Bitcoin (BTC), the world’s largest crypto asset (virtual currency) by market capitalization, settled in the narrowest price range in months, amid concerns over the stability of US regional banks and the national debt ceiling. The market has become boring.

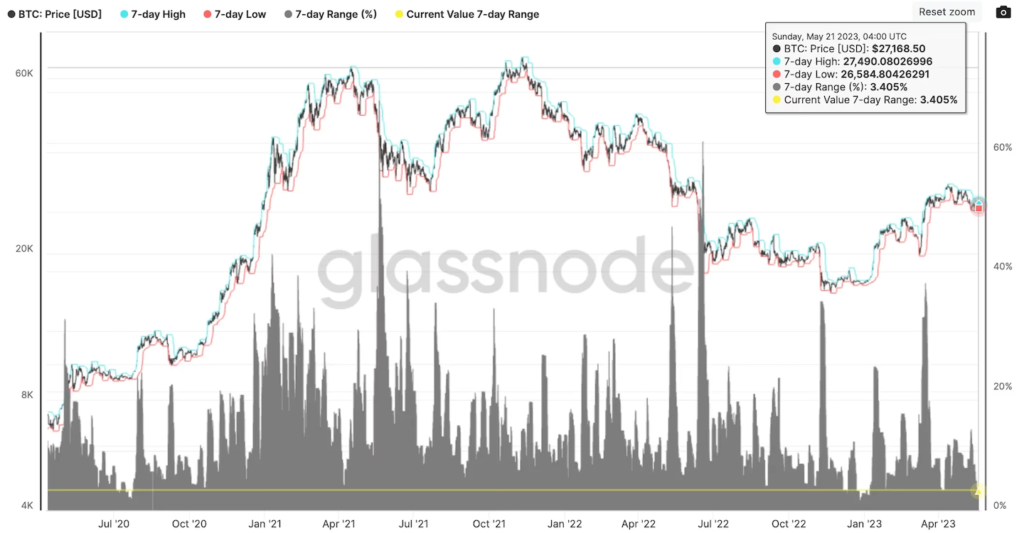

The price range, which is the difference between the high and low prices reached in the seven days ending May 21, was 3.4%. That’s one of the narrowest ranges in the past three years, comparable to the weak trading earlier this year, part of last month and July 2020, according to data tracked by analytics firm Glassnode.

Changes in the price range of Bitcoin for 7 days. (Glassnode)

Changes in the price range of Bitcoin for 7 days. (Glassnode)“January 2023 and July 2020 were both before major market moves, suggesting high volatility ahead,” Glassnode tweeted early May 22. are doing.

Bitcoin and Ethereum (ETH) options-based volatility measures also hit record lows recently.

A narrow trading range indicates that neither bullish nor bearish view dominates the price action. This is usually what happens when markets are faced with competing influences and stories. The lingering troubles in the U.S. banking sector have favored the rally in perceived safe-haven assets such as bitcoin, but the stalled debt ceiling talks and recovery in the dollar index suggest otherwise.

Eventually, some influence will be removed and the trading range will widen sharply or move strongly in one direction or the other. Traders typically use straddles (combination of call and put options in the same contract with the same strike price) or strangles (same contract with different Develop price-agnostic strategies such as trading a combination of price call and put options.

Bitcoin is trading near $26,830 at the time of writing, according to CoinDesk data.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Glassnode

|Original: Bitcoin’s Trading Range Narrows to Tightest in Months

The post Bitcoin price range, lowest in recent months ── Is it a sign of high volatility | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

112

2 years ago

112

English (US) ·

English (US) ·