Macroeconomics and financial markets

On the US NY stock market on the 26th of the previous weekend, the Dow Jones Industrial Average was 328 dollars (1.0%) higher than the previous day, and the Nasdaq Index was 277 points (2.1%) higher.

The stock fell for five days in a row due to uncertainty over the debt ceiling issue, but US President Biden reached an agreement in principle with Speaker of the House of Representatives McCarthy and announced a policy to submit a bill to raise the debt ceiling to Congress, which is a risk. On-mood spread.

However, there is still some uncertainty as to whether the bill will pass successfully in parliament, as the two parties have yet to reach a consensus.

connection:AI / semiconductor related stocks soar, NY Dow down for 5 days | 26th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rebounded to $28,129, up 3.78% from the previous day.

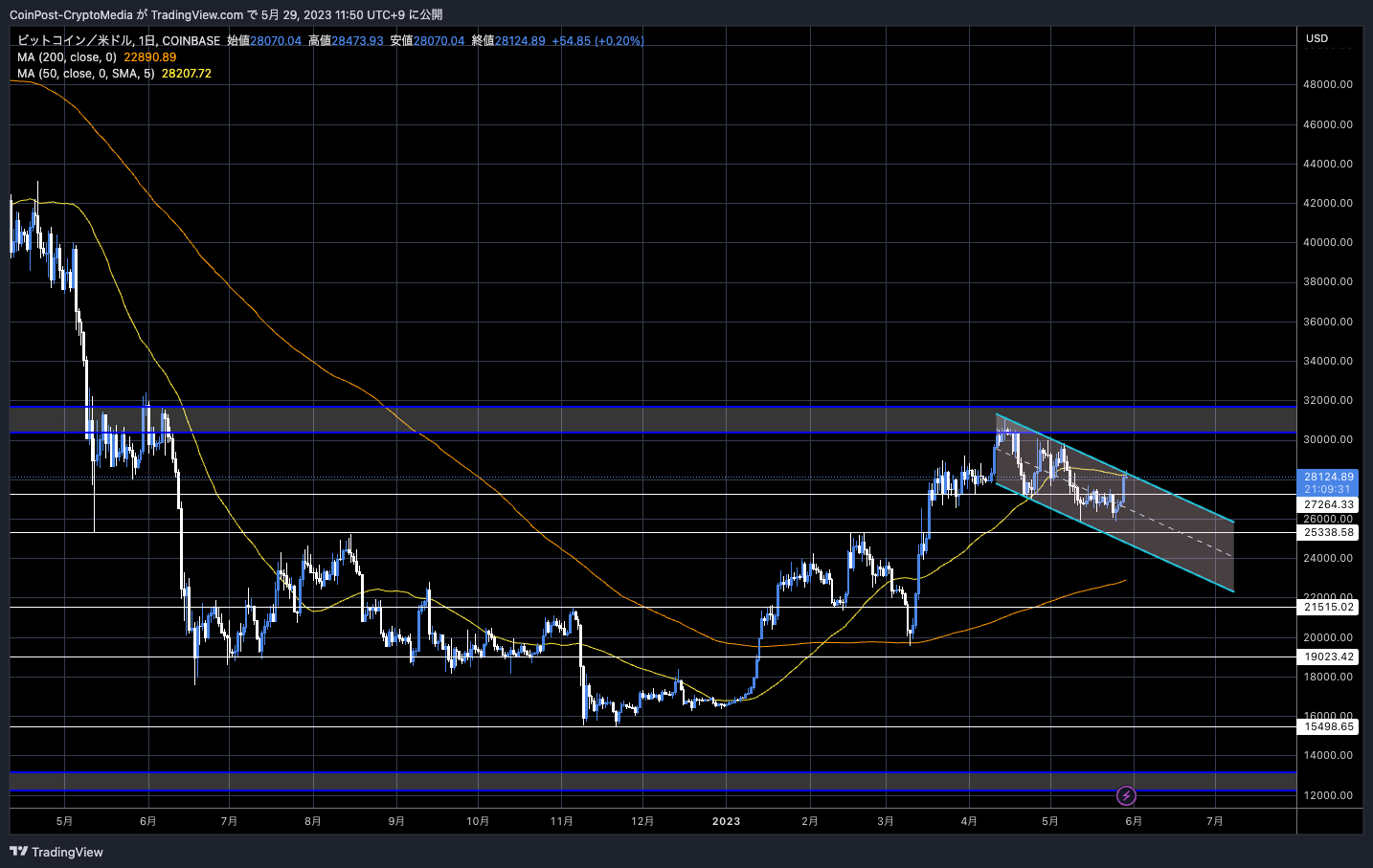

BTC/USD daily

As with the stock market, concerns about a US default (debt default) have receded significantly, and the worsening market sentiment has improved sharply. Since there were also a considerable number of position adjustments for risk hedging, it seems that short covering pushed up the market.

