Macroeconomics and financial markets

The US stock market on the 19th is a holiday of Emancipation Day.

In the Tokyo stock market, while the US market was closed and there was a lack of clues, profit-taking sales were dominant as the opening began to fall due to the decline in European stocks.

In terms of individual stocks, semiconductor-related stocks, which had soared against the backdrop of the AI (artificial intelligence) boom such as ChatGPT, stopped rising, but Berkshire Hathaway, led by the famous US investor Warren Buffett, revealed that it would increase its purchases (increase its shareholding ratio). Stocks of the five major trading companies rose across the board.

Berkshire has suggested the possibility of increasing its stake to a maximum of 9.9%, and it was also well received that it is for long-term holding purposes.

connection:Buffett’s Berkshire to increase stake in Japan’s five largest trading companies

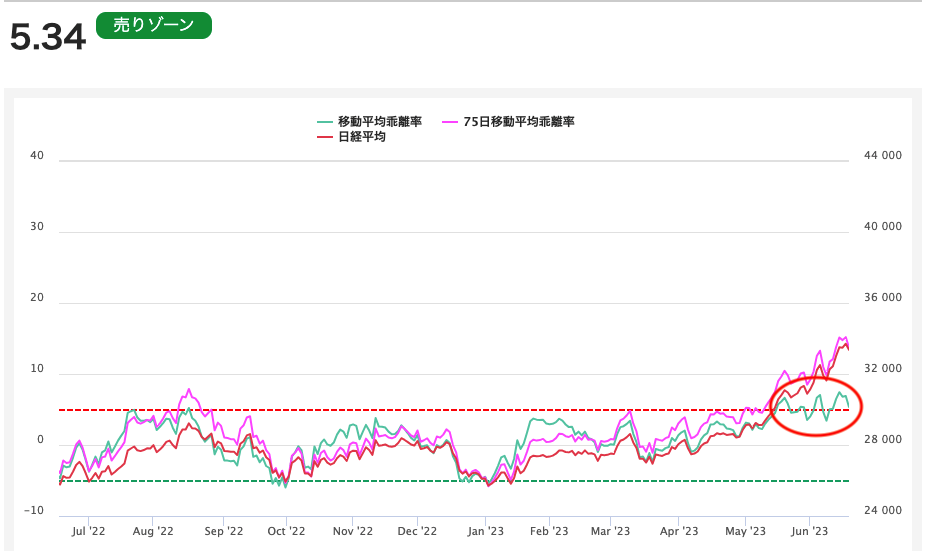

While the Nikkei Stock Average reached its highest level since the collapse of the bubble economy for the first time in 32 years, the deviation rate from the moving average line (25th) has remained at an overheating level of over 5%, which is regarded as a sell signal. It reached 7.44% on the 14th.

forest of investment

Bloomberg reported on the 16th that JP Morgan expects a -5% correction in the stock price to come if the biggest rebalancing flow since the fourth quarter of 2021 occurs as a result of soaring stock prices. there is

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.7% from the previous day to 1 BTC = $ 26,895.

BTC/USD daily

Bitcoin (BTC), which had been at an oversold level, is rebounding due to the application of “Bitcoin ETF” by BlackRock, the largest asset management company.

As with the beginning of the year, the majority of the market is skeptical about the market outlook. There is also a view that the sharp drop in the market accompanied by loss cuts has resulted in the reduction of supply and demand.

