Macroeconomics and financial markets

On the US New York stock market on the 1st of last weekend, the Dow Jones Industrial Average rose $294.6 (0.82%) from the previous day, setting a new year-to-date high. The Nasdaq index closed 78.8 points (0.55%) higher.

Expectations for an end to interest rate hikes have strengthened after Federal Reserve Chairman Jerome Powell stated that the current level of interest rates is “significantly tightened.”

In the Tokyo stock market, the Nikkei Stock Average fell by 177 yen (0.54%) from the previous day, while Monex, which owns the major crypto asset (virtual currency) exchange Coincheck, declined due to the soaring price of Bitcoin (BTC). , which rose 5.6% from the previous day to 695 yen, and Ceres, the parent company of major exchange bitbank, rose 12.4% from the previous day to 1,032 yen.

In the U.S. stock market, virtual currency-related stocks such as Coinbase, MicroStrategy, and mining-related stocks have risen sharply, suggesting that investors are looking into the sector.

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

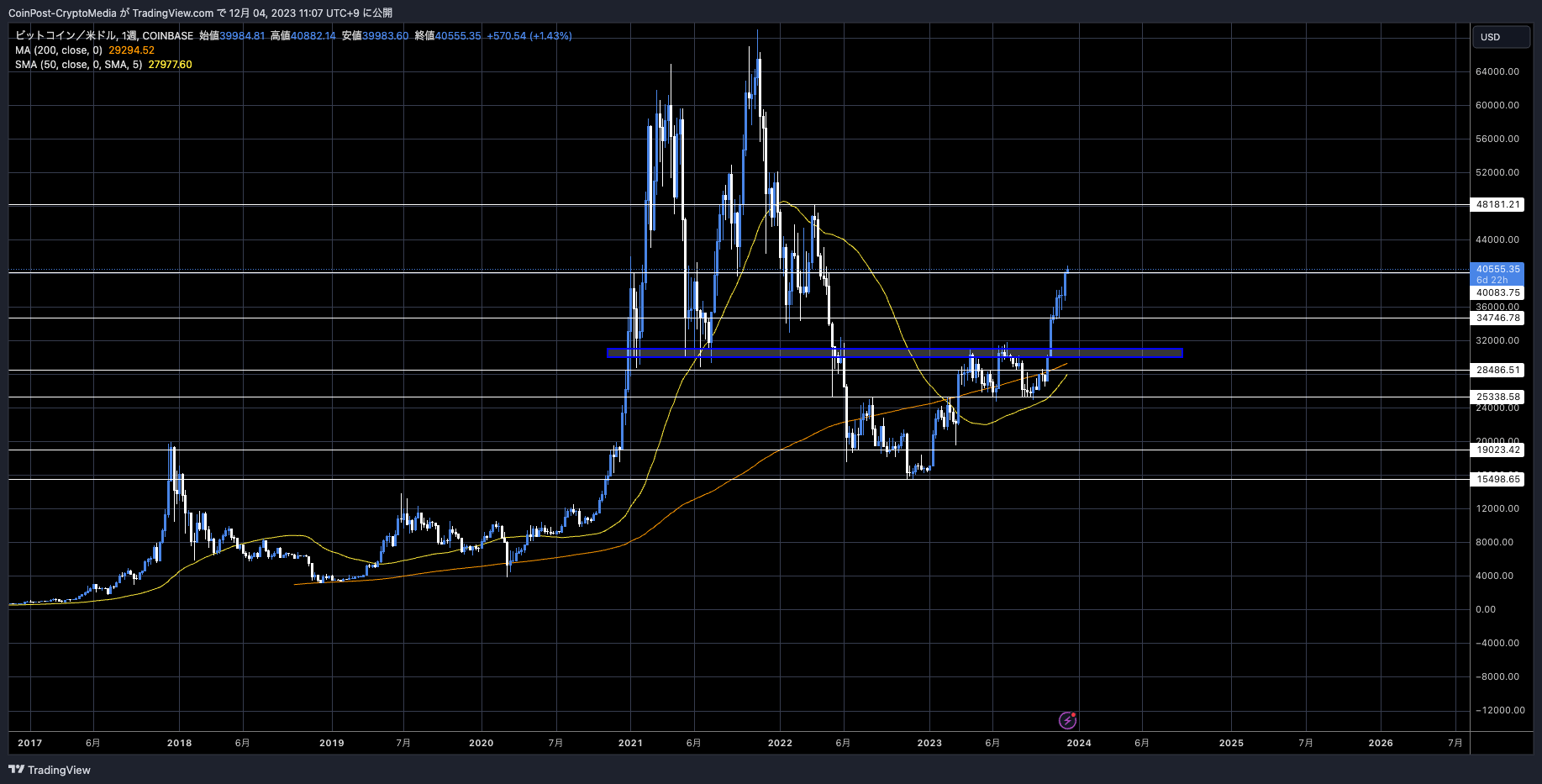

In the crypto asset (virtual currency) market, Bitcoin prices continued to rise, rising 2.52% from the previous day to 1 BTC = $40,552 (approximately 6 million yen). Passed the psychological milestone of $40,000

