Bitcoin (BTC) surged to a two-month high, boosting call demand and boosting the options market.

The price of Bitcoin, the crypto asset (virtual currency) with the largest market capitalization, soared to $30,800 on June 21, the highest since April 14, BlackRock, WisdomTree ), highlighting the continued appetite of institutional investors to push for a Bitcoin ETF application by Invesco.

With the price briefly breaking below the critical support of $25,200 a week ago and the market trajectory suddenly changing, traders are turning to options to chase the gains.

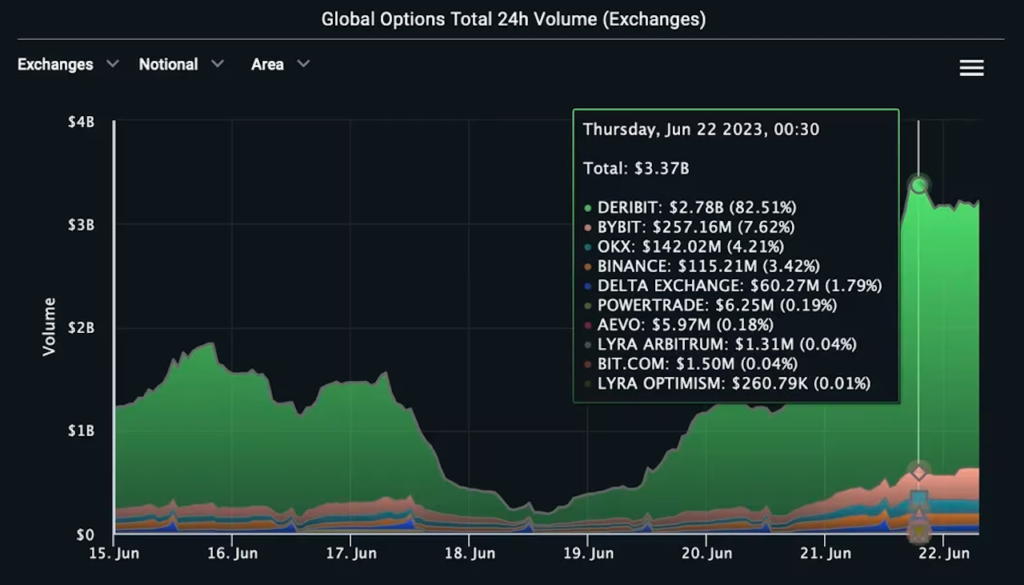

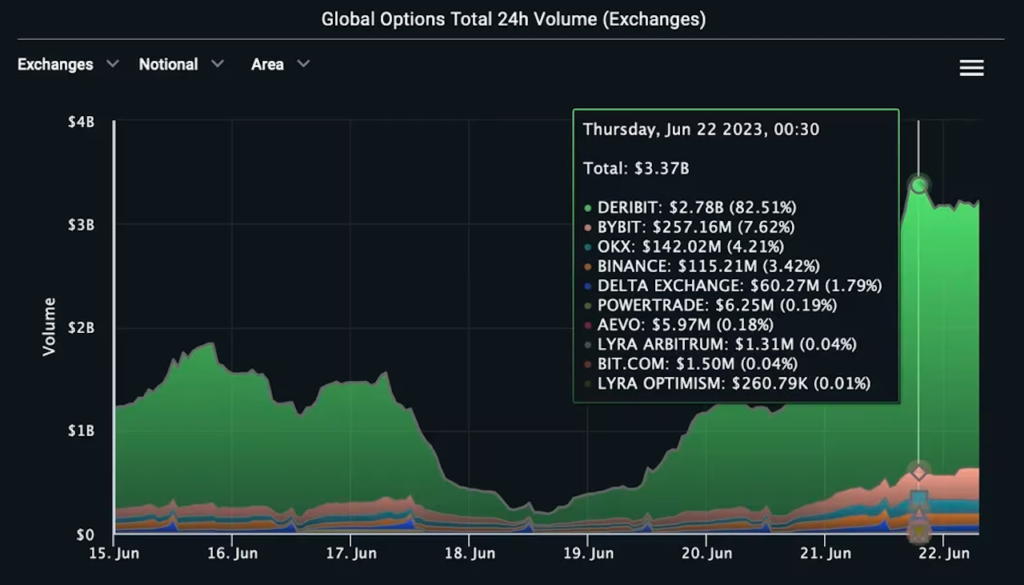

Bitcoin global options trading volume. (Laevitas)

Bitcoin global options trading volume. (Laevitas)On June 21, $3.3 billion worth of bitcoin options contracts traded on major exchanges, including Deribit. That was the highest daily notional value in three months, and Deribit accounted for more than 80% of global trading volume.