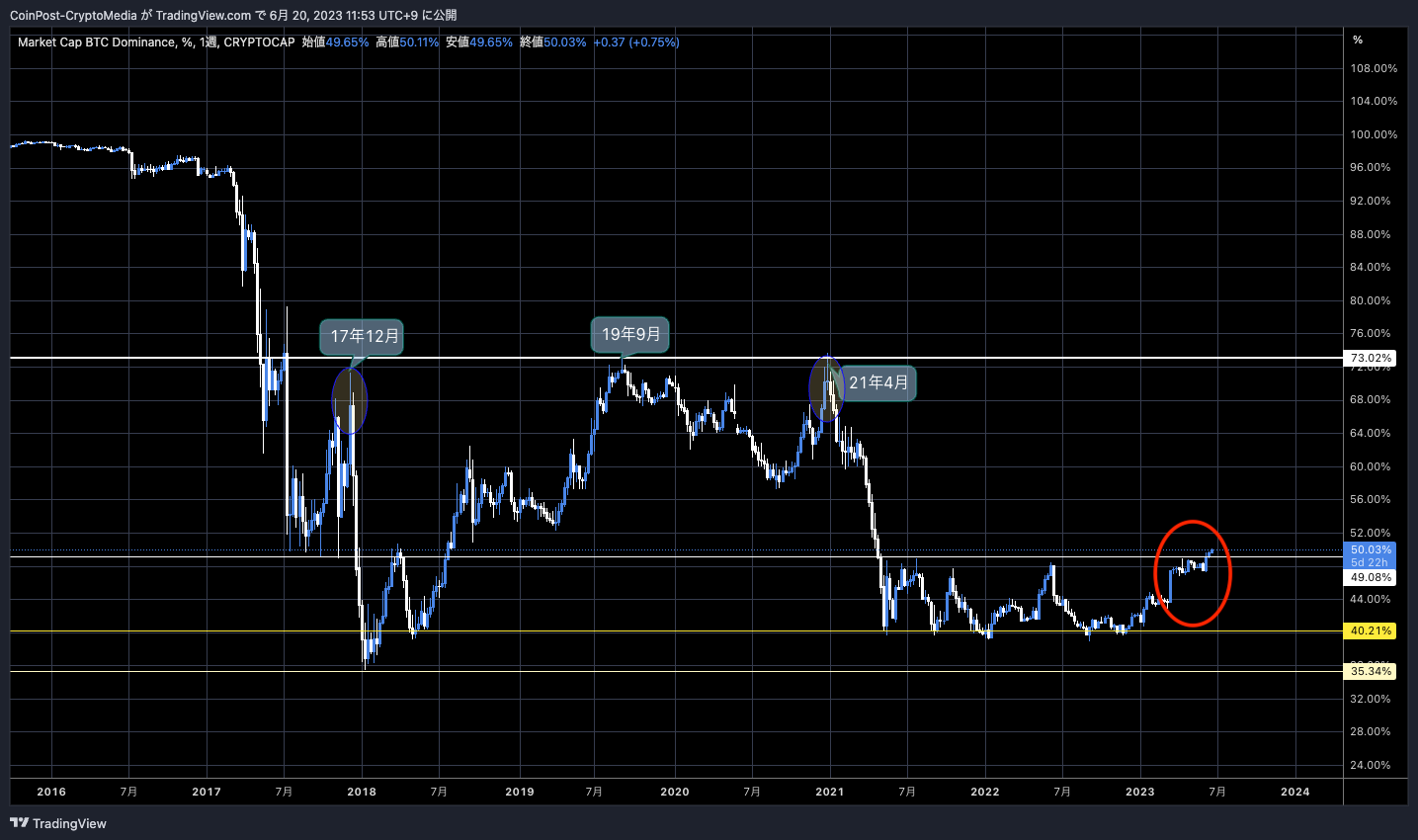

Bitcoin dominance, which indicates the market share of virtual currencies, has exceeded the 50% level for the first time in about two years since May 2021.

Bitcoin Dominance Weekly

In past market cycles, there was a period in 2018-2019 after the burst of the cryptocurrency bubble 2017, when Bitcoin attracted funds and its dominance surged.

Due to the bankruptcy of major exchange FTX in November last year and the filing of a lawsuit against Binance by the US SEC (Securities and Exchange Commission), many altcoins were designated as securities. Evacuation funds flowed into the coin.

In addition, recently, stable coins such as USDC and Tether (USDT), which are backed by the US dollar at a 1:1 ratio, have become stable as alternative assets and reserve assets, such as dipeg (price divergence) occurring every time. Gender is beginning to be questioned.

In March of this year, it was revealed that Circle, which issues stablecoin USDC, had deposited part of its reserves with the bankrupt Silicon Valley Bank, causing a large-scale dipeg due to credit concerns. When 1USDC = $1.00 needed to be maintained, 1USDC = $0.82 at one point.

In addition, Binance USD (BUSD), which held the third largest share of stablecoins last year, has been issued by the New York State Department of Financial Services (NYDFS), claiming that the SEC (U.S. Securities and Exchange Commission) is an unregistered security. The company Paxos was ordered to suspend new issuance of BUSD, and its market share dropped sharply.

In this regard, Michael Thaler, CEO of MicroStrategy, which owns a large amount of bitcoin, said, “The clarification of regulations will ease the barriers to entry for institutional investors. It will become more and more solid,” he said.

Regulatory clarity is going to drive #Bitcoin adoption by eliminating the confusion & anxiety that has been holding back institutional investors. Bitcoin dominance will continue to grow as the #Crypto industry rationalizes around $BTC and goes mainstream. pic.twitter.com/Foq4lpderj

— Michael Saylor (@saylor) June 13, 2023

(@saylor) June 13, 2023

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Reversal Offensive, Dominance Exceeds 50% Level for First Time in 2 Years appeared first on Our Bitcoin News.

1 year ago

179

1 year ago

179

English (US) ·

English (US) ·