The post Bitcoin Price Prediction 2025: Is this a Calm of Maturity or Just the Eye Before the Next Storm? appeared first on Coinpedia Fintech News

The US Bureau of Labor Statistics has released May’s CPI inflation rose to 2.5% YoY, matching expectations. With no surprises and, apparently, no shocks to the markets either. Despite the uptick, Bitcoin, equities, and altcoins remained steady with no panic, no rally, but just quiet resilience. This suggests that the markets have priced in mild inflation as the new normal, as the investors are more focused on rate decisions, ETF flows, and broader macro narratives than a CPI number.

Now that the BTC price has officially traded above $100,000 for 30 consecutive days for the first time in history, will the upswing continue toward new highs?

Bitcoin has experienced a sustained adoption from states, banks, and corporations, which has marked a new era of institutional confidence in BTC. As per some reports, 116 public companies now hold 809.1K Bitcoin, up from 312.2K a year ago. Moreover, since early April alone, nearly 100K BTC has been added, with 25+ companies disclosing new holdings. The data also shows MicroStrategy and other institutions have intensified their accumulation since November 2024 when the market rose above the consolidation phase.

Since then, the BTC price has maintained a strong ascending trend and is just 3% to 4% away from the ATH. Despite this, the whales remain optimistic and not interested in taking away their profits.

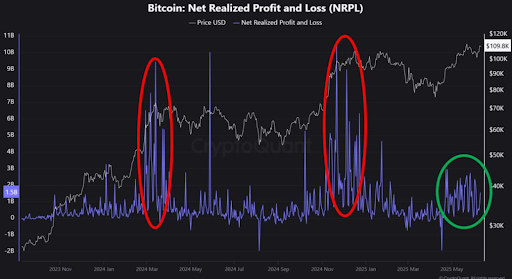

The above chart shows the net realized profit or loss, which has spiked each time the BTC price surged above the consolidation. This was aimed to extract profit as the whales and the investors may not be confident about the upcoming price action. However, the current breakout does not appear to have attracted them to take out the profit, as the whales seem to be bullish on Bitcoin and expect the price to maintain a strong upswing. This suggests the BTC price may continue to maintain a strong ascending trend and eventually mark a new ATH soon.

Currently, Bitcoin has entered the final resistance zone ahead of an ATH but has still not broken the barrier yet. Moreover, the price is squeezing with a significant rise in the volume from around $36 billion to close to $60 billion. This suggests panic selling but the question remains whether the price will hold the key levels around $106K after plunging below $108K. If this happens, then a new ATH could be a few weeks away; otherwise, the Bitcoin (BTC) price may face a deeper correction and reach levels just below $100,000 and further trigger a strong upswing to mark a new ATH.

3 weeks ago

33

3 weeks ago

33

English (US) ·

English (US) ·