Macroeconomics and financial markets

In the US NY stock market on the 22nd, the Dow was down $530 (1.63%) from the previous day and the Nasdaq was down $190 (1.60%).

The US Federal Open Market Committee (FOMC) had already factored in an interest rate hike of 25bps, but Chairman Powell made it clear that he would lower the inflation rate to 2% in order to stabilize prices. In addition, by mentioning that “we do not expect an interest rate cut within this year,” expectations for a change in monetary policy have waned.

Bearing in mind the bankruptcy of Silicon Valley Bank (SVB), he said, “The financial system we have built up (after the Lehman Brothers shock) is resilient, and we are prepared to use all possible means.” No,” he said.

At the same time, U.S. Treasury Secretary Janet Yellen’s congressional testimony showed a negative view of the scope of coverage of deposit insurance.

Currently, the amount covered by the US Federal Deposit Insurance Corporation (FDIC) deposit insurance is only $250,000 (approximately 33 million yen). There is a trial calculation that the ratio of large depositors in banks will reach 70%.

connection:US stocks, Nasdaq reversal FOMC additional interest rate hike, expectations for rate cut within the year recede | 23rd Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.59% from the previous day to $27,405.

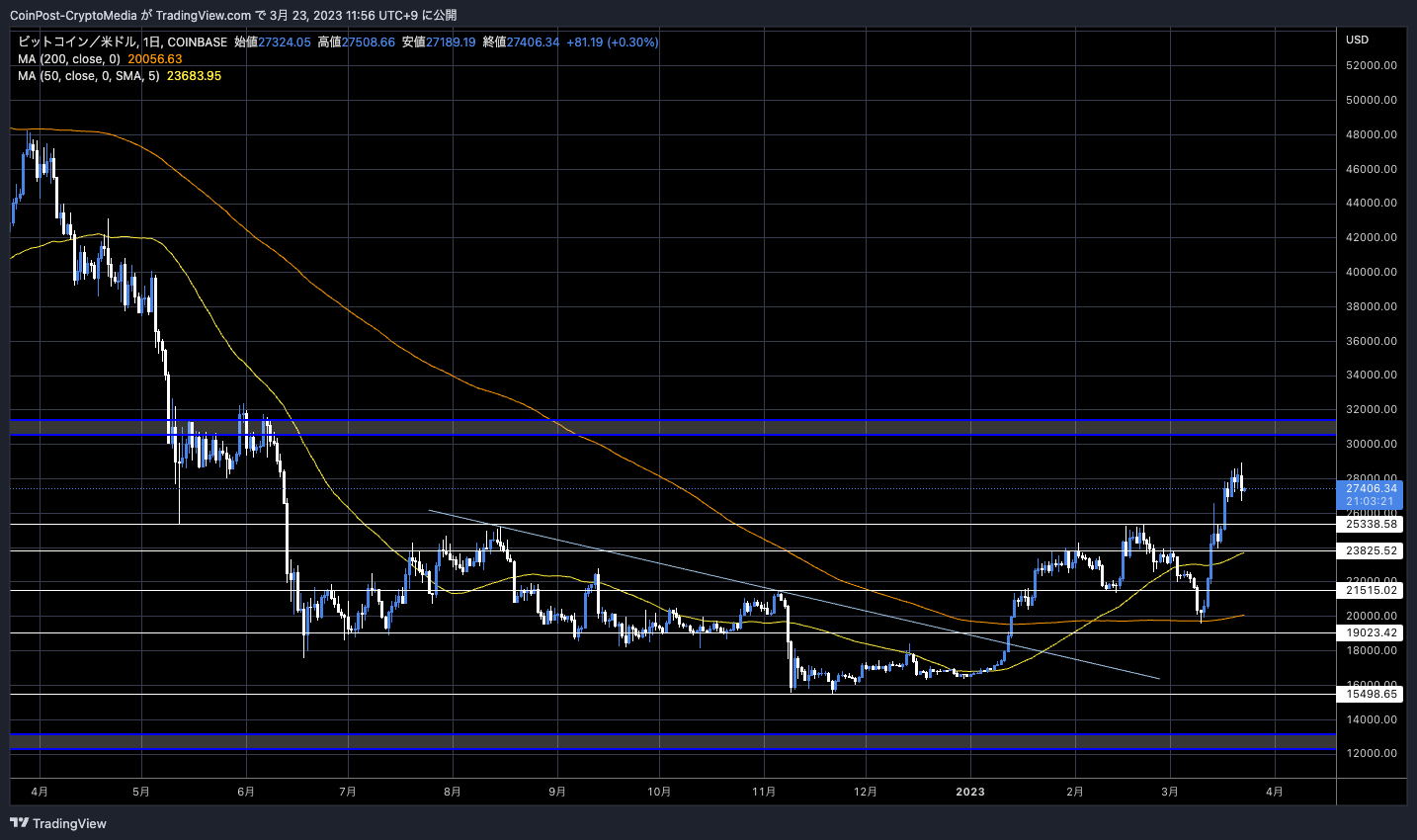

BTC/USD daily

Bitcoin (BTC) briefly climbed to $28,937.

