Bitcoin (BTC)’s 63% year-to-date gain could be the first step towards a bull market.

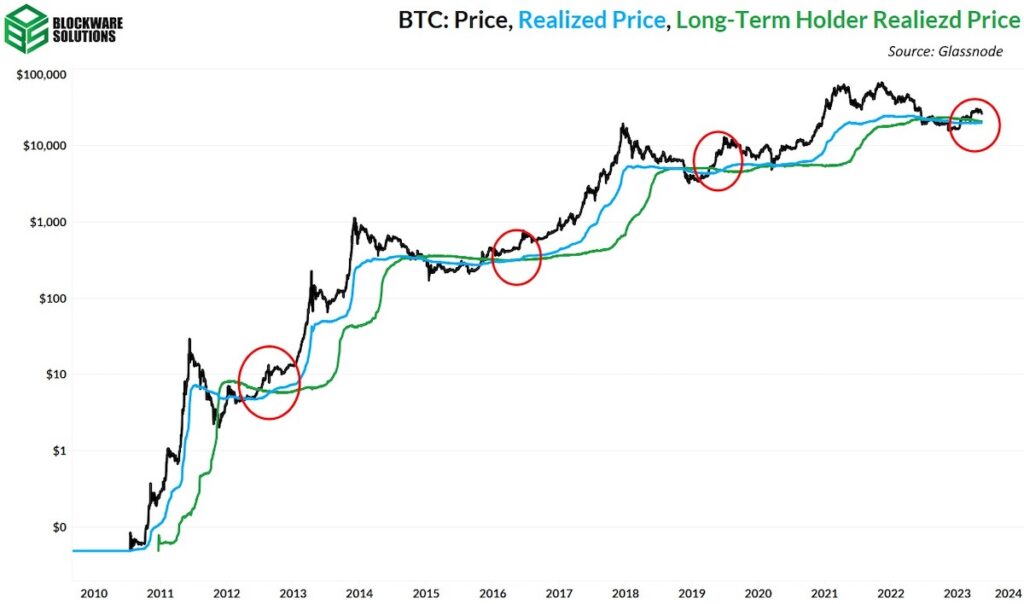

This is a message that can be read from the momentum that the realization price of Bitcoin exceeds the realization price of long-term holders. A realized price crossover historically marks the end of a bear market and the beginning of a major price rally.

Bitcoin’s realized price is the average price of Bitcoin when it last moved on the chain. Long-term holder realized price, on the other hand, is the average acquisition price of bitcoins that are held outside a centralized exchange and have not moved for at least 155 days.

As of this writing, Bitcoin’s realization price is $20,129, according to Glassnode data, closing in on the long-term holder realization price of $20,845, which has been trending downward since November.

“Looking at realized and realized prices for long-term holders, we are approaching a bullish cross that has pinpointed the bottom of past bear markets,” Blockware Solution said in its May 12 weekly report. stated in the newsletter.

Blockware Solutions, Glassnode

Blockware Solutions, GlassnodeLooking at the chart above, the realized price (blue) is about to exceed the realized price of long-term holders (green). Past crossovers in June 2019, May 2016 and September 2012 heralded a multi-year bull market.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Blockware Solutions, Glassnode

|Original: Bitcoin’s Realized Price on Cusp of Flashing Major Bullish Signal

The post Bitcoin Realization Price Marks the Beginning of a Bull Market? | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

90

2 years ago

90

English (US) ·

English (US) ·