Macroeconomics and financial markets

On the US New York stock market on the 24th, the Dow Jones Industrial Average fell 56.6 points (0.16%) from the previous day, and the Nasdaq index fell 9.8 points (0.06%), ending the day’s rise.

Among crypto-asset (virtual currency)-related stocks, the stock price of Coinbase in the US has recovered to an 18-month high of $119.7, following the resignation of CEO Changpeng Zhao of Binance, the largest crypto-asset (virtual currency) exchange. This is due to market expectations that while customers will continue to outflow Binance, competitors are expected to regain market share.

However, compared to the peak price of $343 in November 2021, which was the peak of the bull market, it remains below half the price, and it is expected that it will be influenced by the future market environment of crypto assets such as Bitcoin (BTC).

Coinbase stock plummeted in June this year after being sued by the U.S. SEC (Securities and Exchange Commission) for violating U.S. securities laws, but since then, the price of BTC has soared on the back of expectations for the approval of a Bitcoin ETF (exchange traded fund). There was a big backlash.

connection:U.S. online spending on Black Friday hits record high; focus on personal consumption data this week | 28th Financial Tankan

connection:Stock investment recommended for virtual currency investors, “10 representative virtual currency stocks in Japan and the United States”

Virtual currency market conditions

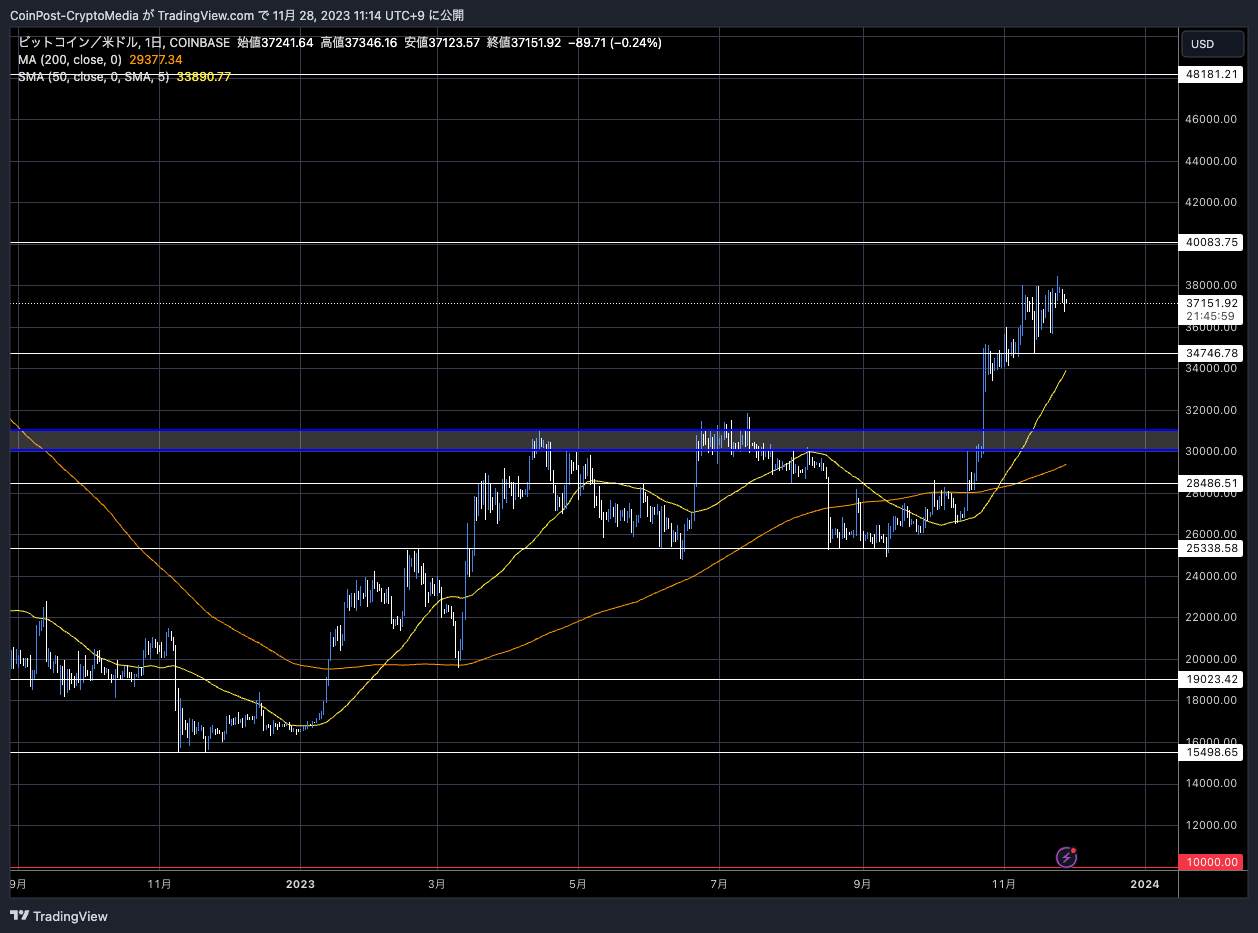

In the crypto asset (virtual currency) market, the Bitcoin price fell 0.88% from the previous day to 1 BTC = $ 37,157.

