Bitcoin continued trending downwards throughout the day after failing to breach past the $114,000 resistance as macro pressures continued to keep risk sentiment at bay.

The downturn was evident across the broader crypto market as the total crypto market cap dropped over 3% to near $3.7 trillion, while the Crypto Fear and Greed Index slipped deeper into the “extreme fear” territory at 25, confirming that markets remain cautious.

Most of the top 100 cryptocurrencies traded in the red throughout the day, with gains limited to select low-cap tokens that appeared to benefit from isolated speculative interest rather than broader market support.

Even established altcoins struggled to hold ground, weighed down by thinning volumes and a risk-off tone that dominated investor sentiment heading into the US trading session.

Why is Bitcoin price down today?

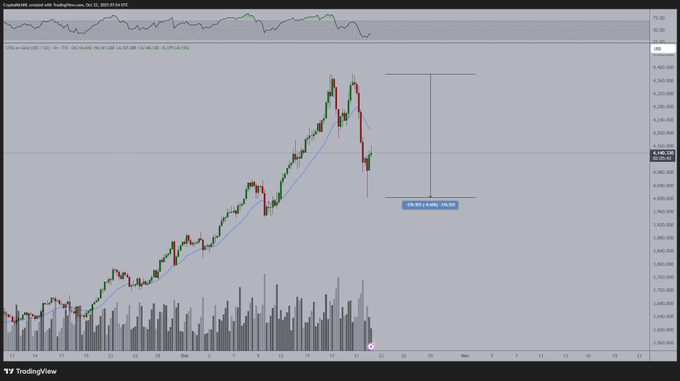

After hitting an intraday high of $113,804, supported by a temporary rotation into perceived safe haven assets following a dramatic sell-off in gold markets, Bitcoin reversed course and slid toward lows around $107,393.

The sharp decline mirrored the scale of gold’s drop, which marked one of its worst single-day performances in five years, pushing some investors initially toward Bitcoin.

However, the relief was short-lived, as macroeconomic pressures quickly took center stage again.

Interestingly, the move to $107,393 also partially filled a CME gap that had opened earlier in the week.

While the gap was not entirely closed until this point, the proximity of Bitcoin’s low to the gap level at $107,390 appears to have attracted short-term technical buyers looking to front-run a potential bounce. See below.

$BTC CME GAP HAS BEEN FULLY FILLED. CAN WE RESUME THE PUMP NOW?

This created a brief pause in the selling, though conviction among bulls remained weak amid growing caution across broader financial markets.

Traders are now fixated on the upcoming Personal Consumption Expenditures report due Friday.

As the Federal Reserve’s preferred gauge of inflation, the PCE figure could heavily sway monetary policy expectations.

A hotter-than-expected number would likely reaffirm the Fed’s hawkish stance and suppress any near-term hopes for interest rate cuts, leading to a further drain in market liquidity and appetite for speculative assets like Bitcoin.

On the other hand, a softer print might trigger a short-lived relief rally, but traders seem unwilling to price in that scenario just yet.

The pressure has also been magnified by the strengthening US dollar, which has climbed steadily over the past few sessions.

The Dollar Index (DXY) closed at 98.93 on Oct. 21, up from 98.59 the previous day, extending a three-day advance fueled by surprisingly resilient economic data.

This surge in the dollar has led to renewed selling in Bitcoin, as investors rotated out of riskier assets and into fiat in anticipation of tighter financial conditions.

Adding to the uncertainty, renewed trade threats from former President Donald Trump have once again jolted investor sentiment.

His remarks about imposing tariffs of up to 155% on Chinese imports if a trade deal is not reached by November 1 triggered fresh concerns around global supply chains and tech sector stability.

Though he hinted at the possibility of a “fantastic deal” with Chinese President Xi, he also cast doubt on whether such a meeting would even take place.

China’s response, described as a “hostile letter” outlining upcoming export restrictions, only escalated the situation.

The fragility in market confidence was further exposed by a wave of liquidations across crypto derivatives platforms.

In the past 24 hours alone, nearly 171,000 traders were liquidated, wiping out $674.18 million in open interest.

Long positions accounted for more than $437 million of the total, suggesting that the majority of traders were still betting on a rebound. The single largest liquidation, valued at nearly $14 million, occurred on Hyperliquid’s BTC-USD pair.

