Bitcoin (BTC) and Ethereum (ETH) have rallied in the past 24 hours as optimism around possible spot exchange-traded fund (ETF) approval in the U.S. continues to grow and gold’s peak price also provides a tailwind. It rose by 4%.

BTC surpassed the $41,000 mark on December 4th, extending its year-to-date gain to over 152%.

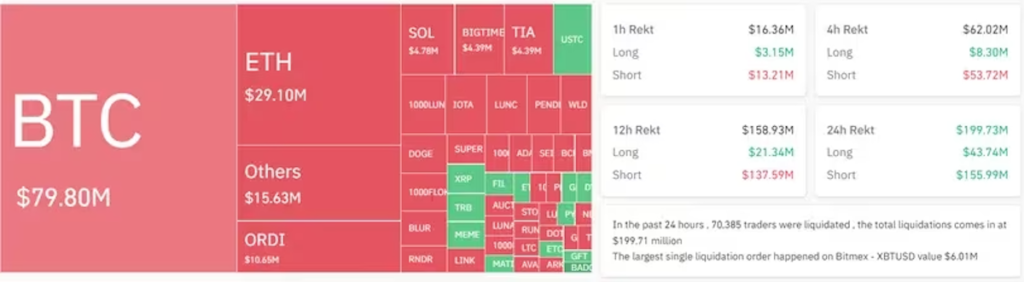

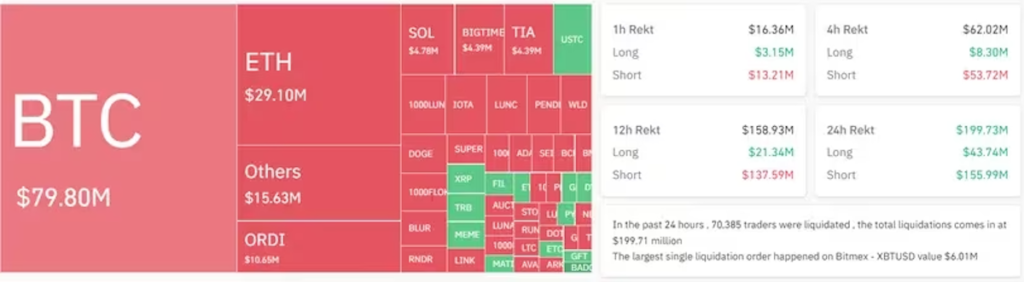

Futures exchanges liquidated crypto perpetual futures positions worth $220 million (approximately 33 billion yen, at an exchange rate of 150 yen to the dollar) over the weekend, according to data from CoinGlass. Bullish longs accounted for nearly 85% of the total.

Liquidation of crypto asset futures. (Coin Glass)

Liquidation of crypto asset futures. (Coin Glass)$120 million (approximately 18 billion yen) worth of Bitcoin shorts (bets that the price will fall) have been liquidated since December 1st. Elsewhere, open interest rose 6% on Monday as traders increased leveraged positions betting on more volatility.

Meanwhile, an analyst from Coinanlyze told CoinDesk in a message on X (formerly Twitter) that BitMEX’s open interest soared 90% within hours from over $200 million on Saturday. It reached $420 million (approximately 63 billion yen).

$BTC open interest on @BitMEX skyrocketed . +90% in a single day! pic.twitter.com/kKeBqeVQxV

— Coinalyze (@coinalyzetool) December 2, 2023

Liquidation refers to the forced closing of a trader’s leveraged position by an exchange due to the loss of some or all of the trader’s initial margin. This occurs when a trader is unable to meet the margin requirements for a leveraged position (does not have enough funds to continue trading).

Large liquidations can indicate local peaks or troughs in sharp price movements, and traders can take positions accordingly.

Such data is useful to traders because it serves as a signal that leverage is effectively being flushed out of popular futures products.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original text: Bitcoin’s Price Rise to $41K Buoyed by $200M in Weekend Short Liquidations

The post Bitcoin price exceeds $41,500 — boosted by $200 million short liquidation | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

93

1 year ago

93

English (US) ·

English (US) ·