The post Bitcoin Price Analysis: What’s Behind the Disappointing Post-Halving Performance? appeared first on Coinpedia Fintech News

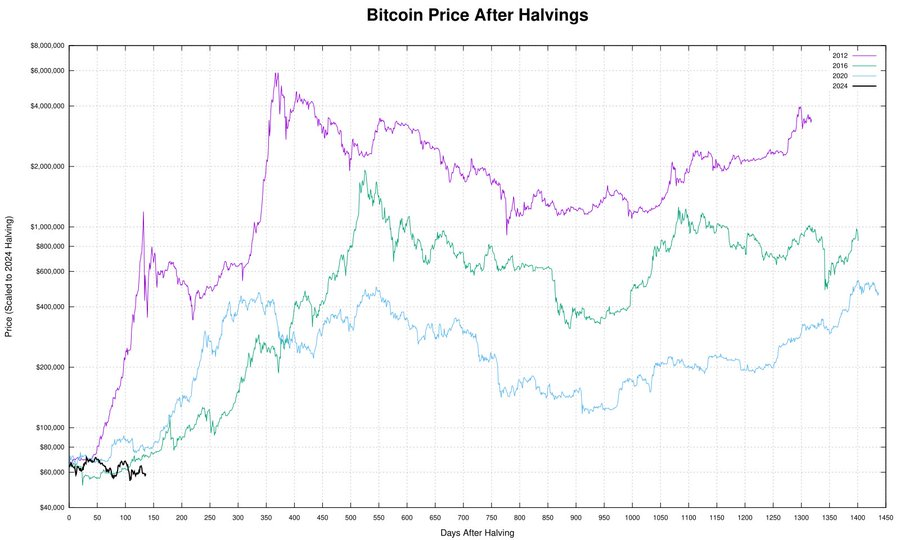

There is an assumption that the latest Bitcoin Halving has not influenced the price of Bitcoin in comparison with the previous Halving. Is there any rationale behind such an assumption? To verify that, let’s go through a comparative analysis published by Halving Tracker in X.

Post-Halving Bitcoin Price Momentum: A Comparative Analysis

Bitcoin halving, which controls the supply of new Bitcoin entering the market, is an important event that takes place approximately every four years. So far, the Bitcoin market has witnessed four such halving events. The first was on 28th November 2012; the second on 9th July 2016; the third on 11th May 2020; and the fourth and the latest on 19th April 2024.

Today, nearly 136 days have passed since the latest halving. At present, the price of Bitcoin stands at around $59,025.63. On 19th April 2024, the price was at around $63.770. It indicates a decrease of 7.44%.

On the day of the first halving, on 28th Nov 2012, the price was just around $25. Around 136 days after that, on April 14, 2013, the price closed at $119. The price recorded at least 376% growth during the period.

On the day of the second halving, on 9th July 2016, the price of Bitcoin was nearly $664. Post 136 days since that, on 23rd November, 2016, the price climbed to at least $762. The market experienced a rise of 14.76%.

On 11th May 2020, on the day of the third halving, the price was nearly $8,545. Around 136 days post that, on 25th September 2020, the price reached $10,733. The Bitcoin market registered a rise of 25.61% during the period.

Post Halving Price Expectation: An In-Depth Study

If the price had followed the same percentage increase as seen in previous halving events:

The price of Bitcoin would have reached $303,545.20 if the price had followed the 376% increase as seen in the post-first halving days;

The price would have reached $73,181.84 if it had followed the 14.76% increase as reported in the post-second halving days; and

It would have reached $80,098.70 if it had followed the 25.61% increase as registered in the post-third halving days.

In the post shared in X by Halving Tracker, we can see a finding of a similar nature.

In conclusion, compared to how the price of Bitcoin behaved post the first three halvings, the price momentum the market has shown post the latest halving is extremely disappointing

Also Check Out: OnChain Capital CEO Ran Neuner’s Fall And Comeback, Lost $134M In The LUNA Crash!

11 months ago

35

11 months ago

35

English (US) ·

English (US) ·