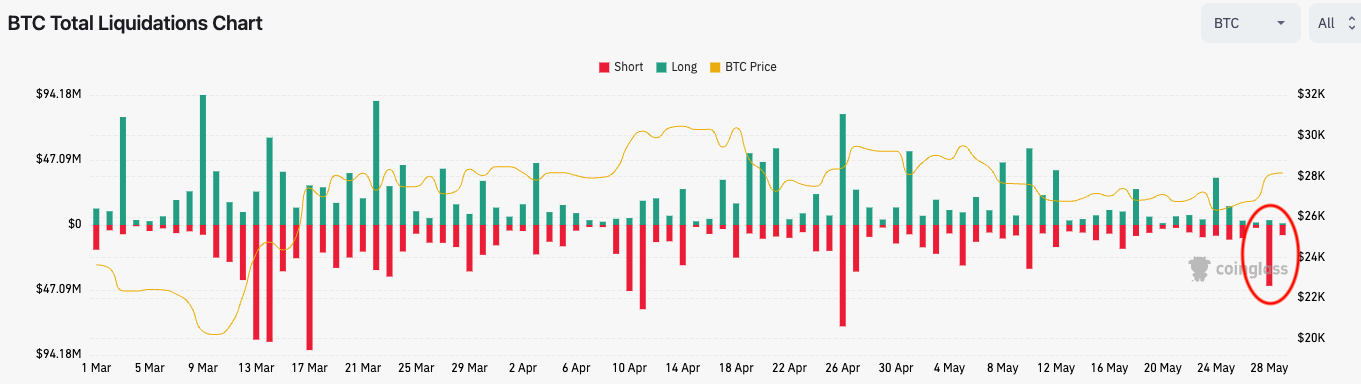

In the futures market, a loss cut (forced liquidation) of about 44 million dollars (equivalent to 5 billion yen) of BTC short positions was confirmed in 24 hours.

coin glasses

It is also a technically important turning point, and if 1 BTC = $ 32,000, which functions as a resistance line (upper resistance line) in the bottom price range of the previous bull market, can be broken, a turn to a bullish trend in anticipation of the halving in 2024 is realistic. comes with

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

After June, the tide may turn in the cryptocurrency market for three reasons.

The first is the aforementioned debt ceiling issue. The fact that a basic agreement was reached on a provisional arrangement before the enactment of the bill was well received.

The second is the monetary policy of the Federal Reserve (Fed).

In order to curb inflation, the FRB has tightened monetary policy at a pace unprecedented in history over the past year.

The interest rate hike phase is also in the final stage, and at the earliest, the US Federal Open Market Committee (FOMC) will stop rate hikes in June. If the economy falls into a recession from next year onwards, the possibility of a pivot (policy change) to monetary easing again is expected.

However, it is undeniable that inflation (high prices) in Western countries has fallen from its peak but remains high. There are also voices from financial authorities concerned about the gap with the optimistic stock market, and if interest rates continue to be raised in June contrary to market expectations, it may become a negative surprise.

The third is the situation in Greater China in the crypto asset (virtual currency) industry.

Authorities at the Beijing Municipal Commission of Science and Technology, which hosts China’s version of Silicon Valley, Zhongguancun, which contributes to the growth and competitiveness of China’s high-tech industry, released a web3 white paper last weekend.

Interesting timing on this Web 3.0 white paper from the Beijing government tech committee with the June 1st anticipation in Hong Kong. pic.twitter.com/0Ts1UB0jnL

— CZ  Binance (@cz_binance) May 27, 2023

Binance (@cz_binance) May 27, 2023

In May 2021, China issued a total ban on crypto assets (virtual currencies) due to concerns about the impact on the traditional financial system and the digital yuan. As a result of shutting out the mining industry, which until then boasted the world’s largest share, the market price of Bitcoin and the global hash rate (mining speed) plummeted.

However, with the collapse of Terra (LUNA) and the collapse of major exchange FTX in 2022, the U.S. SEC (Securities and Exchange Commission) began to further strengthen regulations on crypto assets (virtual currencies), and the attitude changed and softened.

“Hong Kong,” which is positioned as a special administrative region, has suggested that individual investors will resume trading, and announced that it will aim to become an international center for the crypto asset industry. We started to promote the invitation of web3 companies.

connection:Hong Kong Finance Minister Shows Policy for Web3 and Cryptocurrency Development

Some see this trend as a bullish signal that evokes the inflow of Chinese money, which was one of the driving forces behind the 2017 cryptocurrency bubble, and Changpong Zhao (CZ) of the largest cryptocurrency exchange, Binance, is also excited. I can’t hide

On the other hand, Wu Blockchain, who is familiar with the situation in China, said that Ethereum co-founder Gavin Wood was involved in the proposal for Web3 and blockchain, but said, “The white paper is not cryptocurrency itself, but artificial intelligence (AI) and metaverse ( Virtual space) is the main topic, and only NFTs (Non-Fungible Tokens) are mentioned with regard to blockchain.In the way overseas media reports, there are also sections that are expanding interpretations and exaggerating.”

He showed a calm demeanor.

We obtained the full text of this Beijing Web3 white paper. The article acknowledges that Gavin Wood proposed Web3 and the content of the blockchain; but in the Chinese-style Web3, AI and metaverse are the main topics, and the blockchain part only mentions NFT .

Read the full… https://t.co/1Y2FggL3TZ pic.twitter.com/knDe1lBtcI

— Wu Blockchain (@WuBlockchain) May 28, 2023

connection:Beijing, China plans to invest more than 2 billion yen a year to strengthen policy support for Web3 industries

connection:Bitcoin stays flat, is there limited room for upside | bitbank analyst contribution

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin rebounds due to receding default concerns, 3 backgrounds that change the tide appeared first on Our Bitcoin News.

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·