Bitcoin (BTC) began trading slightly higher, at one point trading above $41,000. Ethereum (ETH) also rose slightly, trading above $2,100.

(CoinDesk Indicies)

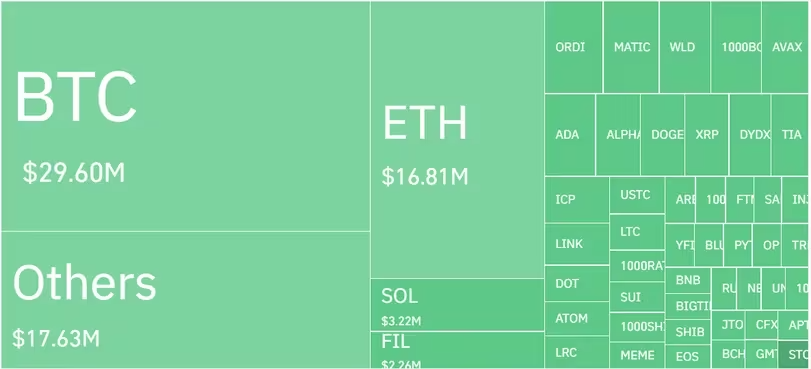

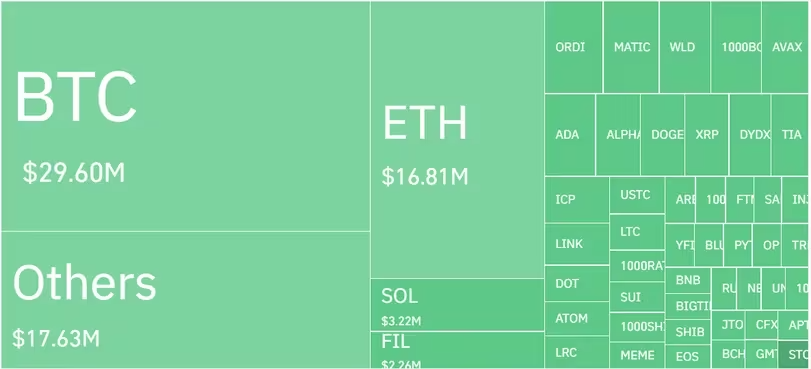

(CoinDesk Indicies)According to Coinglass data, there was $103.5 million (about 14.5 billion yen, exchange rate of 1 dollar = 140 yen) in token tracking futures liquidations in the past 12 hours, of which $95 million (about 13.3 billion yen) was long, that is, the price It was a bet that it would go up. Of the total liquidation amount of $103.5 million, $33 million (approximately 4.6 billion yen) was settled in Bitcoin, of which $29 million (approximately 4 billion yen) was a long position.

(Coinglass)

(Coinglass)Lucy Hu, senior analyst at Hong Kong-based digital asset management firm Metalpha, said that despite the recent Ledger hack, the overall market continues to hold up very well, and that interest rate cuts are unlikely. He says things like Ordinals are increasing interest in Bitcoin.

“The massive Ledger hack has shaken sentiment in the decentralized finance (DeFi) space and raised important questions about wallet security,” Fu said. “Meanwhile, the stellar rise in Bitcoin Ordinals continues to fuel the enthusiasm of Bitcoin miners, who are being rewarded handsomely. We expect Bitcoin’s long-term growth momentum to take hold.” ”.

Still, the forecast is optimistic

Despite Bitcoin’s current correction, year-end forecasts for 2024-2025 remain optimistic, especially when compared to last year’s forecast of $10,000 to $12,000 for Bitcoin. .

In its recent year-end report, Woo Network set a price target for BTC of $75,000 in “early 2024.” Bitwise has a similar price target, predicting Bitcoin to trade above $80,000.

“The Bitcoin ETF has been approved and will be the most successful ETF launch in history,” Bitwise predicts. “Coinbase’s revenue will double and exceed Wall Street expectations by at least 10 times.”

