Macroeconomics and financial markets

In the US NY stock market on April 28, the previous weekend, the Dow Jones Industrial Average continued to rise by $272 (0.8%) higher than the previous day.

connection:U.S. Stocks Rebound Meta +14%, U.S. GDP Slows for Second Consecutive Quarter | 28th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

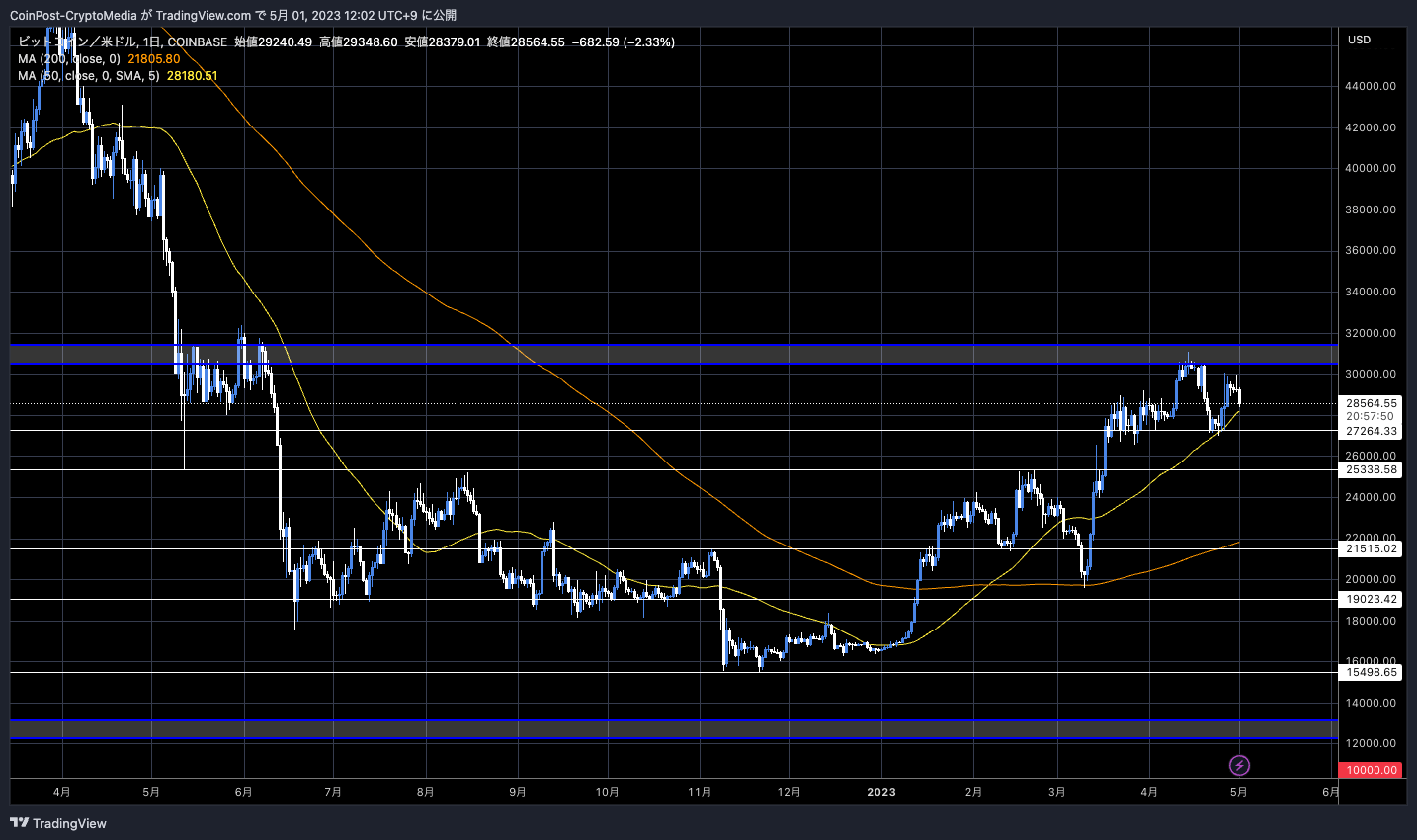

In the crypto asset (virtual currency) market, Bitcoin fell 2.1% from the previous day to $28,574.

