Macroeconomics and financial markets

On the US NY stock market on the 12th of the previous weekend, the Dow Jones Industrial Average closed at $38 (0.02%) lower than the previous day.

The “Consumer Confidence Index (preliminary figures)” released by the University of Michigan, which was announced on the same day, deteriorated more than expected and fell to the lowest level since November last year, but long-term inflation expectations rose.

The deterioration of the index indicates that general consumers in the United States are losing confidence in and expectations of the economy, and the rise in long-term inflation expectations reflects the view that the risk of future price rises is increasing. Markets are also paying close attention to such economic indicators, as they may affect the Fed’s (US Federal Reserve) monetary policy decisions.

connection:U.S. stocks continue to fall Pacwest Bank’s deposit outflow fuels anxiety | 12th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.33% from the previous day to $27,192.

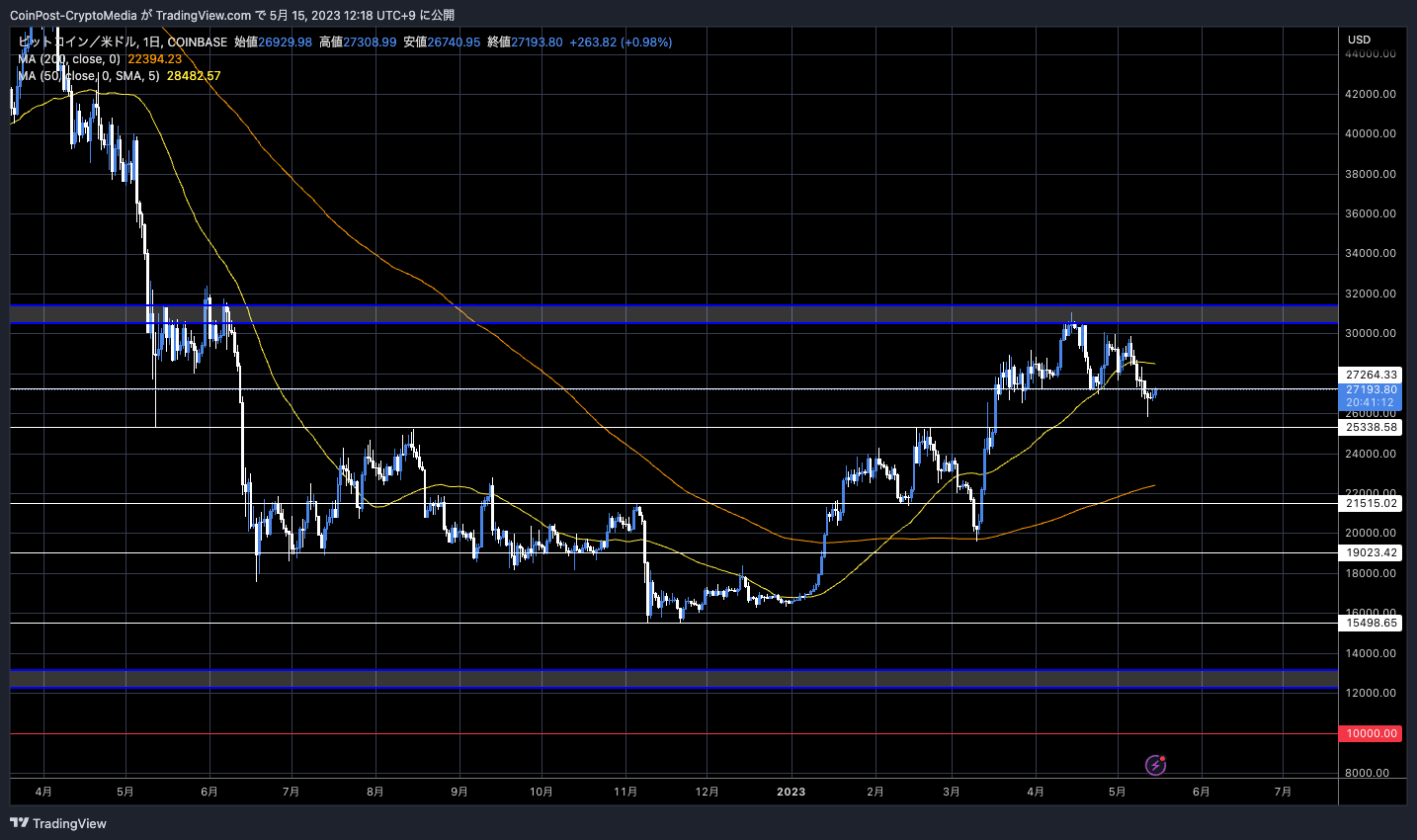

BTC/USD daily

The price fell sharply below the neckline of the triad, but rebounded at $25,800 before the support at $25,200.

The U.S. government is facing a serious risk of a “default,” in which the U.S. government is unable to redeem the principal or interest on U.S. Treasuries.

Raising the “debt ceiling ($31.4 trillion),” which limits the government’s borrowings, must be approved by Congress. To.

Treasury Secretary Yellen recently sounded the alarm that “we could default as early as June 1st.”

Should US Treasuries, which are supposed to be highly reliable assets, default, the impact on financial markets would be immeasurable. The United States plays an important role in each country in the global financial system, and US Treasuries and dollars are widely used as collateral for international transactions and financial institutions.

If trust is eroded and confidence in U.S. Treasuries is shaken, the value of U.S. Treasurys will fall and bondholders could suffer huge losses. If that happens, it is pointed out that risky assets will fall sharply along with the downgrading of government bonds, and the bankruptcy risk of banks that hold large amounts of government bonds will increase.

US Circle, which issues stablecoin USDC, has begun adjusting its reserves to reduce default risk, such as stating that it will not hold US Treasuries that mature after June.

According to Glassnode data, net outflows (withdrawals) in net stablecoin positions are declining.

The Aggregate #Stablecoin Supply has been experiencing severe outflows as market participants have rampantly redeemed their tokens following the LUNA collapse, culminating in a peak monthly outflow of -$8.6B.

However, when assessing the monthly supply change from a high… pic.twitter.com/4Vw02nTEzg

—glassnode (@glassnode) May 13, 2023

Monthly outflow peaked at $8.6 billion as market participants redeemed massively in the wake of algorithmic stablecoin UST (TerraUSD) collapse and Terra (LUNA) shock in May 2022 reached.

A decrease in outflows suggests an increase in demand for crypto assets and an improvement in sentiment.

On the other hand, USD Coin (USDC), the second-ranked US dollar-linked stablecoin that was once prosperous, caused a price divergence (dipeg) due to the bankruptcy of Silicon Valley Bank, which was one of the deposit recipients. Since it was not possible to maintain the 1:1 value against the dollar that should have been maintained, its power has declined significantly since then.

Binance USD (BUSD), which ranks third, also faced a large net outflow due to an order to suspend new issuance by the NY State Department of Financial Services, resulting in Tether (USDT) dominance (market share). is on the rise again.

Tether generated a profit of around $1.5 billion in the first quarter of 2023 and disclosed for the first time its holdings of gold and bitcoin, representing 4% and 2% of its reserves.

connection:Tether reveals gold and bitcoin holdings for the first time

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Rebounds, Net Stablecoin Outflow Trends Down appeared first on Our Bitcoin News.

2 years ago

120

2 years ago

120

English (US) ·

English (US) ·