Bitcoin moved sideways this week, trading within a narrow range between $115,184 and $119,959.

Momentum slowed heading into Friday, with no major breakout in either direction.

The total cryptocurrency market cap briefly crossed the $4 trillion mark before retreating to $3.85 trillion. This reflected a decline of more than 6% late in the week.

Broader sentiment remained bullish. The Crypto Fear and Greed Index stayed in greed territory, though it had fallen three points from the previous week at press time.

Altcoins outperformed Bitcoin. While the leading cryptocurrency was down over 2% on the week, several high-cap tokens ended with double-digit gains.

Why is Bitcoin stuck?

Bitcoin remains range-bound as conflicting forces weigh on short-term price direction. A sharp rise in open interest, now at an all-time high of $44.5 billion, is a sign of a speculative market.

This trend comes alongside falling prices, which happens when there is a buildup of leveraged positions that heightens the risk of sudden volatility and forced liquidations.

Instead of long-term investors, the market is seeing a wave of short-term traders attempting to capitalise on rapid price swings.

Analysts have observed that many are entering long positions without waiting for clear confirmation, a sign of heightened FOMO after Bitcoin briefly rallied from $116,000 to $120,000 earlier this week.

That rally was quickly sold off, as larger players used the $120,000 mark to offload holdings, reinforcing it as a key resistance level.

Binance data shows the price of perpetual contracts has moved above the spot rate, suggesting an upward bias during intraday moves.

However, funding rates remain neutral, which means the market is largely undecided about the direction of the broader trend.

Profit-taking is also limiting further upside. Bitcoin’s recent surge, which has taken it over 65% above its April lows, has prompted investors to lock in gains. This trend is playing out across the market, particularly among altcoins that have recorded stronger rallies.

Broader macroeconomic uncertainty is another drag. The upcoming August 1 tariff deadline, with the US planning to impose sweeping trade restrictions, is fuelling risk-off sentiment.

While agreements have been reached with Japan and the Philippines, talks with the EU and South Korea remain unresolved.

Additionally, traders are cautious ahead of next week’s Federal Reserve meeting. While there is hope for a rate cut, officials have signalled that monetary easing is unlikely in July.

With inflation ticking higher, most analysts now expect the first cut to come in September or October, delaying the kind of policy support that often boosts crypto markets.

Will Bitcoin go up?

Despite Bitcoin’s late-week slowdown, bullish conviction remains strong.

A notable options trade on Deribit saw a high-net-worth investor place a $23.7 million bet on Bitcoin reaching $200,000 by year-end.

The trade used a December $140K–$200K bull call spread, a setup that puts a ceiling on both risk and reward.

Such whale activity often draws attention, as similar trades have shaped price action in previous cycles.

Analysts view these structured bets as signs of long-term confidence, even as the market navigates short-term volatility.

According to Deribit Insights, this structure leans on lower implied volatility at the $140K strike while offsetting costs with pricier $200K calls, essentially a calculated bet on Bitcoin breaking into record territory soon.

Technical indicators also support the bullish view. According to Rekt Capital, Bitcoin continues to follow a broader price discovery trend and has retested key support levels on both daily and weekly timeframes.

BTC/USD weekly chart. Source: Rekt Capital.

Holding above $119,000 on the weekly close would keep the current bull flag breakout structure intact.

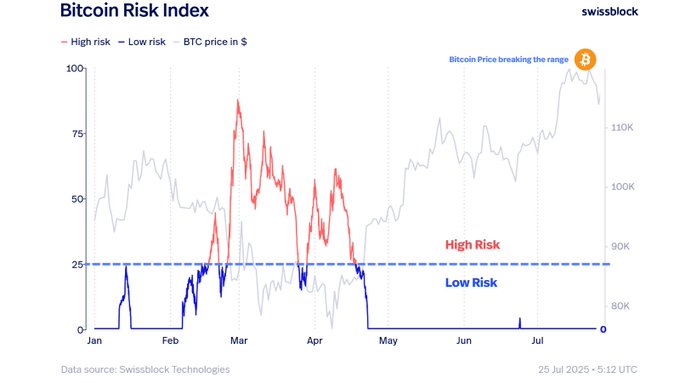

Adding to the bull case, asset manager Swissblock said in a Friday post on X that the Bitcoin Risk Index remains at zero. This index measures the likelihood of significant price drawdowns in BTC.

