Macroeconomics and financial markets

In the US NY stock market on the day, the Dow Jones Industrial Average fell 344 dollars (1.02%) from the previous day, and the Nasdaq Index closed 102 points (0.8%) lower.

connection:First Republic crashes, Microsoft rises sharply with good results | 26th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

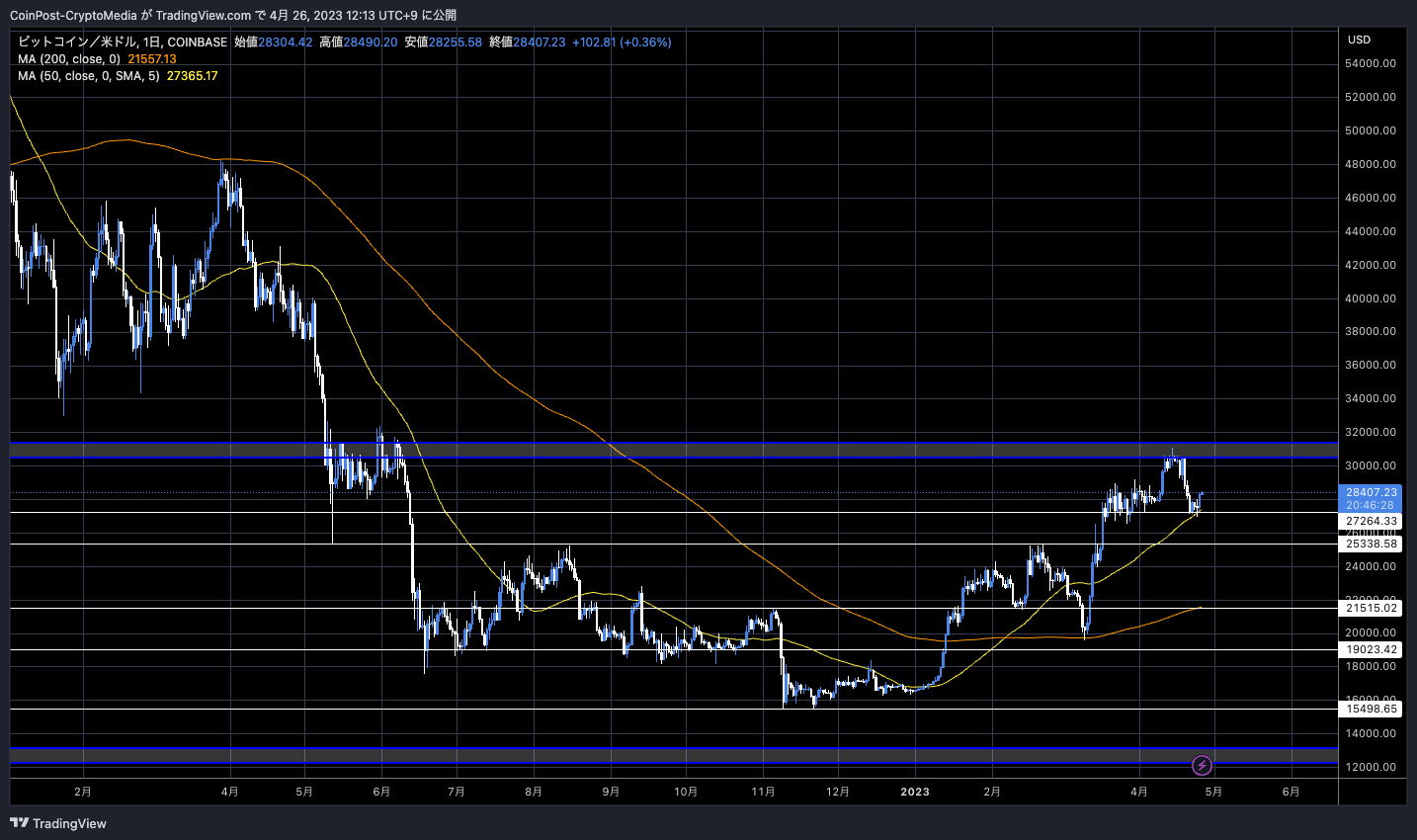

In the crypto asset (virtual currency) market, Bitcoin rose 3.55% from the previous day to $28,381.

BTC/USD daily

It briefly dipped below $27,000, but then rebounded.

One of the factors seems to be the rise of financial instability due to the crash of the stock price of the US regional bank First Republic Bank, and the buying of Bitcoin and gold (gold).

