Macroeconomics and financial markets

On the US New York stock market on the 24th, the Dow Jones Industrial Average closed 48.9 points (0.1%) higher than the previous day, and the Nasdaq index closed 37 points (0.24%) higher than the previous day.

In the Tokyo stock market, the Nikkei average stock price rose 166 yen (0.45%) from the previous day, exceeding the 37,000 yen level.

As Bitcoin (BTC) rose, among U.S. stocks related to crypto assets (virtual currency), Coinbase rebounded sharply, rising 7.8% from the previous day, and MicroStrategy rose 13.6%.

CoinPost app (heat map function)

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

Virtual currency market conditions

In the crypto asset (virtual currency) market, Bitcoin (BTC) rose 3.3% from the previous day to 1 BTC = $46,151.

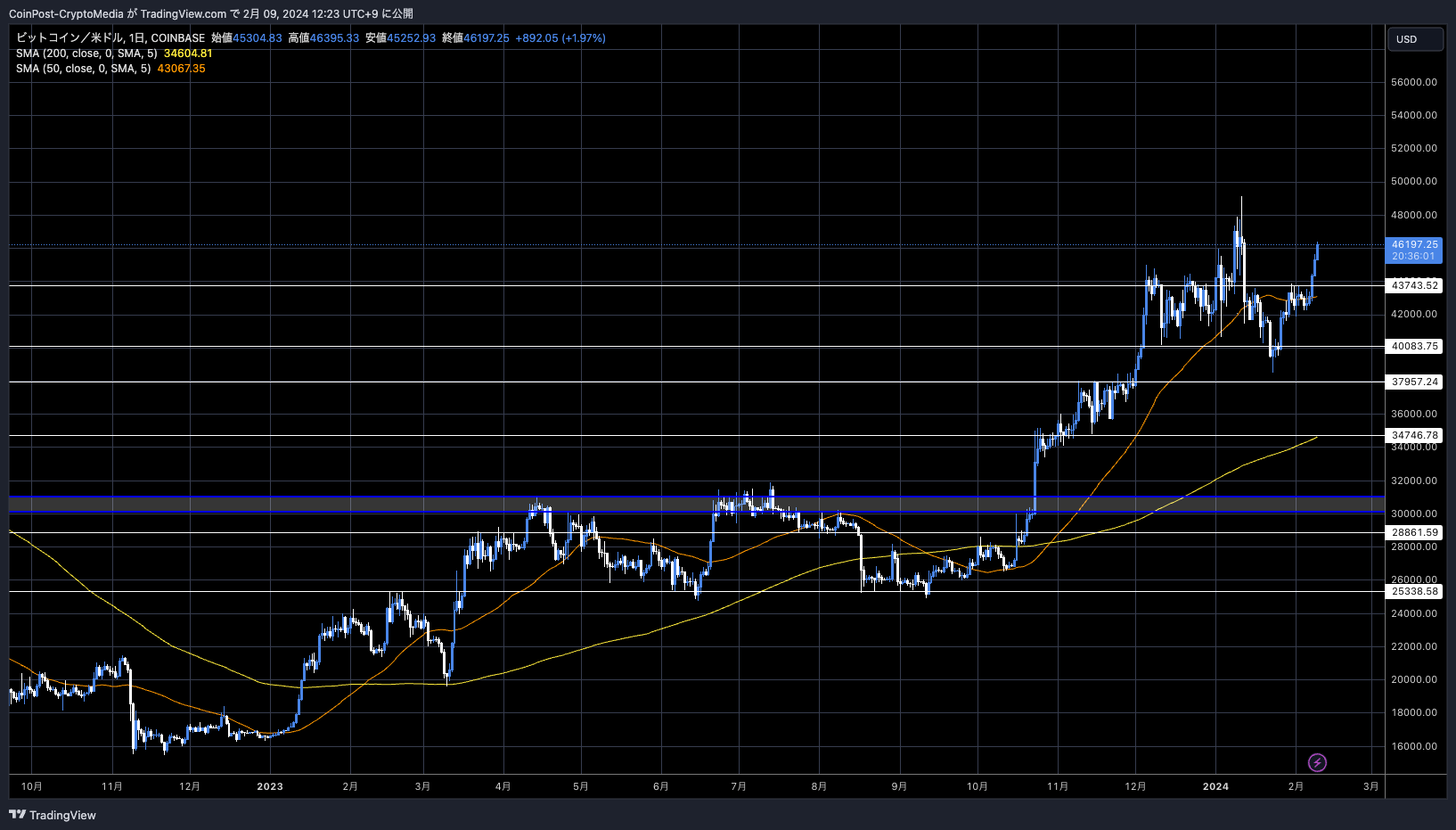

BTC/USD daily

From the opening price of $43,100 on the 6th, it has continued to rise significantly over the past three days, and is now within range of the year-to-date high of $49,100 on January 11th. According to Coinglass, OI (Open Interest) increased by 11.5% in 24 hours to reach $20 billion.