Bitcoin saw $7.82 million in liquidations over the past hour alone, while Ethereum registered $9.19 million, according to data from CoinGlass.

These short-term liquidations added to the selling pressure, triggering additional stop-loss orders and pushing prices further down before any meaningful support could be established.

The cascading nature of these forced liquidations turned what was initially a gradual pullback into a deeper flush, intensifying volatility throughout the session.

With sentiment rattled and multiple macro factors still unresolved, Bitcoin’s price action remains vulnerable to further downside.

Until traders have more clarity on inflation data, interest rate trajectory, and global trade stability, the broader market is likely to remain on edge.

Will Bitcoin price go up?

According to Bitcoin’s Market Value to Realized Value (MVRV) ratio, a key on-chain metric that evaluates whether the asset is overvalued or undervalued, BTC may be nearing a local bottom.

The indicator recently slipped below its 365-day moving average, a level that has historically marked major buying opportunities.

“The MVRV ratio currently stands near 1.9, slightly below its 365-day moving average,” CryptoQuant analyst ShayanMarkets noted in a QuickTake published Monday.

“Historically, each time the ratio dropped below the 365 SMA, it has marked a buying opportunity and a local bottom signal,” he wrote.

Previous breakdowns below this threshold in mid-2021, June 2022, and early 2024 were followed by significant rallies.

The analyst added that Bitcoin appears to be “entering an undervalued phase, where long-term holders typically begin accumulating.”

This outlook comes on the heels of an 18% drawdown that pushed Bitcoin from its $126,000 all-time high to a low of $103,530.

While on-chain signals may be turning constructive, short-term price action will likely remain dictated by external macro events.

Traders continue to watch the bond market, the Fed’s messaging, and upcoming inflation prints for cues on liquidity conditions.

In this uncertain environment, many participants are adopting a wait-and-see approach.

Elsewhere, some believe that capital may soon rotate back into Bitcoin and altcoins if gold’s weakness persists.

Gold has now pulled back by over 8.5 percent from its recent record high of $4,380 reached on Monday.

“That’s a pretty harsh move on gold,” MN Trading Capital founder Michaël van de Poppe remarked in a Tuesday post on X, adding that the metal may have “peaked for the moment.”

If this correction in gold deepens, van de Poppe argues that it could mark the start of “the rotation” into digital assets like Bitcoin, which some investors increasingly see as an alternative store of value. See below:

A pretty harsh move on Gold, as it corrected by more than 8% on a day. Initially, #Bitcoin moved up massively, but gave it back as well. I don’t think that this will last. The volatility on Gold is super high, that’s due to the fact that it’s a massive outlier which we’ve

However, the short-term outlook for Bitcoin may still be grim.

According to crypto analyst BitBull, Bitcoin has lost its “weekly bull market support band,” which historically leads to corrections between 10-20%.

BTC/USD 1-Week price chart. Source: BitBull on X.

Adding to the bearish narrative, crypto analyst Ted Pillows warned that the flagship crypto must defend the $108,000 support level or it risks a deeper correction towards $100,000 mark.

BTC/USDT 1-Day price chart. Source: Ted Pillows on X.

BTC/USDT 1-Day price chart. Source: Ted Pillows on X.At press time, Bitcoin price was hovering just above $108,000, down roughly 4% in the past 24 hours.

Altcoin market recap

Over the past 24 hours, the altcoin market cap climbed from $1.58 trillion to a peak of around $1.77 trillion before giving up most of its gains and settling near $1.59 trillion, still up by nearly 1% on the day.

The move came amid subdued sentiment across the altcoin space, with the Altcoin Season Index stuck at 30, signaling that Bitcoin continues to dominate the broader market trend.

Ethereum (ETH), the top altcoin by market share, made a strong move from $3,900 to briefly break above the $4,000 mark.

However, it ran into heavy resistance near $4,100 and has since pulled back to around $3,800 at press time, marking a 3.1% decline over the period.

Other major altcoins, such as XRP (XRP), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA), were also in the red, posting losses ranging between 2-5%.

Out of the top 99 altcoins, only four managed to stay in the green. MemeCore (M) led with a 7.87% gain, while Aptos (APT) followed with a modest 2.6% uptick on the day.

Source: CoinMarketCap

Source: CoinMarketCapThe post Bitcoin price crashes as traders brace for PCE data, MemeCore leads altcoins appeared first on Invezz

English (US) ·

English (US) ·