BTC/USD daily

The monthly chart has been positive for four consecutive months since the beginning of the year, but it bounced back to the resistance line near $30,000.

With the Federal Open Market Committee (FOMC) interest rate announcement and chairman Powell’s press conference coming up at 3:00 a.m. on the 4th Japan time, as well as the release of important indicators such as the US employment statistics over the weekend, it will be difficult to take risks. be.

As of April 28, foreign analyst Justin Bennett predicted that the BTC price would fall back to the $26,000 level.

Something like this from $BTC wouldn’t surprise me after this week’s volatility.

Take shorts, then take longs.

Let’s see. pic.twitter.com/UyXd3ysYxm

— Justin Bennett (@JustinBennettFX) April 28, 2023

Looking at the heat map (volume by price range), the bulls have placed many limit orders for long positions at the $26,000 level, and the support line near $25,200 is also conscious.

Bitcoin market share has been in the 38%-48% range for about two years, according to noted analyst Peter Brandt. He predicted that a break above this level could lead to a concentration of funds in Bitcoin.

The Bitcoin % Dominance chart has now formed a 24-month rectangle with multiple upper and lower boundary contacts. pretenders $BTC… pic.twitter.com/KCS9Pt5dMx

— Peter Brandt (@PeterLBrandt) April 29, 2023

In the market from 2018 to 2020, there was an alt-drain phenomenon in which funds were drained from altcoins as a reaction to the collapse of the alt-bubble in the bear market, and the share of bitcoin increased rapidly.

connection:Bitcoin remains solid, May FOMC may be a headwind | bitbank analyst contribution