Some point out that the selling of Grayscale's investment trust “Bitcoin Trust (GBTC)'' and the selling of major miners has come to an end, and that the supply and demand balance has begun to reverse.

connection:JP Morgan analysis: Is Grayscale's GBTC profit selling almost over?

Analysts at Bernstein, a major securities alliance, expressed the view that “Bitcoin (BTC) will soar to a level that exceeds the $69,000 level recorded in November 2022 by the end of this year.''

One of the reasons for this is the inflow of funds from institutional investors following the approval of the listing of Bitcoin spot ETFs (exchange traded funds). The growth in Bitcoin wallets holding 1,000 BTC or more has reached its highest level in the past 14 months.

Bitcoin spot ETFs have already attracted $6.6 billion, with BlackRock's IBIT and Fidelity's FBTC attracting over $3 billion and $2.6 billion, respectively. Over the past week, these funds have seen net inflows of 19,000 BTC, which is three times the amount mined and sold by Bitcoin miners over the same period.

Miners have been ramping up production capacity ahead of the halving, scheduled for April, and have been ramping up selling pressure to secure cash reserves. Although he points out that miners with high maintenance costs will reduce production by about 15% after the halving, he expects low-cost, competitive miners such as RIOT to expand their share.

Macroeconomic tailwinds are also expected. If the Federal Reserve begins to cut interest rates, the profitability of the bond market will decline, which will be positive for risky assets such as stocks and Bitcoin (BTC). If there is a change of government in the presidential election, Gensler, chairman of the US SEC (Securities and Exchange Commission), who maintains a strict stance on crypto assets, is expected to resign, which could lead to a rebound in crypto currencies.

Meanwhile, Chairman Gensler has indicated that he intends to continue in his role as SEC Chairman if President Joe Biden is re-elected for a second term.

Related: Points to note about virtual currency IEOs Domestic and international examples and how to participate

altcoin market

Solana (SOL) rose 2.2% from the previous day, recovering the $100 level.

On-chain analysis firm Santiment said that the sudden drop in SOL during the large-scale failure that occurred on the 6th may have resulted in the formation of a local bottom.

#Solana is one of the few #altcoins outperforming #Bitcoin this week, surging back above $102. In the past 36 hours, $SOL / $BTC is +4.5%. The outage that concerned traders Monday ended up being a local bottom, with the #FUD fueling this price rebound. https://t.co/lUC0DBS5B3 pic.twitter.com/1NTk5R4QBj

#Solana is one of the few #altcoins outperforming #Bitcoin this week, surging back above $102. In the past 36 hours, $SOL / $BTC is +4.5%. The outage that concerned traders Monday ended up being a local bottom, with the #FUD fueling this price rebound. https://t.co/lUC0DBS5B3 pic.twitter.com/1NTk5R4QBj

— Santiment (@santimentfeed) February 8, 2024

In the past 36 hours, it has outperformed Bitcoin, gaining +4.5% in Bitcoin terms. According to CoinGlass data, 24-hour trading volume increased by 82% and open interest increased by 7% to the $1.5 billion level.

Exchange traded products (ETPs) that provide exposure to Solana (SOL) have seen $3 million in inflows over the past week.

On the 7th, the UAE's international financial center, Abu Dhabi Global Market (ADGM), announced the growth of Abu Dhabi's blockchain and Web3 ecosystem, strengthening solutions in distributed ledger technology and driving blockchain innovation. For this reason, we have announced a memorandum of understanding (MOU) with the Solana Foundation.

I spent the day with the @ADGlobalMarket leadership, and have come away with great optimism about their progressive, consultative approach to regulation.

I am excited to share that we are collaborating with Abu Dhabi Global Markets to support ecosystem teams in accessing the… pic.twitter.com/MZHEKOKtEm

— Lily Liu (@calilyliu) February 7, 2024

connection:Solana Foundation partners with UAE Abu Dhabi to advance blockchain innovation and regulation

Related: Explaining the advantages of staking and accumulation services and the benefits of virtual currency exchange “SBI VC Trade”

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin recovers rapidly and returns to the $46,000 level, approaching the high price before ETF approval appeared first on Our Bitcoin News.

1 year ago

115

1 year ago

115

English (US) ·

English (US) ·