BTC/USD weekly

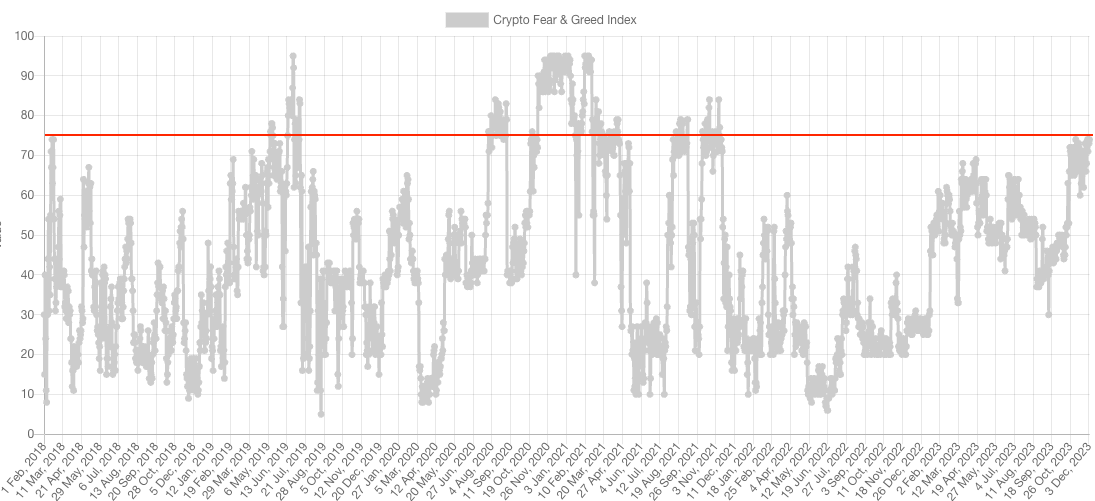

As crypto assets (virtual currency) prices rise, the Fear & Greed Index, which measures investor sentiment, has risen to 74, which indicates optimism.

The highest level this year, the 2021 bull market reached above 90, indicating extreme optimism.

