Macroeconomics and financial markets

In the US NY stock market on the 17th, the Dow Jones Industrial Average rose 408 dollars (1.2%) from the previous day, and the Nasdaq Index rose 157 points (1.3%) to finish trading.

US President Biden said, “I am confident in the agreement with the opposition party. There will be no default.” The Republican House Speaker McCarthy also agreed on the move, greatly reducing fears of a US default.

Related: NY Dow and cryptocurrency-related stocks rebound sharply US default concerns recede | 18th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

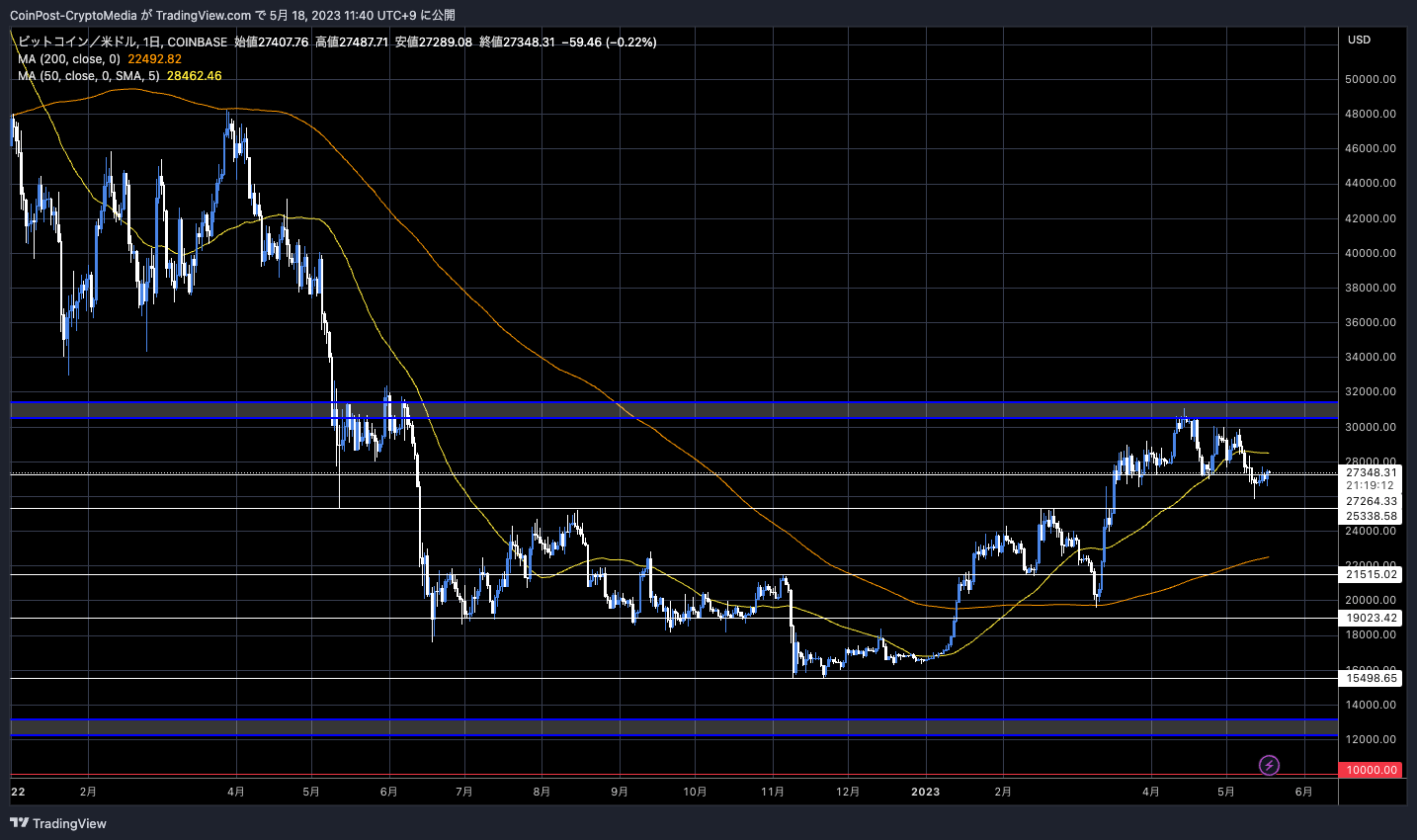

In the crypto asset (virtual currency) market, Bitcoin rose 1.09% from the previous day to $27,358.

