Macroeconomics and financial markets

In the US NY stock market on the 13th, the Dow closed at $90 (0.3%) lower than the previous day and the Nasdaq at $49 (0.45%) higher.

Selling led mainly to bank stocks, and the stock price of First Republic Bank, a commercial bank based in San Francisco, California, plunged 67% from the previous day. Regional banks have fallen sharply across the board.

The US Federal Reserve Board (FRB) and JPMorgan Chase announced that they would secure an additional credit facility of $70 billion (about 9.4 trillion yen), but due to credit concerns and investors rushing to reduce portfolio exposure It looked like panic selling.

It has been pointed out that liquidity is being withdrawn from the stock market at an accelerated rate, and funds are being transferred to the highly safe US Treasuries. Both long-term and short-term government bond yields fell due to the view that the Fed (Federal Reserve System)’s monetary policy will also be affected.

On the other hand, crypto-asset-related stocks, which had been on a downward trend recently, rebounded sharply in response to the rebound in Bitcoin. Coinbase, the largest exchange in the United States, rose 10.7% from the previous day, Micro Strategy, which holds a large amount of BTC, rose 16.22%, and mining-related stocks such as Riot and Marathon Digital soared.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 9.19% from the previous day to $24,416.

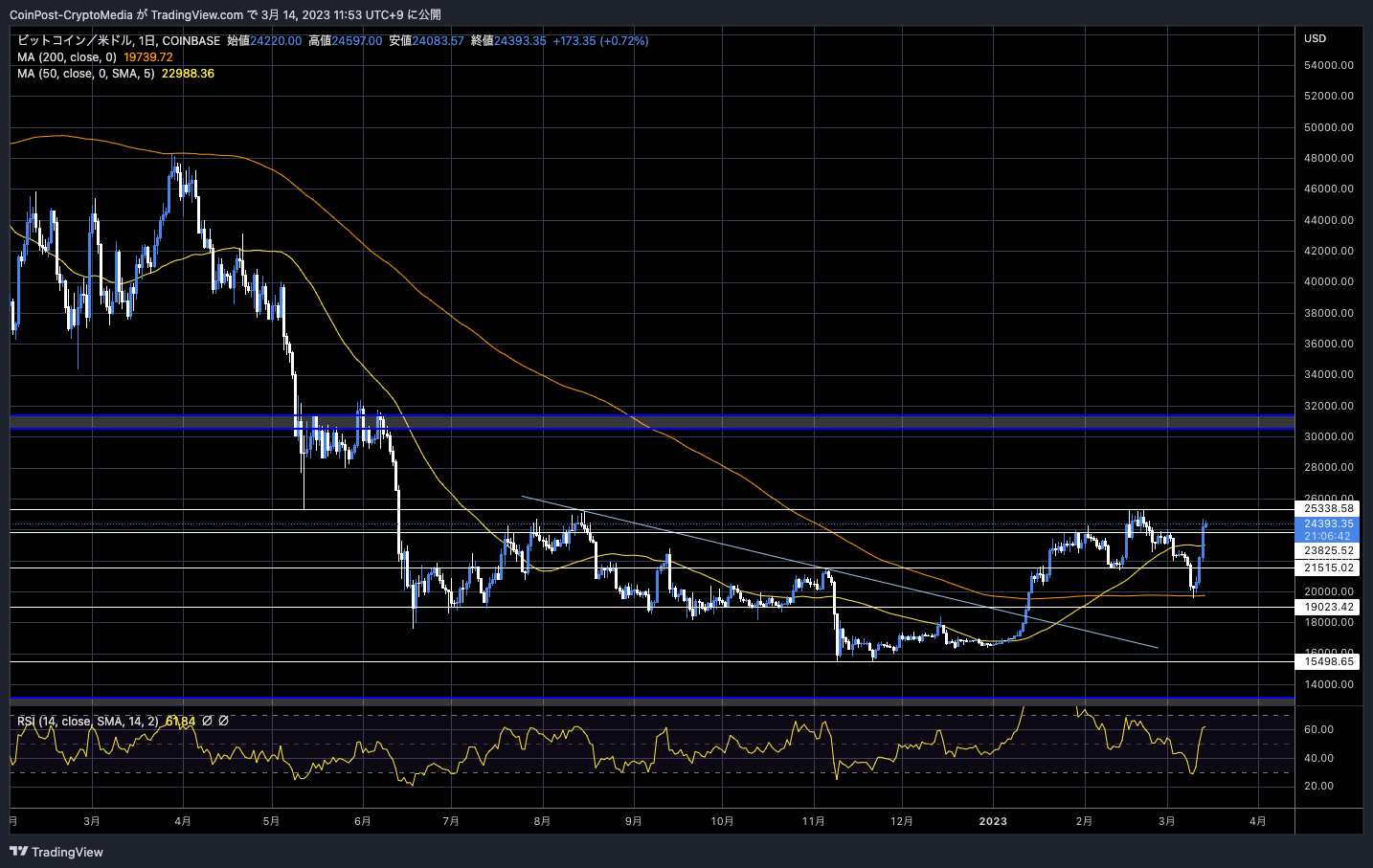

BTC/USD daily

The price has rebounded to close to the recent high of $25,256 in mid-February. Rising factors include receding fears of Silicon Valley Bank (SVB) bankruptcy and USDC collapse risk and positive news for Binance.

Changpong Zhao (CZ), CEO of Binance, said on the 13th that about $ 1 billion (about 133 billion yen) of unused money of the “Recovery Initiative Fund” will be converted from the stable coin “BUSD” to Bitcoin (BTC) and Ethereum (ETH). ), which translates to Build and Build (BNB).