The Crypto Fear & Greed Index, which measures sentiment (market sentiment), reached 62 on the 22nd, approaching the “Extreme Greed” level since November 2021. The optimism disengaged led to a sharp pullback.

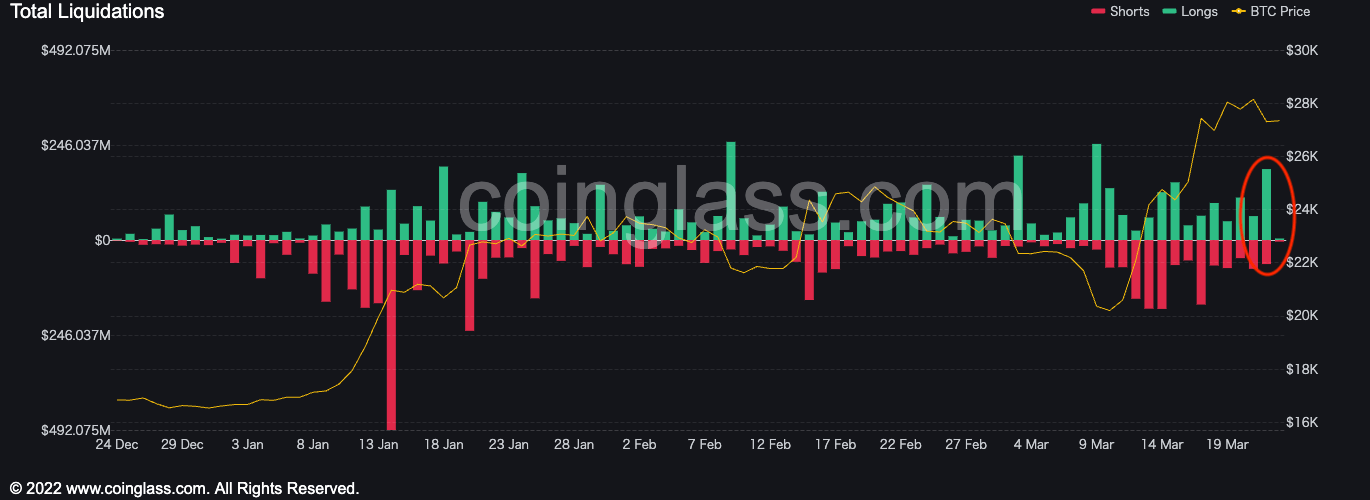

In the cryptocurrency futures market, crypto assets equivalent to $ 180 million were cut (forced liquidation) in 24 hours.

coin glasses

The U.S. SEC (Securities and Exchange Commission) issued a “Wells Notice” to major U.S. exchange Coinbase, which weighed on the market.

connection:SEC Investigates Coinbase for Securities Law Violations, Sends Wells Notice

The Wells notice is a text warning that legal action will be taken for violations of securities laws. The survey targets are expected to include Coinbase Earn, a staking service provided by the company, Coinbase Prime, a platform for institutional investors, and self-managed Coinbase Wallet.

In response to the lawsuit, Coinbase said, “Regulatory standards for cryptocurrencies, such as target stocks, are ambiguous. The token listing process is shared with the SEC and undergoes strict screening. We have also explored business registration with the SEC, but In the past nine months, I tried to contact him more than 30 times, but I could not get a sufficient answer.”, and the conclusion may be brought to court.

connection:“Why Staking Services Should Be Excluded from Securities Accreditation” Coinbase Filed Petition with SEC

Earlier this month, the SEC filed a lawsuit against the long-established US exchange Kraken for violating securities laws. The Kraken side has settled by suspending staking services for US customers and paying a fine.

connection:US SEC: Kraken’s cryptocurrency staking service violates securities laws

The SEC also filed a lawsuit against Tron (TRX) founder Justin Sun and three companies he owns, alleging securities law violations and market manipulation.

Today we charged crypto entrepreneur Justin Sun and three of his wholly-owned companies for the unregistered offer and sale of crypto asset securities Tronix and BitTorrent.

Read more: https://t.co/4tXgKNof6Q

— US Securities and Exchange Commission (@SECGov) March 22, 2023

According to the SEC, from April 2018 to February 2019, Sun directed large-scale wash trades, adding bulk to falsely claim that he was boosting the exchange’s trading volume. pointed out.

Along with this, eight celebrities, including actress Lindsay Lohan and YouTuber Jake Paul, have been indicted for participating in the promotion of unregistered securities with TRX and BTT rewards.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Rebound, FOMC Powell Remarks and Yellen Congressional Testimony Facilitate Optimism appeared first on Our Bitcoin News.

2 years ago

183

2 years ago

183

English (US) ·

English (US) ·