“This is the highest trading volume in three months,” Deribit’s Asia business development manager Lin Chen told CoinDesk, adding that “there is interest in buying call options.” rice field.

Options give the investor the right to buy or sell the underlying asset (in this case Bitcoin) at a set price at a later date. Call option buyers have the right to buy and put option buyers have the right to sell. Traders often buy calls as low-cost leveraged bullish bets.

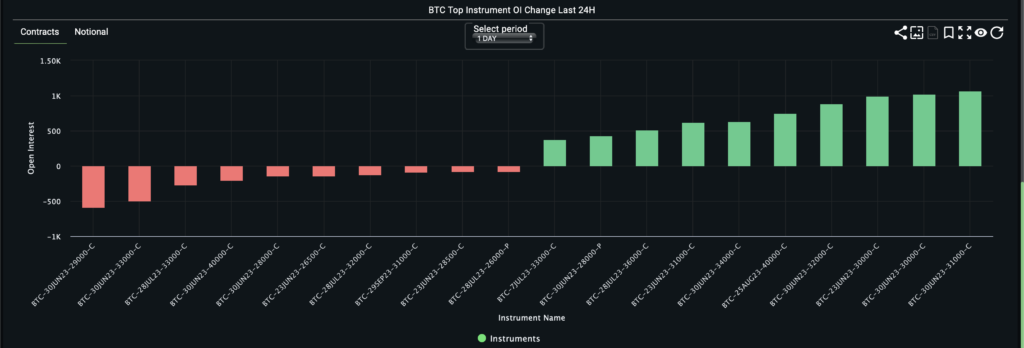

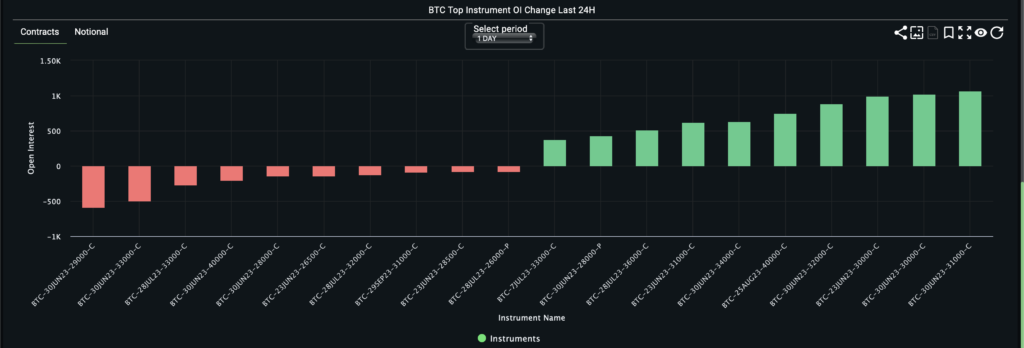

The chart shows a bias towards call options with higher strike prices. (Laevitas)

The chart shows a bias towards call options with higher strike prices. (Laevitas)Call options with strike prices of $30,000, $31,000, $32,000 and $40,000 were popular among traders over the past 24 hours, according to Laevitas.