First Republic Bank said on Tuesday it was seeking to restructure its balance sheet after withdrawing $100 billion in deposits in the first quarter, well above market expectations. It shows that the market remains skeptical of the financial system and is still exposed to strong uncertainties as banks remain distrustful.

In the recent financial instability phase, the decline in the US stock index and bitcoin tend to be inversely correlated. In early March, demand for alternative assets such as gold and BTC surged due to the successive failures of Silicon Valley Bank and Signature Bank.

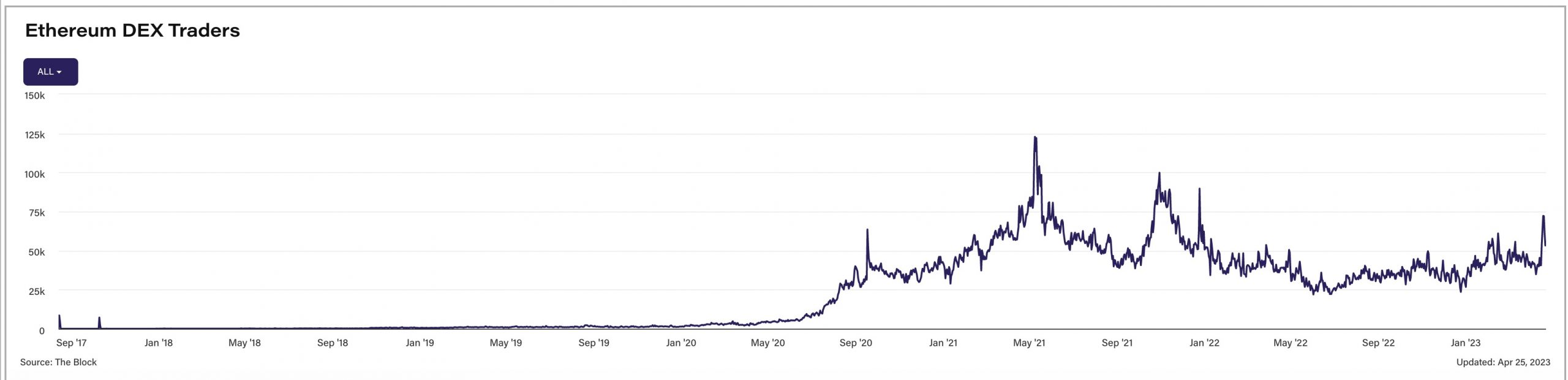

On the other hand, the transaction volume of UniSwap, a decentralized finance company, surged, and the number of active users reached 72,000 per day, the highest level since May 2021.

The meme coin Pepe the Frog (PEPE) is believed to have soared by 21,000% in three days.

UniSwap On the 13th, they announced the launch of “Uniswap Mobile Wallet,” which allows seamless swapping of L2 such as Polygon, Arbitrum, and Optimism from outside.

In addition, it is widely believed that the US Federal Open Market Committee (FOMC), scheduled for May 3, will raise interest rates by 25 bps, which will bring the FRB (Federal Reserve) to the final stages of monetary tightening.

According to the IMF (International Monetary Fund) economists’ baseline forecast published on April 11, the global economic growth rate in 2023 is expected to slow to 2.8% from 3.4% in 2023. If credit uncertainty in the financial sector escalates, global economic growth will drop to around 2.5%, while advanced economies will grow below 1%.

IMF

Baseline forecasts are projections of future economic growth, inflation rates, unemployment rates, etc., based on current policies and economic conditions, and are highly likely to change depending on the policies of each country and external factors. should be noted.

Inflation (high prices), which the FRB uses as a criterion, is analyzed as follows.

Global headline inflation is expected to slow from 8.7% in 2022 to 7.0% in 2023 on the back of falling commodity prices (such as grain and natural gas), but core inflation will slow at a slower pace will do. In most cases, inflation will not return to the target level (2.0%) until 2025.

The more obvious the economic recession risk such as deterioration of corporate performance becomes, the more difficult it will be to continue the tightening monetary policy for a long time, and the more likely it is to pivot (policy change) such as stopping rate hikes or starting rate cuts, but the FRB is currently showing signs of this. not showing

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Rebound, Financial Uncertainty Facilitates appeared first on Our Bitcoin News.

2 years ago

141

2 years ago

141

English (US) ·

English (US) ·