Given the changes in stable coins and banks, #Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund movements will occur on-chain. Transparency.

— CZ  Binance (@cz_binance) March 13, 2023

Binance (@cz_binance) March 13, 2023

The recovery fund is a fund established by Binance to support companies that were in trouble after the FTX bankruptcy in November 2022. CZ decided to convert the change in the situation surrounding banks and stable coins, bearing in mind that a series of bank failures had an impact on USD Coin (USDC) issued by Circle, etc. mentioned.

Last weekend, the USDC, which is designed to track the value of the US dollar at a 1:1 rate, was flooded with selling when it was reported that $3.3 billion of its reserves could not be withdrawn from Silicon Valley banks. It caused a sharp dipeg (price divergence) and caused market turmoil.

According to CZ, the transaction for the transaction, which involved transferring about $1 billion, was completed in 15 seconds and the transfer cost was only $1.29. “Imagine moving $980 million out of your bank before business hours on Monday,” he said. We compared the risks that depend on bank business hours, the complexity of procedures, the cost of transaction time and fees, and emphasized the unique advantages of crypto assets (virtual currencies).

The risk-off in the financial markets is due to the bankruptcy of Silicon Valley Bank (SVB), which provided loans mainly to start-up companies. Total assets as of the end of December 2022 reached about $ 210 billion (about 28 trillion yen), making it the largest bank failure since the 2008 financial crisis.

The FRB (Federal Reserve System)’s rapid interest rate hikes swelled bond investment losses, and startup funding costs increased, leading to a series of withdrawals of funds from the SVB. ) is thought to be the cause.

In response to this, the US financial authorities announced that they would set up an “Emergency Loan Facility (BTFP)” for financial institutions out of concern that it could develop into a serious “financial crisis” if left unchecked. Introduced full deposit protection measures.

The U.S. Federal Deposit Insurance Corporation (FDIC) protection limit is only $250,000 per account, and about 90% of all SVB deposits were not covered, which also accelerated panic withdrawals. There is

connection:Circle CEO Emphasizes Safety of USDC Reserve Stablecoin

Expectations of another expansion of interest rate hikes have receded significantly

In response to this situation, major financial groups such as Goldman Sachs and Barclays changed their forecasts to keep interest rates unchanged (suspend interest rate hikes) at the US Federal Open Market Committee (FOMC) meeting in March. Economists at Nomura Securities International Inc., a U.S. subsidiary of Nomura Securities, have gone further, predicting a 25 basis point rate cut and the end of quantitative tightening (QT).

Until a week ago, more than 80% of the interest rate futures market was expecting a 50bp rate hike, but the situation has changed as the financial crisis scenario became more likely due to the bankruptcy of Silicon Valley Bank. The turmoil in the traditional financial markets (concern about the financial crisis) and the receding of speculation about tightening monetary policy are expected to have a positive effect on the Bitcoin market as an alternative asset, leading to buybacks.

In the financial crisis Cyprus shock that occurred in March 2013, Bitcoin, which was singled out as an alternative asset, soared. It was later called “Digital Gold”.

Ten years ago this week, there was a bank run in Cyprus, where ATMs were emptied and vaults were depleted. This event triggered the largest-ever rally (in percentage terms) in BTC, which rallied from $45 to $260 in a month.

—Cumberland (@CumberlandSays) March 13, 2023

At 21:30 today, the CPI (Consumer Price Index), an important inflation indicator, is scheduled to be released, and depending on the figures, the FRB (Federal Reserve System) will have an impact on monetary policy decisions. In any case, the next meeting of the Federal Open Market Committee (FOMC) is likely to be an extremely difficult decision to make.

CME FedWatch Tool

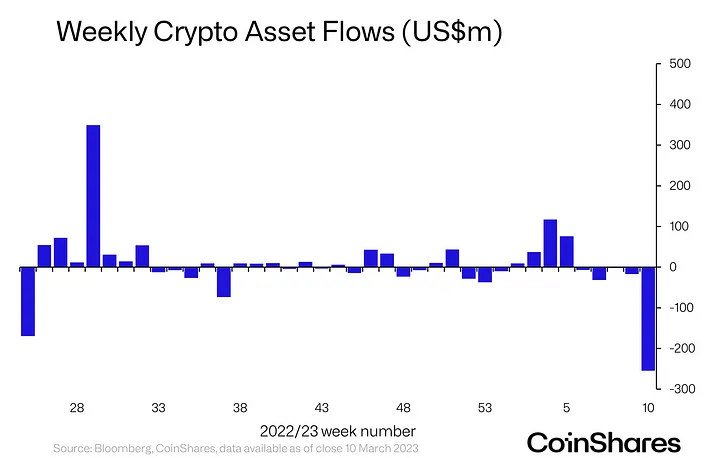

According to the weekly report of CoinShares, an asset management company, the outflow of funds from institutional investors to digital assets such as crypto asset (virtual currency) investment trusts has reached a record high of $255 million compared to the previous week. became.

CoinShares

The bankruptcies of Silvergate Bank and Silicon Valley Bank caused a deterioration in investor sentiment. The outflow amount is equivalent to 1.0% of the investment product “Total Assets Under Management (AuM)”.

In terms of amount, this is the largest ever, but compared to AuM, a 1.9% outflow of funds was observed in May 2019. At that time, 7,000 BTC (about 4.5 billion yen) of hacking damage occurred on Binance, which was compensated by the SAFU fund (Secure Asset Fund for Users).

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin returns to the $24,500 level due to significant growth, and predictions of “suspension of interest rate hikes” due to major bank failures appeared first on Our Bitcoin News.

2 years ago

194

2 years ago

194

English (US) ·

English (US) ·