Will the impact of macroeconomic factors on crypto assets (virtual currencies) subside? The answer may turn out to be subtle. Macro factors will always play a role, but important issues arise in relatively predictable ways, especially with respect to inflation.

Aside from a few hiccups, the reaction to inflation expectations and FOMC interest rates has been predictable.

BTC survived the hard times

Bitcoin (BTC) is up 87% year-to-date and appears to have found support near $30,000. Ethereum (ETH) is also up 64%, lagging behind Bitcoin but still performing impressively.

Both Bitcoin and Ethereum have largely weathered the rough times for the entire cryptocurrency industry. A metric called Bitcoin’s Fixed Volume Weighted Average Price (AVWAP) speaks for itself.

Volume Weighted Average Price (VWAP) is a technical indicator that allows traders to determine the average price of an asset considering volume and price. AVWAP fixes the starting point to a date of your choice.

Bitcoin’s AVWAP is 9.1% lower than its current trading price after the SEC sued Binance and Coinbase. AVWAP on November 9, 2022, when Binance withdrew its FTX acquisition, was $22,632. Fixed at the point when Celcius suspends withdrawals in June 2022, AVWAP will be $21,400.

In other words, Bitcoin has bounced back from a series of disasters.

The latest industry event driving bitcoin prices will likely be the filing of a bitcoin exchange-traded fund (ETF) by BlackROck.

The question then becomes, “What could possibly go wrong with Bitcoin?” What macroeconomic trends could drive prices down, eroding the aforementioned gains?

Fed Chairman Jerome Powell’s recent statements seem to suggest that the FOMC has no choice but to continue with its current course of action.

The market expects at least two more rate hikes in 2023, with a maximum of around 5.6%. If that happens, it is unlikely that there will be a large shock to prices in either direction and it is already priced in.

But there are a few other macro drivers to watch in crypto markets.

Bank passes stress test

One of the biggest news stories of the year was the bankruptcy of Silvergate Bank and Silicon Valley Bank. The news impacted the crypto industry as a whole, as both had ties to the crypto industry. The bankruptcies of both banks prompted the notion that the FOMC had raised interest rates too far, creating excessive stress among banks.

But recent stress tests of 23 systemically important banks appear poised to weather a deep recession and continue to make eligible loans to households.

The test assumed a 10% unemployment rate, a 40% drop in commercial real estate prices and a 38% drop in home prices.

The FOMC may think it has plenty of room for aggressive rate hikes despite the potential impact. A post-rate hike downturn would be painful, but it would likely lower inflation without bankrupting the banking system.

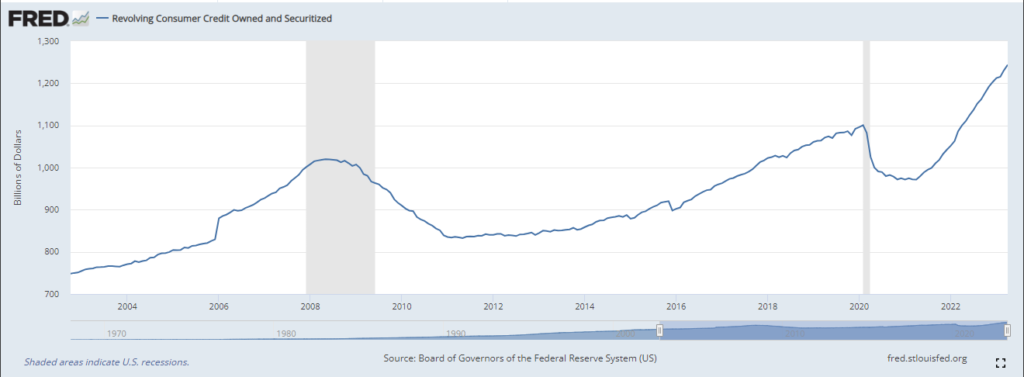

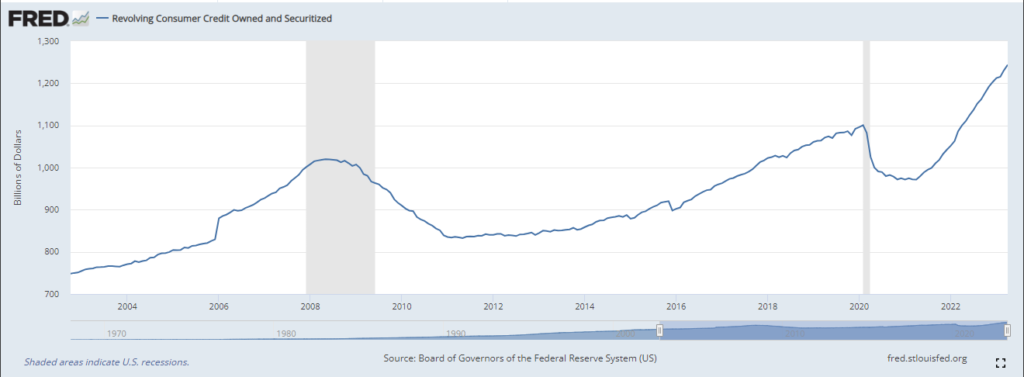

Growing Consumer Revolving Payment Debt

Revolving debt is at a record high level. It doesn’t get a lot of attention, but it’s still important.