BTC/USD daily

It was weak in Asian time, but rebounded in US time. It rose with the rebound of major US stock indices. On the 17th, XRP also rose on positive news about Ripple.

connection:Ripple trial SEC’s Hinman speech nondisclosure petition rejected by court again

connection:Ripple Acquires Crypto Custody Firm Metaco

The U.S. SEC (Securities and Exchange Commission) pointed out that Filecoin (FIL) “meets the definition of a security under federal law.” Grayscale, which applied for the investment trust “Filecoin Trust,” was asked to withdraw the application on the grounds that “the underlying assets are securities.”

connection:U.S. SEC Declares Filecoin (FIL) to be Securities Grayscale Announces

Filecoin is the native token of a decentralized storage platform called “IPFS”. It aims to enable users around the world to store and trade data securely and efficiently.

Grayscale had filed an SEC Form 10 Application in April this year to deal with new issues related to mutual funds. Form 10 requires companies to file quarterly reports like public companies.

Bitcoin buying pressure

Tether announced today that it will allocate up to 15% of its net realized monthly operating income to Bitcoin purchases.

Tether #Bitcoin

#Bitcoin

Starting this month, Tether will regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin. These Bitcoin shall be considered on top of the minimum reserves assets that 100% back tether tokens.

More  https://t.co/7zC2swgwWH pic.twitter.com/BOcSDjjmDf

https://t.co/7zC2swgwWH pic.twitter.com/BOcSDjjmDf

— Tether (@Tether_to) May 17, 2023

Net realized operating profit refers to the amount of profit obtained from a company’s operating activities after deducting non-operating expenses such as taxes, interest, exchange losses, and depreciation. The idea is to evaluate the rarity of Bitcoin and its role as a means of storing value, and to diversify reserve assets.

As of the end of March 2011, the amount of Bitcoin held is about 1.5 billion dollars (200 billion yen).

connection:Tether “will buy bitcoin regularly from this month”

USDT, issued by Tether, is a representative US dollar-linked stablecoin and boasts the largest share among stablecoins.

Asset sales and selling pressure

Voyager Digital, which filed for bankruptcy last July, said on Wednesday that a plan to repay its debtors will come into effect in the coming weeks, the official committee of unsecured creditors said. A bankruptcy court has approved Voyager’s liquidation proceedings.

Voyager Digital fell into a chain of bankruptcies with venture capital “Three Arrows Capital (3AC)” due to the collapse of algorithmic stablecoin UST (TerraUSD) and the shock of Terra (LUNA).

Since July last year, the rescue and acquisition process of Voyager by FTX and Binance.US has been progressing, but after many twists and turns such as the bankruptcy of FTX and the balance with US regulators, both plans have been derailed.

connection:Binance US Cancels Acquisition of Voyager

According to a Reuters report, Voyager customers (creditors) will receive about 35% of their cryptocurrency deposits (unpaid debts) in the liquidation process. Voyager was granted authorization to return a total of $1.33 billion.

Voyager customers are expected to recover up to 63.7% of their money, depending on how the FTX lawsuit goes.

Around the same time, failed lender Celsius Network also entered the process of consolidating debt and selling assets to repay creditors.

Assets from Voyager and Celsius are expected to be sold in stages and allocated to priority claims such as unpaid wages and social insurance premiums to workers under bankruptcy law, before repaying debts to general creditors.

Celsius is withdrawing Lido Staked ETH (stETH) in conjunction with the implementation of the Ethereum withdrawal function on the largest liquid staking platform “Lido”, and in the process of selling assets, short-term selling pressure may occur in the market. There is also sex.

Celsius has been on auction since April 22 as part of a debt consolidation effort, with companies including Fahrenheit Holdings bidding. According to Celsius general counsel, the final bid was “hundreds of millions of dollars” higher than the initial bid by digital asset investment firm NovaWulf LLC, indicating a high level of interest.

Fahrenheit is a consortium formed in April by several companies, including Arlington Capital, an investment firm that does private equity for mid-market companies, to bid for assets in Celsius. The purpose is to acquire assets of bankrupt companies and diversify risks.

Celsius is exploring ways to continue part of its lending business and bitcoin mining business as part of its turnaround plan.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Rebounds as U.S. Stock Index Rise, Mixed Buying and Selling Pressure appeared first on Our Bitcoin News.

2 years ago

127

2 years ago

127

English (US) ·

English (US) ·