Virtual currency market this week from 4/22 (Sat) to 4/28 (Fri)

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 4/22 (Sat) to 4/28 (Fri):

The Bitcoin (BTC) exchange rate against the yen this week has been showing a rough price movement for a while, but it is still stable and is expected to recover by 4 million yen.

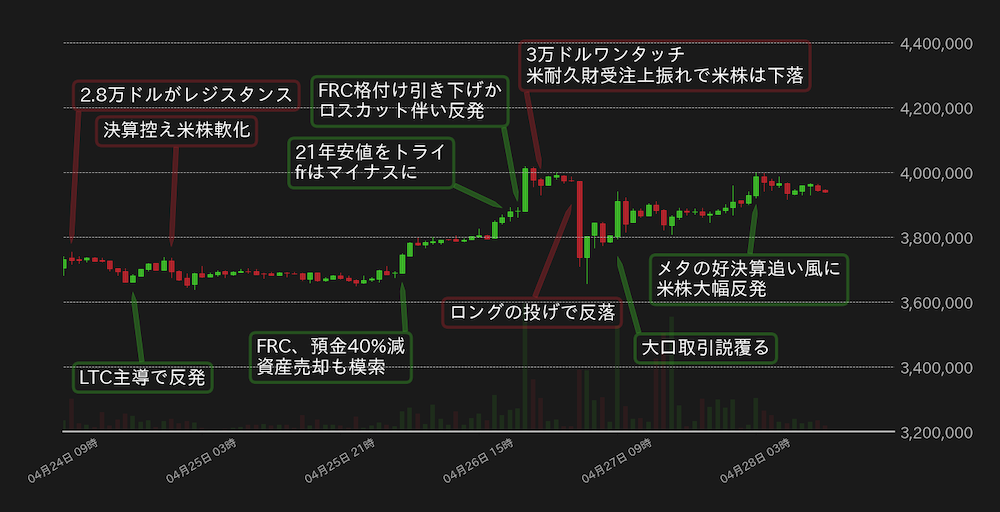

At the beginning of the week, the BTC market continued to struggle around 3.7 million yen. , it was reported that BTC was looking to sell its assets, and BTC turned to follow the upside when the financial turmoil in March was recalled.

When the BTC market price on the 26th returned to the low price of 2021 in dollars, the funding rate (fr) in the BTC perpetual futures market turned negative and short positions increased.

Then, reports rolled in that the US financial regulators were considering lowering the Fed’s rating, and BTC temporarily recovered 4 million yen with a short loss cut. However, when it stops rising at the same level as the milestone $30,000 in dollar terms, the drop in US stocks due to the upswing in US durable goods orders weighs on the BTC market, and this time it plunges with a long throw. I played and canceled the increase.

On the other hand, on this day, based on Arkham’s information, information was circulated on Twitter that the US government and Mt.Gox wallets were trading BTC. By pointing out the error in the information, BTC tried to return from a sense of relief.

On the 27th, buying in the IT and communication technology sectors was driven by the positive results of Meta (former Facebook) on the previous day, and the US stock index rebounded sharply. BTC rose in line with this and returned to around 4 million yen.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

BTC has reached the milestone level of 4 million yen in yen and 30,000 dollars in dollar, but the US economic indicators announced this week are slightly ahead of next week’s US Federal Open Market Committee (FOMC). The result was a cause for concern.

Preliminary gross domestic product (GDP) growth slowed to 1.1% in the first quarter from 2.6% in the previous quarter, but headline and core personal consumption expenditure (PCE) price indexes accelerated from the previous quarter in the same period. bottom.

Although there are some signs of a slowdown in the economy itself, with regard to price indicators, the core consumer price index (CPI) also accelerated in March from the previous month, and there are no significant results in the slowdown in the rate of inflation. in the process of.

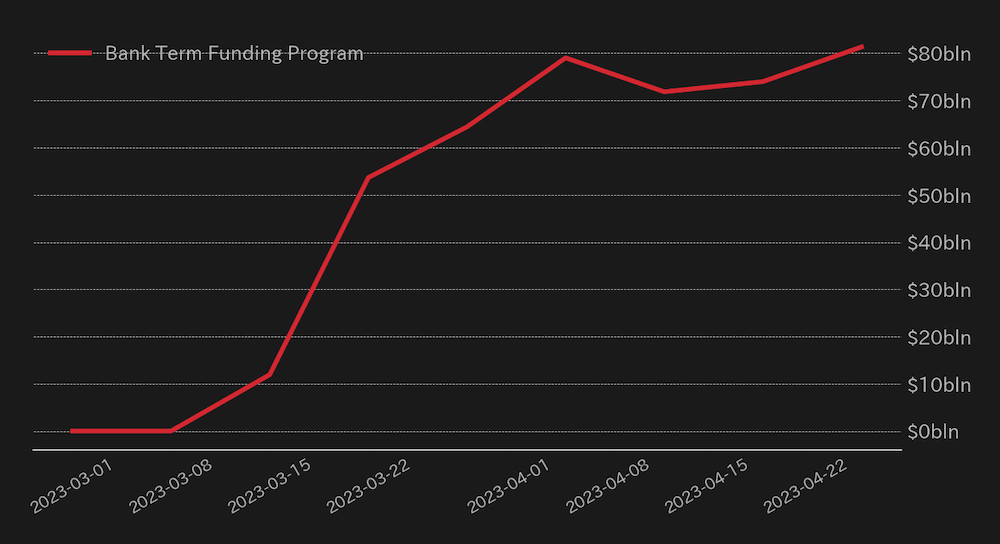

However, as the financial difficulties of the FRC have surfaced, the possibility of the US Federal Reserve Board (FRB) showing consideration for the financial sector is zero. In fact, the amount of loans to U.S. banks through the Bank Term Funding Program, an emergency lending facility established by the Federal Reserve in March, is increasing, and it can be said that the source of financial instability is still smoldering (Figure 2). .

The March FOMC’s economic outlook indicated that the rate hike in May might be the last. The results are extremely difficult to predict. Given this, it has been pointed out that there is a good chance that the FOMC will refrain from making a clear statement about halting interest rate hikes at next week’s FOMC, leaving the options for action at the FOMC in June.

[Fig. 2: Usage of the Bank Term Funding Program (data as of Wednesday)]Source: Created from FRED

connection:bitbank_markets official website

Last report:Bitcoin Breaks Out of 2021 Lows, Next Week Could Be Lacking Clues

The post Bitcoin remains solid, May FOMC may be a headwind | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

132

2 years ago

132

English (US) ·

English (US) ·