Layer 1 fees skyrocket

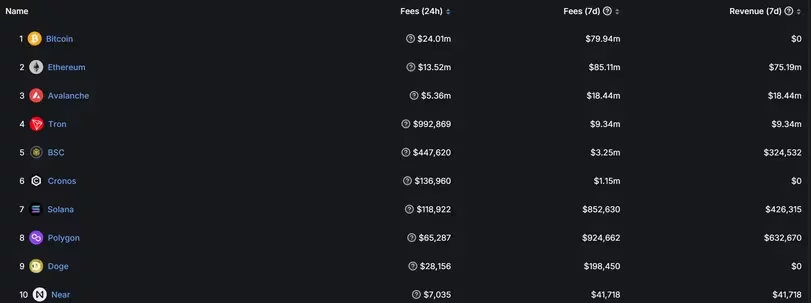

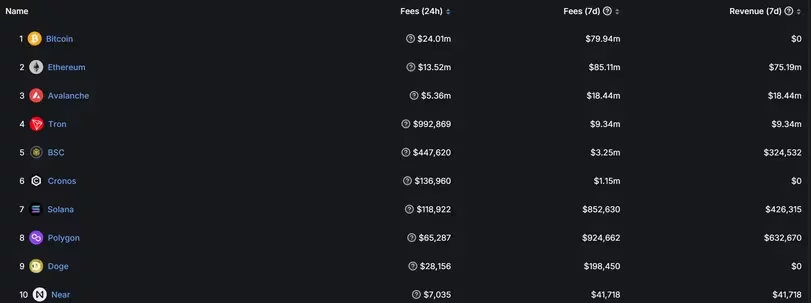

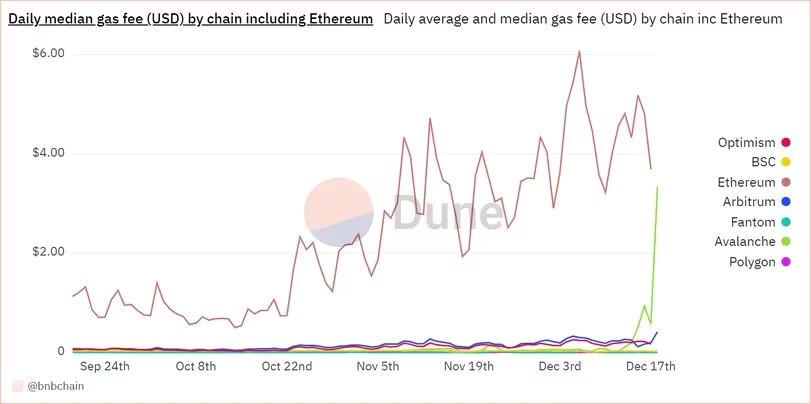

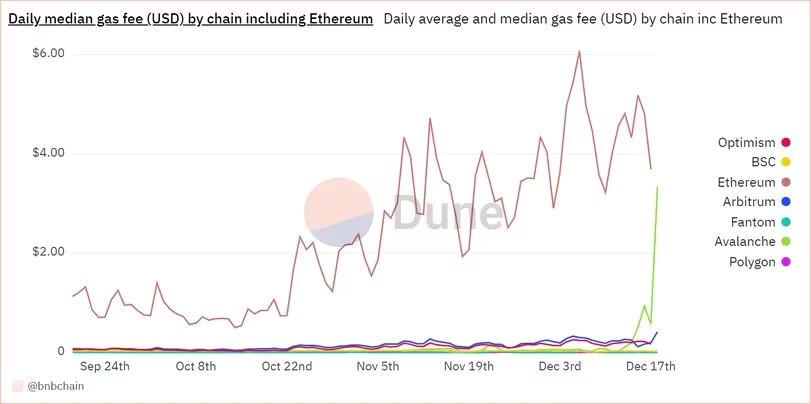

dozens of typesNew meme coins flood the marketMeanwhile, gas fees (fees) are skyrocketing in many layer 1 chains such as Ethereum and Avalanche.

(Coingecko)

(Coingecko)Avalanche generated $5 million in fees in the past 24 hours, while Ethereum, which has the largest market capitalization by far, generated $13.52 million in fees.

Arbitrum and Optimism also saw big spikes in fees last week.

(Dune)

(Dune)Some of these Layer 1 network tokens fell faster than Bitcoin and Ethereum, with Avalanche (AVAX) down 6% and Solana (SOL) down 4%.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: CoinDesk Indicies

|Original text: Bitcoin Hovers Over $41K as Memecoin, Ordinals Frenzy Clogs up Blockchains

The post Bitcoin remains above $40,000 – Blockchain is booming with meme coins and Ordinals | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

112

1 year ago

112

English (US) ·

English (US) ·