Fear & Greed Index

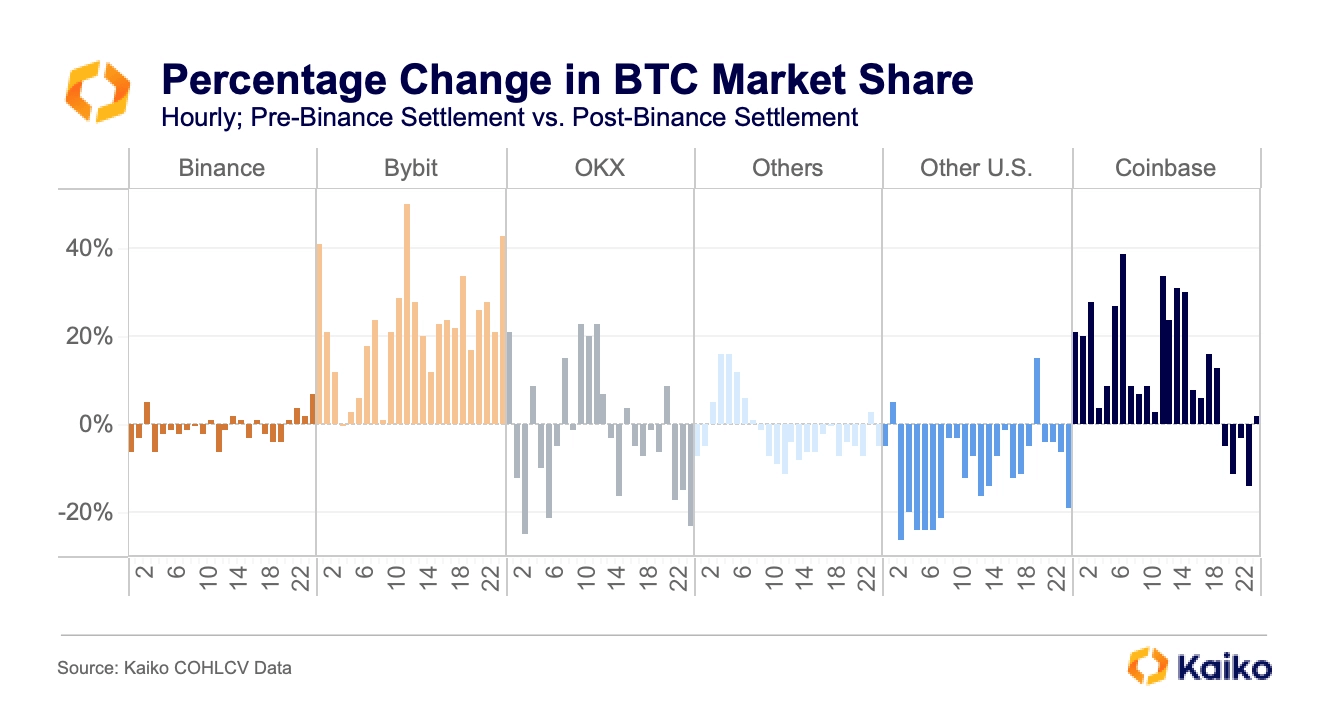

According to a report by kaiko, the market share of crypto asset (virtual currency) exchanges has changed significantly due to Binance’s settlement with US regulators and the retirement of former CEO Changpeng Zhao.

Last week, Binance reached a $4 billion settlement with the U.S. Department of Justice, agreeing to hire an independent monitor and improve its anti-money laundering program.

However, the Wall Street Journal reported that the lawsuit with the US SEC (Securities and Exchange Commission) has not been resolved, and that an investigation into whether backdoor access to customer funds was possible is underway. There is.

Binance has a very large presence in the Bitcoin (BTC) market share, with the market share change rate increasing by 50% for Bybit, which is mainly based on derivatives, and 34% for Coinbase, which is mainly used for spot trading by institutional investors. did.

kaiko

In addition to the withdrawal of competitors from the U.S. market, which has been losing market share, there are strong expectations that a Bitcoin spot ETF (exchange traded fund) will be approved as soon as possible, and Coinbase’s stock price has increased from $77.4 to $124.7 in one month. (up 61% from the previous month). It reached an 18-month high.

However, it remains well below the all-time high of $354 reached in November 2021 during the bull market.

The crackdown on crypto-asset (virtual currency)-related companies by US regulators is extending to all companies doing business in the US, and in June of this year, the US SEC (Securities and Exchange Commission) issued a citation for violation of securities laws (unregistered securities). There was a period when the stock price plummeted as a result of a lawsuit being filed against the company. The court outcome, which could have a significant impact on the altcoin market, will be closely watched.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

altcoin market

Analyst Miles Deutscher said, “If history repeats itself, there will be another alto season.”

Is #Bitcoin dominance following the same pattern from last cycle?

In 2019, dominance topped out in September – before alts gained steam into the halving.

In 2023, dominance looks to be exhibiting a similar pattern – which would indicate a reversal into the halving. pic.twitter.com/ZD3nMeltuO

— Miles Deutscher (@milesdeutscher) November 30, 2023

This is based on “Bitcoin dominance,” which indicates market share.

In the phase of trend reversal from a bear market, the market price and dominance of Bitcoin will first rise significantly towards the “halving” of the four-year cycle, and as the Bitcoin dominance declines after profits are taken, individual stocks (alt. This shows that funds circulate into coins).

Additionally, according to Santiment, whale wallets (large investors) have purchased $62 million worth of Chainlink (LINK) in the past three days.

#Chainlink is moving ahead of the #altcoin field once again, aided by the top whales continuing to accumulate. The 200 largest wallets have added just over $50M $LINK in ~5 weeks. In 5 months, its market cap is +143% overall, and +93% vs. #Bitcoin. https://t.co/HUjTnCY5c9 pic.twitter.com/oAPl9SQaJ5

#Chainlink is moving ahead of the #altcoin field once again, aided by the top whales continuing to accumulate. The 200 largest wallets have added just over $50M $LINK in ~5 weeks. In 5 months, its market cap is +143% overall, and +93% vs. #Bitcoin. https://t.co/HUjTnCY5c9 pic.twitter.com/oAPl9SQaJ5

— Santiment (@santimentfeed) December 2, 2023

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

Click here for a list of past market reports

The post Bitcoin reaches the $40,000 level for the first time in a year and a half, and “virtual currency-related stocks” are being looked for in the Japanese and US stock markets appeared first on Our Bitcoin News.

1 year ago

129

1 year ago

129

English (US) ·

English (US) ·