Bitcoin finally broke out of its range— but this isn’t capitulation, it’s a rotation-led correction. → Risk Index = 0 → No overheating → Structure intact The trend remains bullish. Corrections at low risk levels = opportunity, not exit.

According to the firm, a zero reading suggests the market hasn’t overheated and still has room to move higher.

Swissblock maintains that the current dip is a low-risk correction rather than a trend reversal, and described the late week dip as an opportunity rather than an exit signal.

Other analysts, like Daan Crypto Trades, pointed to $115,000 as a key support level. A breakdown could lead to a retest of $113,500, which is being closely watched by traders as a potential entry point if Bitcoin drops lower.

$BTC Testing its range low and swept the local liquidity. Most of this sell off is coming from Galaxy Digital which has sent $2B+ of Bitcoin to exchanges to sell. This is still part of that 80K BTC whale. The Bitcoin price has stalled ever since those coins started moving. A

Meanwhile, some caution is also warranted, according to well-followed analyst Crypto TA King, who highlighted a symmetrical triangle breakdown on the 4-hour BTC/USDT chart.

BTC/USD 4h Perpetual contract on Binance. Source: Crypto TA King.

Based on the chart, Crypto TA King expects a potential move toward the $112,000–$113,000 range if the breakdown holds.

At the time of writing, one Bitcoin was selling for $115,399, down 2.4% in the past 7-days.

Altcoins close the week on a high note

The altcoin market cap rose 7.7% to a weekly high of $1.67 trillion before it settled at $1.59 trillion, still up 2.5% over the 7-day period.

Ethereum climbed to $3,800 earlier in the week, briefly lifting the broader altcoin market; however, the rally lost steam as selling pressure returned, leading to sideways movement heading into the weekend.

By late Friday, most altcoins had given back a portion of their early-week gains.

As of press time, Ethereum was up just 1.2% over the past seven days. Meanwhile, other major altcoins like XRP, Solana (SOL), Dogecoin (DOGE), Tron (TRX), and Cardano (ADA) saw losses between 4% and 12%.

Conflux (CFX) saw the strongest rally this week among the top altcoins, up 69% while Ethena (ENA) and Pudgy Penguins (pengu) followed with 40.5% and 22% respectively.

Source: CoinMarketCap

Conflux: Conflux started gaining momentum after the team revealed its upcoming Conflux 3.0 upgrade, set to launch on July 31.

The project is also working on key infrastructure to enable real-world asset tokenization and blockchain-powered cross-border trade.

One major focus is a planned offshore Chinese yuan stablecoin, which could support China’s broader push to expand the global use of its currency via digital technology.

Conflux has also teamed up with crypto wallet TokenPocket to promote the stablecoin among its users.

Ethena: ENA’s price shot up late in the week as whales and influential figures, like Arthur Hayes, scooped up millions worth of the token.

Such large-scale accumulation trends often trigger retail FOMO, drawing in retail interest that adds to the momentum.

Another major catalyst is StablecoinX, a newly listed Nasdaq firm, which has started executing a large-scale ENA treasury strategy.

Over the next six weeks, the company will allocate $260 million to ENA. This steady buying activity is beginning to influence the market and support the price.

In addition, Ethena Labs has partnered with Anchorage Digital, a federally chartered crypto bank, to launch USDtb, the first stablecoin designed to comply with new US stablecoin regulations.

Pudgy Penguins: PENGU’s rally is picking up steam thanks to a string of recent developments.

First, it secured a listing on Gemini on July 22. It also announced two major partnerships, one with US motosports organisation NASCAR, and the other with Lufthansa, Germany’s largest airline.

PENGU’s momentum picked up further after the U.S. SEC began reviewing the Canary Spot PENGU ETF.

Moreover, sales numbers for the Pudgy penguins NFT collection have surged over the past weeks, which has helped instill market confidence in the meme coin.

The post Bitcoin range-bound ahead of Fed decision, CFX, ENA post double digit weekly gains appeared first on Invezz

English (US) ·

English (US) ·