido and cryptocurrency exchanges such as Coinbase and Binance. There is also a trial calculation that “selling pressure will be limited and will be absorbed by the market,” and the details are summarized in the following article.

detail:What is the ETH “Shanghai” upgrade?Summary of each company’s view on staking cancellation and ETH selling pressure

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin plummets with large-scale loss cuts, stock price crash of Silvergate Bank Holding Company, which handles virtual currency business appeared first on Our Bitcoin News.

2 years ago

172

2 years ago

172

English (US) ·

English (US) ·