Revolving debt (St. Louis Fed)

Revolving debt (St. Louis Fed)Cryptocurrency investment continues to be largely driven by individual investors. Investors with less than 1 Bitcoin hold 1.3 million BTC, a 73% increase since 2021, according to data from blockchain analytics firm Glassnode.

I am concerned about a combination of rising credit balances and the potential for rising interest rates and reduced employment in relation to cryptocurrency investments.

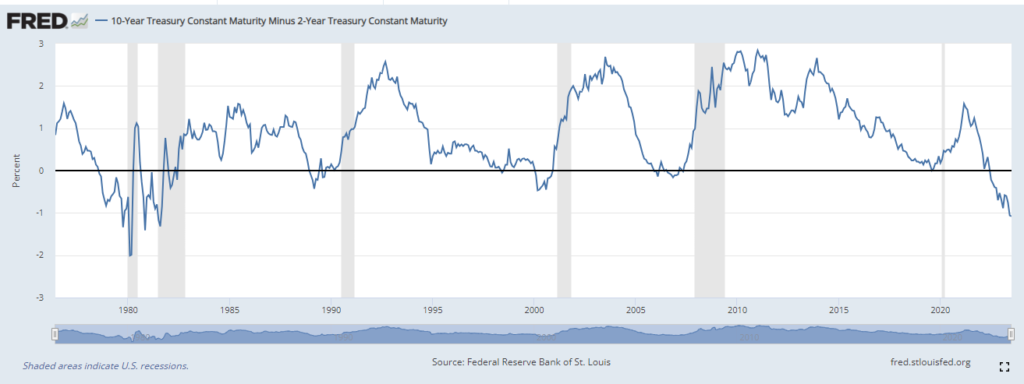

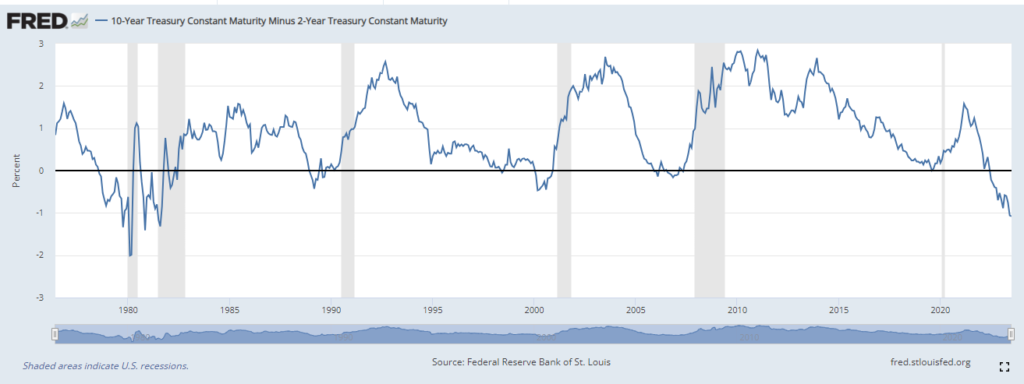

Continuation of a troublesome inverted yield curve

The spread between 2-year and 10-year Treasury yields has flipped sharply to -1.08%, the largest since 1981.

2-Year and 10-Year Treasury Spreads (St. Louis Fed)

2-Year and 10-Year Treasury Spreads (St. Louis Fed)Historically, an inverted yield curve has often been followed by a recession. But the FOMC’s latest summary of economic forecasts doesn’t seem to predict a recession.

Still, this disconnect between economic history and economic forecasts suggests a degree of uncertainty that may not be priced into the market.

As an investor with a bullish bias, I can’t help but ask, “What if I’m wrong?” I’m not alone in this. If the number of investors who have such doubts increases, there is a possibility that their reluctance to invest in crypto assets will spread.

As such, it may be a short-term hurdle for crypto asset prices.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Bitcoin Prices Are Hot, but Here’s What Could Crush the Rally

The post Bitcoin price booming, what could hurt the rise? | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

94

2 years ago

94

English (US) ·

English (US) ·