on-chain data

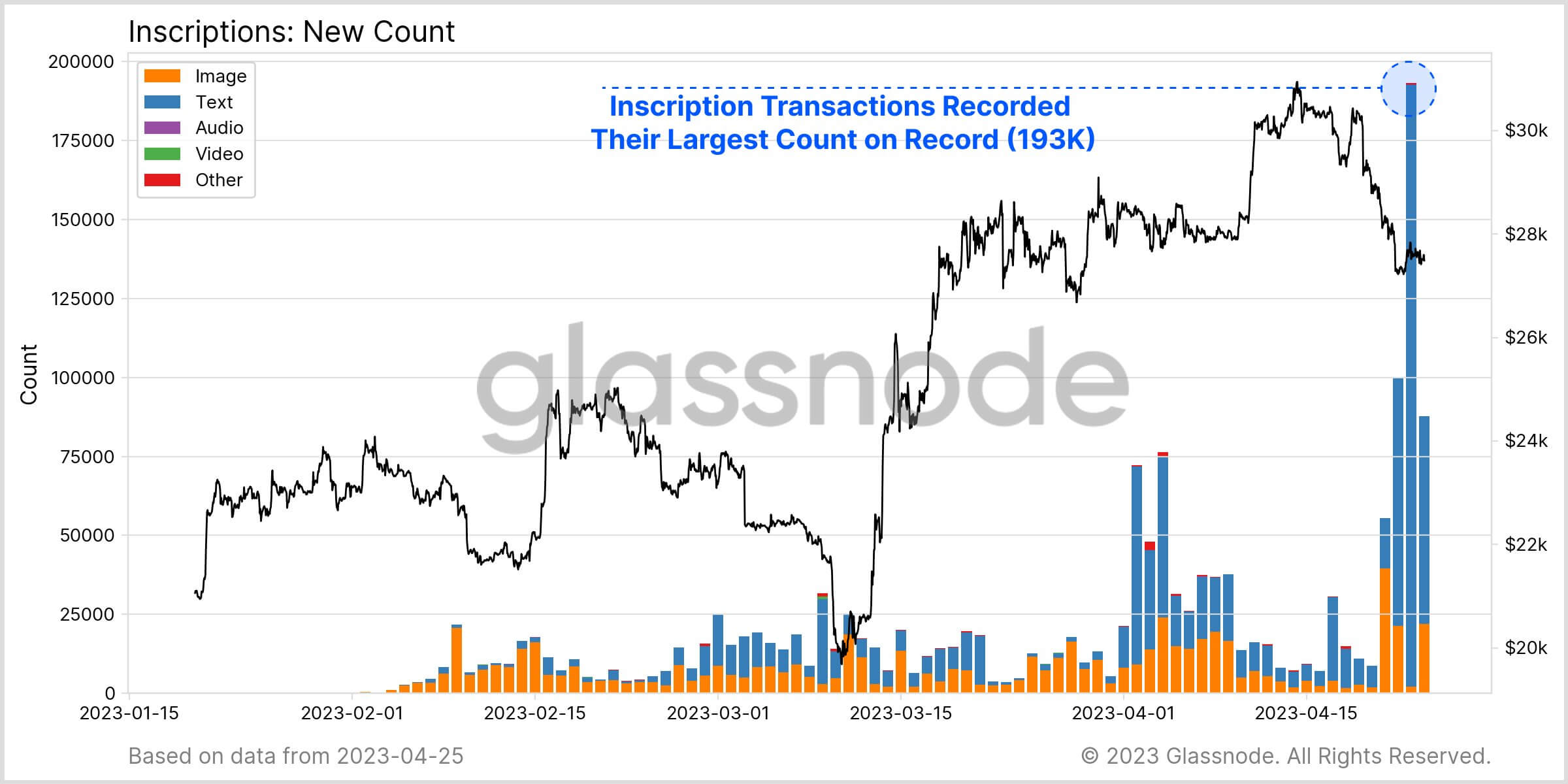

Bitcoin trading volume (weekly average) hit a record high. It surpassed December 2017, the peak of the cryptocurrency bubble.

It seems that Ordinals (Inscriptions), which exceeded the record high of 190,000 cases/day, had an impact. Inscriptions can account for about 40% share of all Bitcoin transactions.

Glassnode

With the advent of the Ordinals Protocol, it became possible to record image data in Satoshi, the smallest unit of Bitcoin, and it was recognized with the entry of major players and platforms such as Yuga Labs, DeGods, and Magic Eden around February this year. Since then, it has become frequently traded as a type of NFT (non-fungible token) on Bitcoin.

As a result, the average block size in early February jumped from 1.2MB in the previous month to more than 3MB.

The recent trend is that text-based instructions, which are lighter in data size, are proliferating rather than image-based instructions, which were popular in the early days and quickly declined.

Glassnode

In the background is an experimentally created Bitcoin Request for Comment (BRC-20) token. Interest has grown rapidly as it stores script files on the Bitcoin network and enables token transactions between users.

Unlike Ethereum (ETH)’s ERC-20 standard, smart contracts and DeFi (decentralized finance) applications will not be supported.

On the other hand, Ordinal Labs, which develops the Ordinals (Inscription) ecosystem, said on April 27, “The BRC-20 token will start in earnest, but it is a prototype using unfinished technology, and the risk is very high.” cautioned.

As for Ordinals itself, some Bitcoin maximalists have expressed skepticism that it deviates from the original purpose of Bitcoin as advocated by Satoshi Nakamoto, and that it can clog transactions.

On April 27, Grayscale posted a review of the data so far.

#Ordinals have generated a great deal of attention in the crypto ecosystem by introducing #NFTs-like assets on the #Bitcoin blockchain. @mzhao8 and our research team explore their potential in our latest Market Byte:

https://t.co/7muc9Lyrok

— Grayscale (@Grayscale) April 28, 2023

Since the start of the protocol, there has been a significant increase in the fees paid to miners who maintain the security of the network. positive for the Bitcoin network.”

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin pulls back before FOMC, average weekly trading volume hits record high due to Inscriptions appeared first on Our Bitcoin News.

2 years ago

177

2 years ago

177

English (US) ·

English (US) ·