Bitcoin (BTC) has recorded a price increase of more than 20% since June 15th. This euphoric bull market may now routinely take a breather.

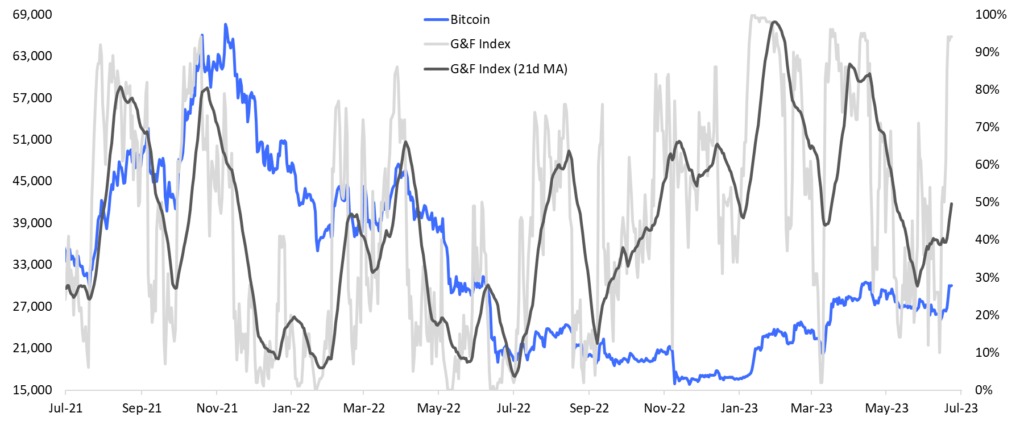

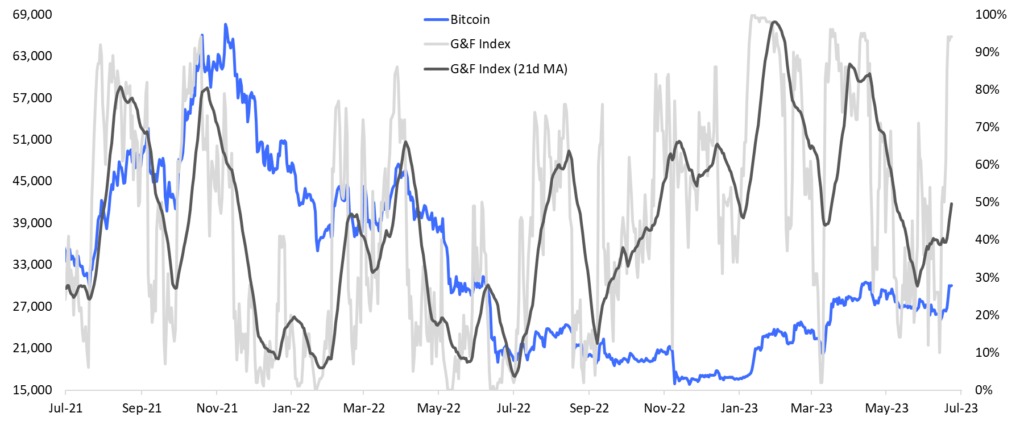

This is a message from Matrixport’s Bitcoin Greed & Fear Index (GFI), a crypto asset (virtual currency) service provider.

The index seeks to track market sentiment, with numbers above 90% indicating greed or excessive optimism and numbers below 10% indicating extreme fear or pessimism.

“Our Bitcoin Greed & Fear index reached euphoric levels in record time. Short-term traders are encouraged to take profits,” said Markus Thielen, Head of Research and Strategy at Matrixport. said in an email.

GFI’s 21-day SMA shows there is room to move higher even after the current euphoria wears off. (Matrixport)

GFI’s 21-day SMA shows there is room to move higher even after the current euphoria wears off. (Matrixport)Historically, numbers above 90% have coincided with an intermediate peak in Bitcoin price, while numbers below 10% have portended subsequent price increases.

The 21-day simple moving average (SMA) of the index is far from 90%, which means Bitcoin’s path of least resistance is still on the high side.

“The fact that the 21-day moving average (black line) is still rising suggests that the Bitcoin price could rise further after the current phase of elevated momentum tapers off due to some consolidation. It suggests that,” Thielen added.

Some chart analysts are suggesting a possible rally above $35,000.

“BTC price has bounced back in the throwback area, completing the set-up of the falling wedge. We have both the previous reversed head and shoulders target zone and the new folding wedge target zone, plus an overhead near $38,000. There is pivot resistance,” market analyst Josh Olszewicz told CoinDesk.

“Therefore, we expect Bitcoin to attempt a move towards the mid-$30,000 range after going through heavy resistance and recalibration,” added Olsevich.

(Matrixport)

(Matrixport)Bitcoin’s pullback from mid-April highs of $31,000 to $25,200, a former resistance-turned-support in early June, represents a “throwback.” This pattern often accelerates price increases, as in the last few days.

Bitcoin was trading at $30,650 at the time of writing, according to CoinDesk data.

The second-largest cryptocurrency by market capitalization, Ethereum (ETH), is up 15.9% since June 15, trailing Bitcoin by a wide margin. Ethereum’s GFI index has yet to hit 90% and could continue to climb while Bitcoin takes a breather.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Matrixport

|Original: Matrixport’s Bitcoin Greed & Fear Index Surpasses 90%, Suggests Bull Breather Ahead

The post Bitcoin Rise Pauses ─ Greed & Fear Index Exceeds 90% | CoinDesk JAPAN appeared first on Our Bitcoin News.

2 years ago

84

2 years ago

84

English (US) ·

English (US) ·