- Bitcoin’s stay below $38,000 over the past three weeks is a positive sign, one analyst said, as it has a bullish undertone with a shallow price decline.

- Seasonality favors the continued rise in Bitcoin prices in December.

Bitcoin (BTC) price growth has been stalled since November 9th, and it has proven difficult to break above $38,000. But that doesn’t mean the uptrend is over.

In fact, a closer look at price movements during this correction shows that this is not the case.

Although the rally is capped at around $38,000, the subsequent decline is shallow and short-lived, indicating persistent “buy on the edge” demand amidst firm prices. Horizontal resistance and support rising from a shallow push from the upper limit are considered to form an ascending triangle on the price chart.

In other words, Bitcoin may be accumulating energy for the next rally.

“Bitcoin bounced back in the ascending channel and reached three-week resistance at $37,800 on the night of the 22nd,” said Alex Kuptsikevich, senior market analyst at FxPro. said in an email. “The sell-off has intensified, hampering any attempts to push prices higher, but the decline has narrowed over the past three weeks, suggesting bullish territory is forming.”

Horizontal resistance and upward support indicate an ascending triangle pattern. (TradingView/CoinDesk)

Horizontal resistance and upward support indicate an ascending triangle pattern. (TradingView/CoinDesk)Technical Analysis: The Complete Resource for Financial Markets, written by Charles D. Kirkpatrick II, a certified technical analyst, and Julie R. Dahlquist, a technical analyst. According to Technicians 3rd Edition, ascending triangles almost always end with a bullish breakout, extending the previous uptrend. However, this book focuses on traditional markets.

“Upward breakout occurs 77% of the time, and breakout occurs approximately 61% of the distance (time) from base to cradle,” Kirkpatrick II and Dahlquist write in their book. , it also warns of the possibility of a breakout failure. A false breakout occurs when price moves above resistance, only to quickly fall back into the pattern, trapping buyers on the wrong side of the market.

Kapchikevich expects Bitcoin to break out of the ascending triangle and rise above $40,000. If there is a breakout, Bitcoin could aim for $45,000, according to Markus Thielen, head of research and strategy at crypto services provider Matrixport.

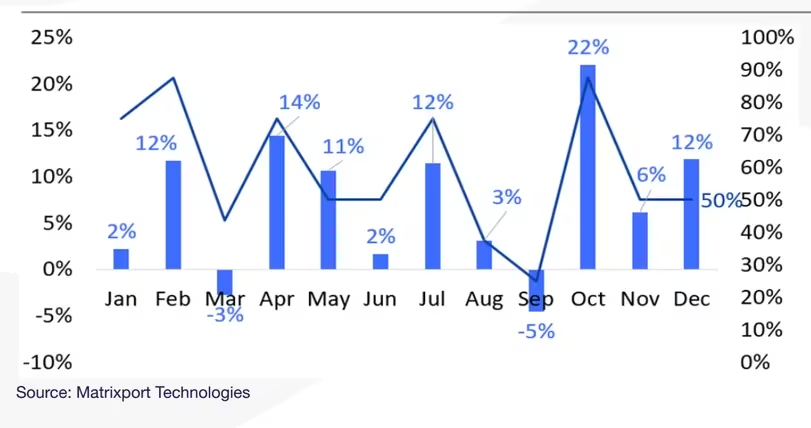

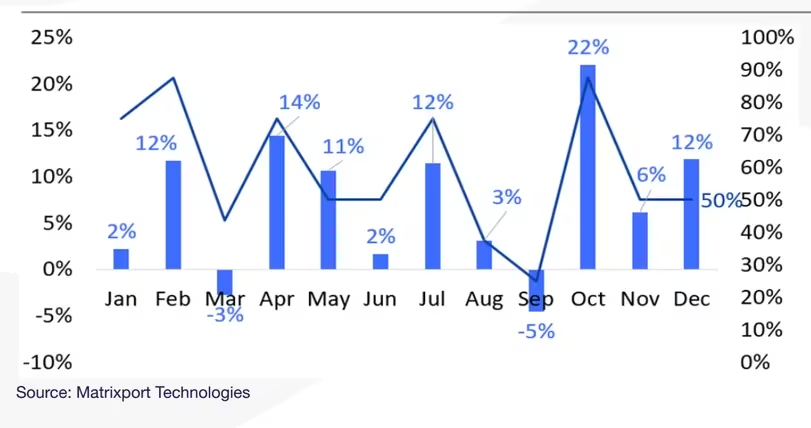

Seasonal trends support the continued rise of this crypto asset (virtual currency). According to data tracked by Matrixport, Bitcoin’s average gain in December over the past eight years has been 12%.

Seasonal factors suggest a continued rally for Bitcoin. (Matrixport)

Seasonal factors suggest a continued rally for Bitcoin. (Matrixport) “Seasonality seems to be in effect again. December’s average return of +12% is respectable, and this metric alone could propel Bitcoin to $42,000. ” Thielen said in a note to clients on Tuesday.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: TradingView/CoinDesk

|Original text: Bitcoin’s 3-Week Consolidation Under $38K Has Bullish Undertone

The post Bitcoin price movement below $38,000 for the past three weeks is a bullish sign | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

56

1 year ago

56

English (US) ·

English (US) ·