Virtual currency market this week (5/13 (Sat) – 5/19 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 5/13 (Sat) to 5/19 (Fri):

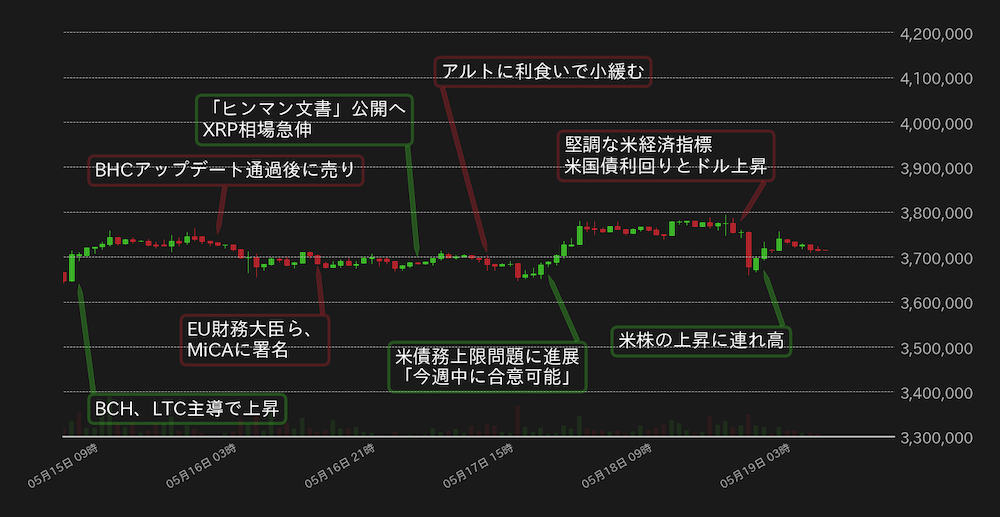

The Bitcoin (BTC) exchange rate against the yen this week has been steady despite the heavy topside, and as of noon on the 19th, it is hovering around 3.7 million yen.

With the update of Bitcoin Cash (BCH) just around the corner, altcoins such as Litecoin (LTC), led by BCH, have risen, and since the beginning of the week, BTC has also risen from the mid-3.6 million to mid-3.7 million yen range. It rose to the board, but after passing the update, it became selling dominant and fell back.

After that, amidst a mixture of strong and weak factors, the development continued to be a struggle around the milestone of 3.7 million yen, but in the middle of the week, Speaker of the House of Representatives McCarthy made a deal with the White House and the Republicans in Congress over the US debt ceiling issue. US stocks rebounded sharply by saying that an agreement could be reached within this week, bringing BTC back to 3.8 million yen.

Meanwhile, U.S. unemployment claims on Friday fell sharply from the previous week, lower than market expectations. In addition, the Philadelphia Fed’s manufacturing index also improved from the previous month, indicating the strength of the US economy, and US Treasury yields and the dollar rose. This weighed on the BTC market, and at one point fell below 3.7 million yen.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

Talks between the White House and Congressional Republicans on the U.S. debt ceiling have progressed since midweek, with McCarthy saying on Thursday that a vote in the House of Representatives could be possible next week.

In response to these movements, the three major US stock indices rose for two days in a row with Mizuki, but the rise in government bond yields is putting pressure on the BTC market’s topside.

Until last week, the federal funds rate futures market had priced in only about a 10% chance of an additional interest rate hike in June, but this week it rose to 36.2%. Strong U.S. economic data also contributed to this move, and multiple regional Fed presidents have indicated the possibility of further interest rate hikes if necessary. situation.

Against this backdrop, today’s conference is scheduled to be held in Washington, D.C., where the US Federal Reserve (Fed) Chairman Powell and former Chairman Bernanke are scheduled to speak on a panel, and attention will be focused on their remarks.

U.S. stocks have strengthened as discussions on the debt ceiling progressed, but it has been pointed out that if Chairman Powell hints at the possibility of an additional interest rate hike, it could put a damper on the risk-on mood. Will the rise in US stocks, which has been the underpinnings, come to a halt?

That said, McCarthy said if a debt ceiling deal is reached over the weekend and the House of Representatives votes next week, hopes of avoiding a U.S. default could give risk appetite some room to recover. In the short term, we will be cautious about policy interest rate trends, but we hope to see further progress on the debt ceiling issue next week.

connection:bitbank_markets official website

Last report:Bitcoin Market Deterioration in Both Fundamental and Technical, Prospects for Lower Prices

The post Bitcoin price is heavy but solid, expect progress on US debt problems next week | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

165

2 years ago

165

English (US) ·

English (US) ·