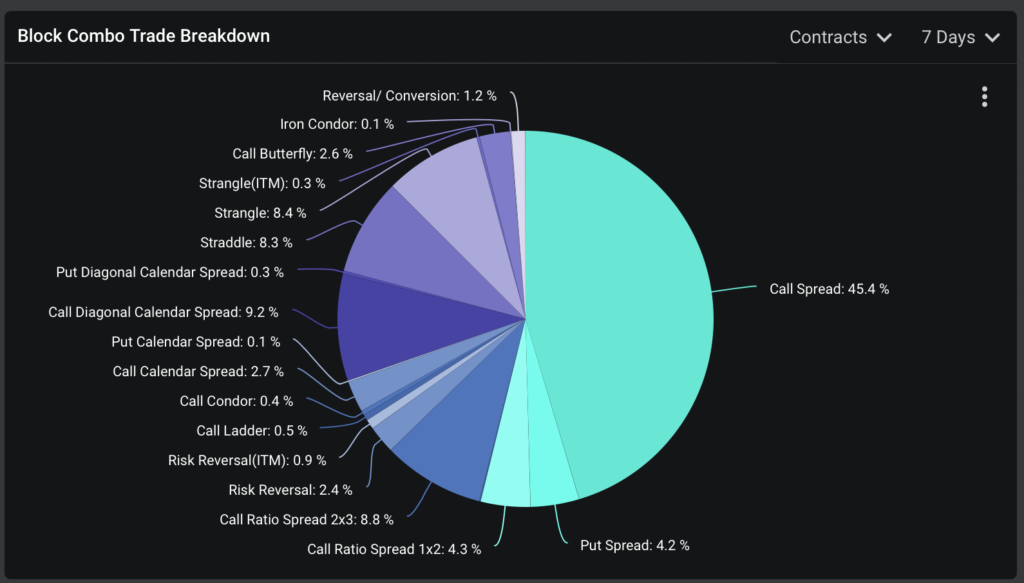

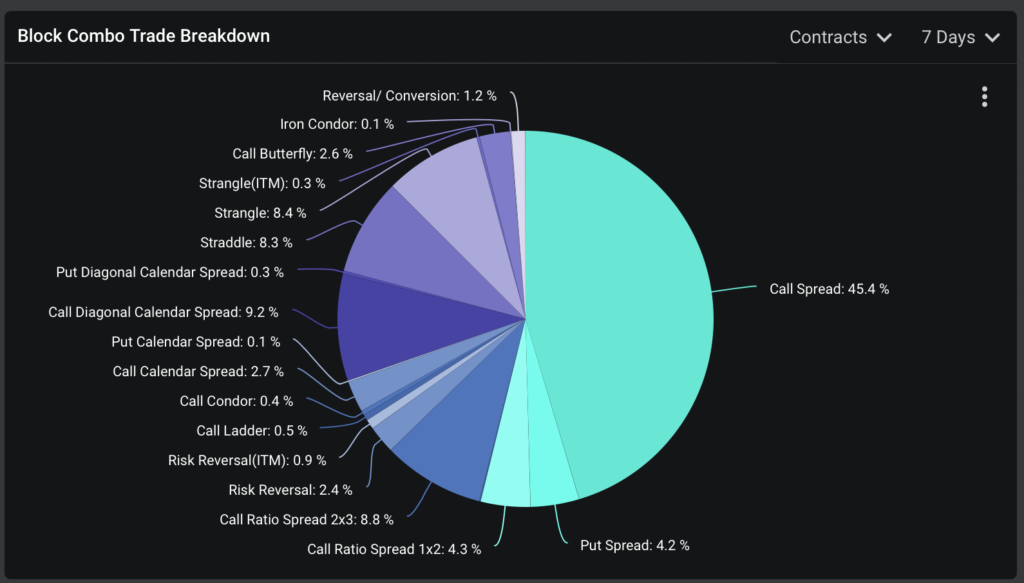

Over the past seven days, call spreads accounted for 45% of total blockflow. Block trades are large orders that are executed on an over-the-counter crypto liquidity network like Paradigm and then listed on an exchange.

The callspread strategy is the most favored over the past seven days. (Amberdata)

The callspread strategy is the most favored over the past seven days. (Amberdata)Rising prices have forced some callover writers to buy back their bullish exposures, said Patrick Chu, director of institutional sales and trading at Paradigm. Call overwriting, which involves selling calls against your crypto holdings, is a popular strategy for generating extra yield in flat to negative markets.

“Most people, especially options overwriters, are buying back the topside in light of the sharp rise,” Chu said.

DVOL spikes

Rising options demand pushed Deribit’s Bitcoin Volatility Index (DVOL) up to 59.24, its highest level since early April, according to Amberdata.

DVOL measures Bitcoin’s 30-day implied volatility (IV) calculated using Deribit’s options order book. The higher the demand for an option, the higher the IV and vice versa. IV refers to an investor’s expectation of price volatility over a specified period of time.

“Rising demand for options has boosted DVOL,” Deribit’s Chen said.

IVs typically rise when there is risk aversion in traditional markets. However, Deribit’s DVOL tends to rise when prices rise, explained Chen.

DVOL has shown a notable rise over the past seven days. (Amberdata)

DVOL has shown a notable rise over the past seven days. (Amberdata)Bitcoin implied volatility and spot price have been positively correlated since the beginning of the year.

“DVOL has been moving in response to recent headlines and spot action over the last three days. Over the last two months, prices have been very contained and realized volatility has been low overall. Volatility is lacking and people are desperate to cover it,” Chu said.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Laevitas

|Original: Bitcoin Options Volume Jumps to $3.3B as Price Rallies to Two-Month High

The post Bitcoin price soars, option trading volume surges | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

68

1 year ago

68

![Optimism [OP] breaks $0.85 neckline — Here’s what it means for the traders](https://ambcrypto.com/wp-content/uploads/2025/05/Lennox-3-1.png)

English (US) ·

English (US) ·