BTC/USD daily

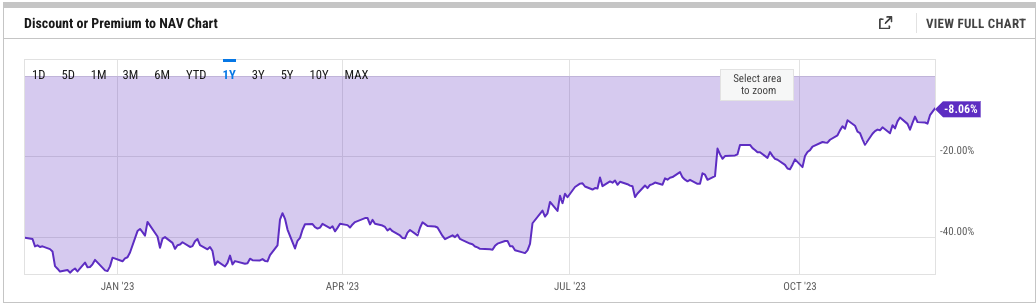

The Grayscale Bitcoin Trust (GBTC) investment fund is expected to win in court with the US SEC (Securities and Exchange Commission), and as the market’s optimistic view of Bitcoin ETFs (Exchange Traded Funds) grows. The market price deviation (discount) has narrowed to the -8% range.

GBTC divergence

In December 2022, after FTX went bankrupt, there were instances where the negative deviation reached nearly -50%.

connection:Ark’s Bitcoin strategy is also successful as GBTC’s negative deviation reaches single digits

While there is optimism that Binance’s resolution will speed up the approval process for Bitcoin exchange-traded funds (ETFs), the US Securities and Exchange Commission (SEC) investigation into Binance reveals market manipulation and other fraud. There are pessimistic views that if the act is revealed, the approval of physical Bitcoin and Ethereum ETFs may be delayed.

On-chain analysis company Santiment analyzed the impact of stablecoins on the recent rise in Bitcoin prices.

From August 19th to October 16th, 3.54% of #Tether‘s entire supply, and 0.72% of #USDCoin‘s entire supply moved to exchanges. These transfers were the predecessor to the #crypto-wide rally from late October to mid-November. After a cooldown, $USDT & $USDC returning

From August 19th to October 16th, 3.54% of #Tether‘s entire supply, and 0.72% of #USDCoin‘s entire supply moved to exchanges. These transfers were the predecessor to the #crypto-wide rally from late October to mid-November. After a cooldown, $USDT & $USDC returning

(cont) pic.twitter.com/wXJpnQoYxb

— Santiment (@santimentfeed) November 26, 2023

From August 19th to October 16th, 3.54% of the total supply of Tether (USDT) and 0.72% of the total supply of USDC were transferred to crypto exchanges. This suggests that he bought virtual currencies such as Bitcoin (BTC) using funds stored in Metamask etc.

According to crypto asset (virtual currency) analyst Ali, about 25,000 BTC worth $1 billion has been withdrawn from crypto asset exchanges in the past two weeks, and transferred to cold wallets etc. with the assumption of long-term holding. This suggests a bullish accumulation pattern.

#Bitcoin | Around 25,000 $BTC have been withdrawn from known #crypto exchange wallets in the last two weeks, worth nearly $1 billion! pic.twitter.com/RLwV3iOR7b

— Ali (@ali_charts) November 25, 2023

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

altcoin market

The overheated alt market is expected to subside, as selling pressure is expected to increase in several major alts from early December due to large-scale token unlocking by venture capital firms (VCs) and early investors. spurred on.

Top 7 Biggest Token Unlocks in the Next 7 Days

Monitoring of vested tokens and future unlock events is an important step to make more cautious and, in the end, better trading decisions. Let’s take a look at this and some other biggest unlocks coming in the next 7 days, including… pic.twitter.com/BU4CYzquoe

— TOP 7 ICO | #StandWithUkraine (@top7ico) November 27, 2023

(@top7ico) November 27, 2023

Including dYdX (DYDX), which will unlock $480 million worth 71 billion yen, Immutable X (IMX) worth $50 million, Optimism (OP) $41.5 million, Sui (SUI) $40.9 million, and 1inch (1INCH). Includes $33.7 million.

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

Click here for a list of past market reports

The post Bitcoin remains at $37,000 level, weak altcoin market warns of large-scale unlocking appeared first on Our Bitcoin News.

1 year ago

113

1 year ago

113

English (US) ·

English (US) ·