Macroeconomics and financial markets

On the US New York stock market on the 26th, the Dow Jones Industrial Average closed down 390.69 points (0.16%) from the previous day, and the Nasdaq index closed down 20.5 points (0.13%).

In the Tokyo stock market, which hit a new all-time high, the Nikkei Stock Average fell by 59.79 yen (0.15%) from the previous day to 39,173 yen.

With the soaring price of Bitcoin (BTC), US stocks related to crypto assets (virtual currency) have been rising across the board. Coinbase rose 14.4%, MicroStrategy rose 13.8%, and Marathon Digital rose 17.8%.

CoinPost app (heat map function)

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

connection:Coinbase +16.8% compared to the previous day, exceeding the Nikkei average bubble | 27th Financial Tankan

Virtual currency market conditions

In the crypto asset (virtual currency) market, Bitcoin (BTC) soared to 1 BTC = $56,357, an increase of 9.78% from the previous day.

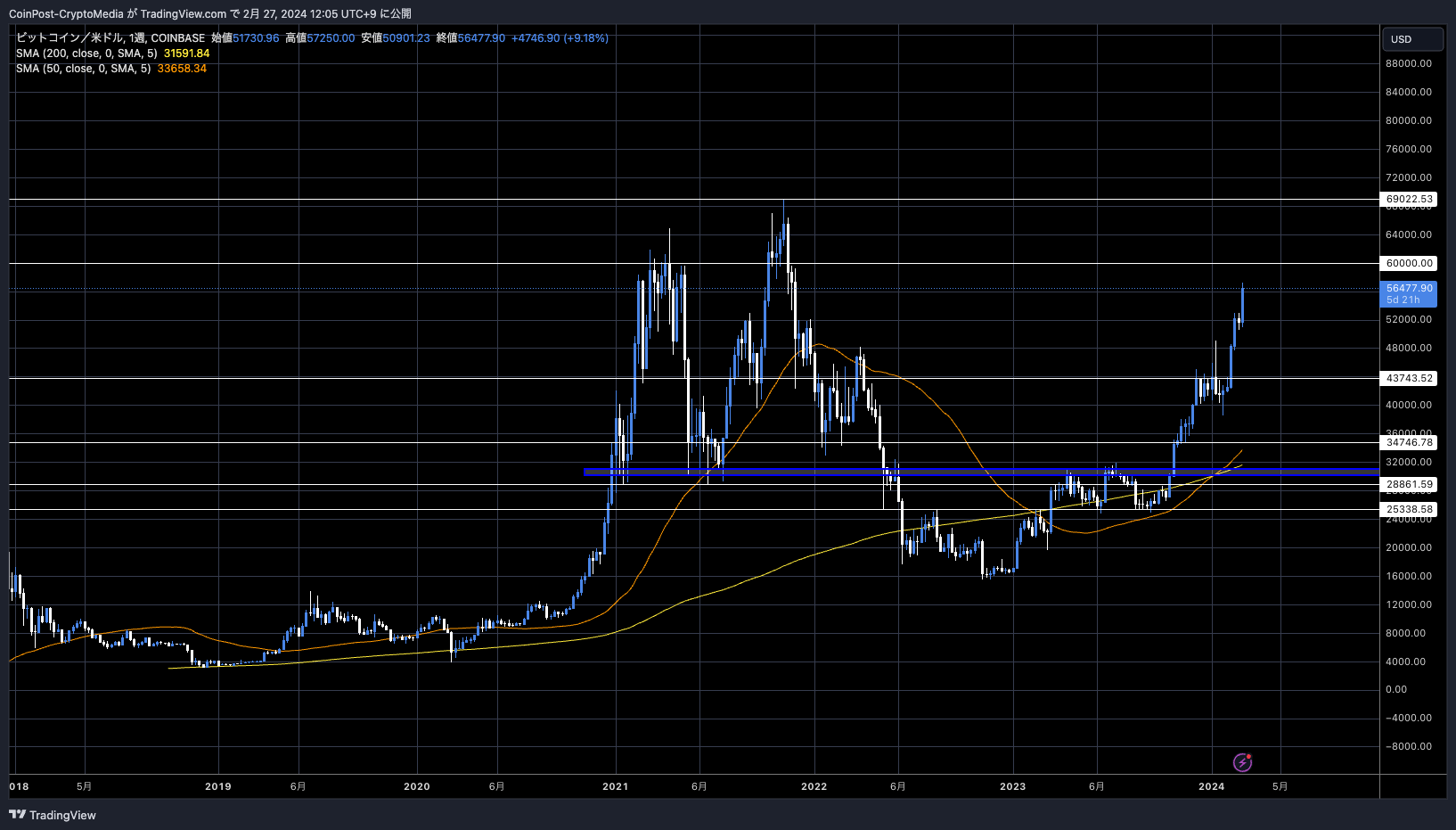

BTC/USD weekly

Among altcoins, Ethereum (ETH) rose 4.1% and Solana (SOL) rose 7.2%.

MicroStrategy, which owns a large amount of Bitcoin, announced an additional purchase of 3,000 BTC at an average price of $51,813. As of February 25th, it holds 193,000 BTC at an average acquisition price of $31,544.

connection:MicroStrategy increases Bitcoin purchases in February BTC reaches $54,000 level for the first time this year

The reason behind the soaring price of Bitcoin (BTC) is that institutional investors continue to buy it due to the inflow of funds into Bitcoin spot ETFs (Exchange Traded Funds).

The iShares Bitcoin Trust (IBIT), the Bitcoin ETF from the largest asset management company BlackRock, has recorded a record high daily trading volume of more than $1.3 billion, exceeding the more than $1 billion on its first day of listing.

It's official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

According to Bloomberg analyst Eric Balchunas, “Bitcoin ETFs are likely to surpass the gold Bitcoin ETF in terms of assets under management within two years.”

Gold's Pain is Bitcoin ETFs' Gain in Store of Value Smackdown.. new from me on how gold being in the gutter is like the cherry on top for bitcoin fans who just got to witness the biggest ETF launch ever. Decent chance bitcoin ETFs pass gold ETFs in aum in less than 2yrs w… pic.twitter.com/rXJra1dyhF

— Eric Balchunas (@EricBalchunas) February 26, 2024

Bitcoin ETFs have seen $5 billion in inflows since January 10, while gold ETFs have seen $3.6 billion in outflows.

connection:What is Bitcoin halving?Outlook for 2024 based on past market price fluctuations

connection:How to make money with virtual currency IEO investment. Domestic and international success stories and how to participate.

Fund inflow into virtual currency listed investment products

According to a weekly report from asset management firm CoinShares, exchange-traded investment products (ETPs) saw $598 million in inflows last week.

Overflow for 4 consecutive weeks. By region, most of the inflows came from the United States, where Bitcoin spot ETFs (exchange traded funds) have been approved.

Outflows from Grayscale's Bitcoin Trust (GBTC) reached $436 million, but the trend that could put pressure on the market is slowing.

By altcoin, the suspension of block generation due to the first large-scale failure in a year affected investor sentiment, resulting in an outflow of $3 million from Solana (SOL), while a large upgrade Dencun was released in March. Ethereum (ETH), which is expected to be approved as an ETF, saw an inflow of $17 million.

connection:Compare the benefits of recommended virtual currency exchanges with illustrated explanations

connection:Explaining the advantages of staking and accumulation services and the advantages of virtual currency exchange “SBI VC Trade”

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin prices soar to $56,000 level, accelerating ETF buying by institutional investors appeared first on Our Bitcoin News.

1 year ago

121

1 year ago

121

English (US) ·

English (US) ·