Macroeconomics and financial markets

In the US NY stock market on the 22nd, the Dow Jones Industrial Average fell 4.8 dollars (0.01%) from the previous day, and the Nasdaq Index closed 128 points (0.95%) higher.

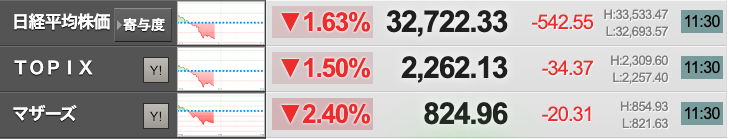

On the Tokyo stock market, the Nikkei Stock Average fell sharply by 542 yen (1.63%) from the previous day.

Source: nikkei225jp.com

The stock price has risen steadily, such as renewing the high price after the collapse of the bubble economy for the first time in 32 years, and in the “Stock Trading Status by Investment Category” announced by the Tokyo Stock Exchange, overseas investors have been driving the market with net purchases for 12 consecutive weeks. The net purchase amount reached 6 trillion yen, which was the highest level since “Abenomics” in 2012, but the moving average deviation rate (25th) exceeded +5%, and the feeling of overheating was intensifying.

In the first half of the day, the growth market and the Mothers index, which is centered on emerging markets, continued to fall sharply, while semiconductor stocks and trading company stocks, which had been soaring, also took the lead in taking profits.

connection:NY Dow flat, virtual currency-related stocks slightly lower, Bank of England raises unexpected interest rate | 23rd Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price fell 0.89% from the previous day to 1 BTC = $ 29,983. Among the top altcoins by market capitalization, Ethereum (ETH) fell 2.07% from the previous day and XRP fell 3.72%.

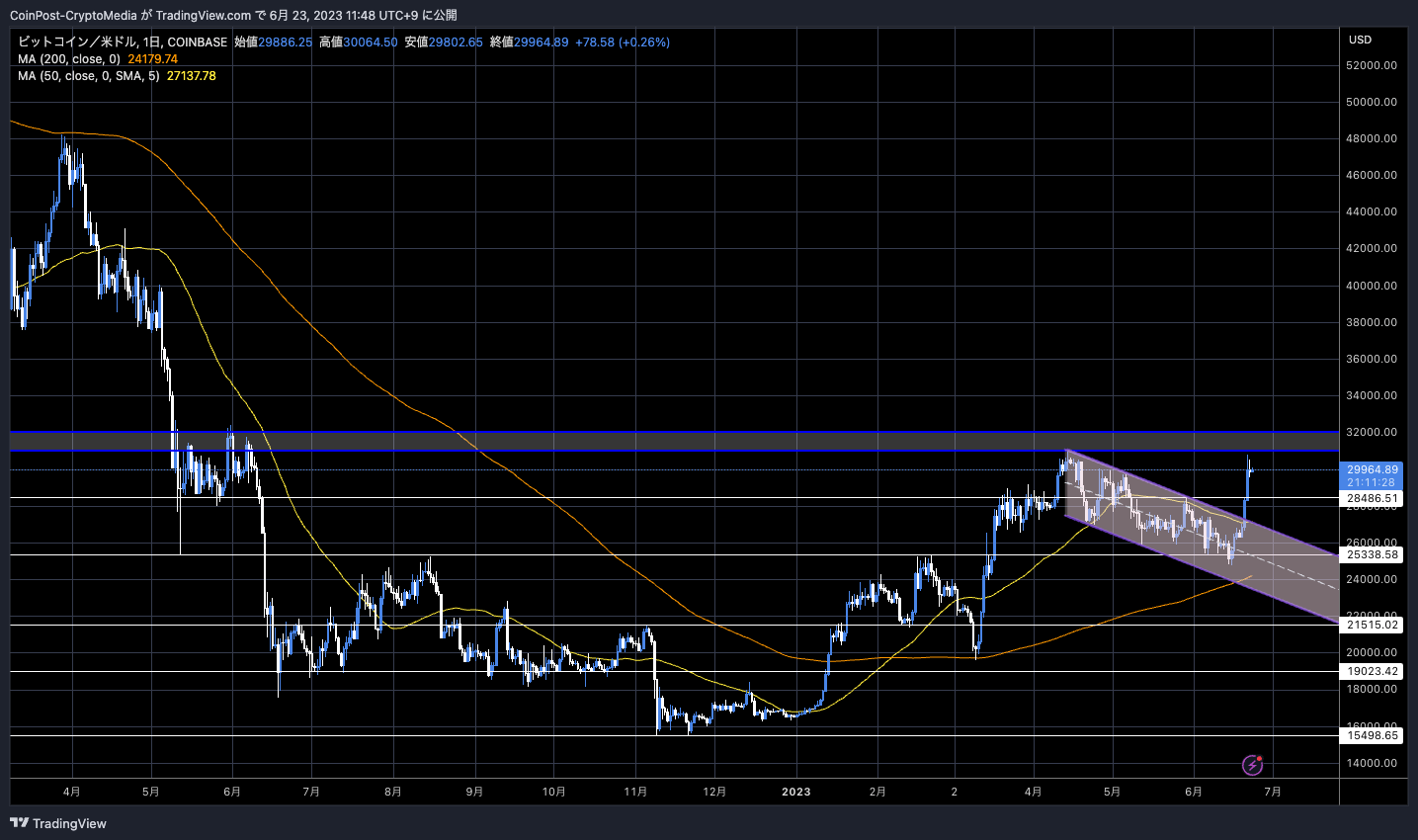

BTC/USD daily

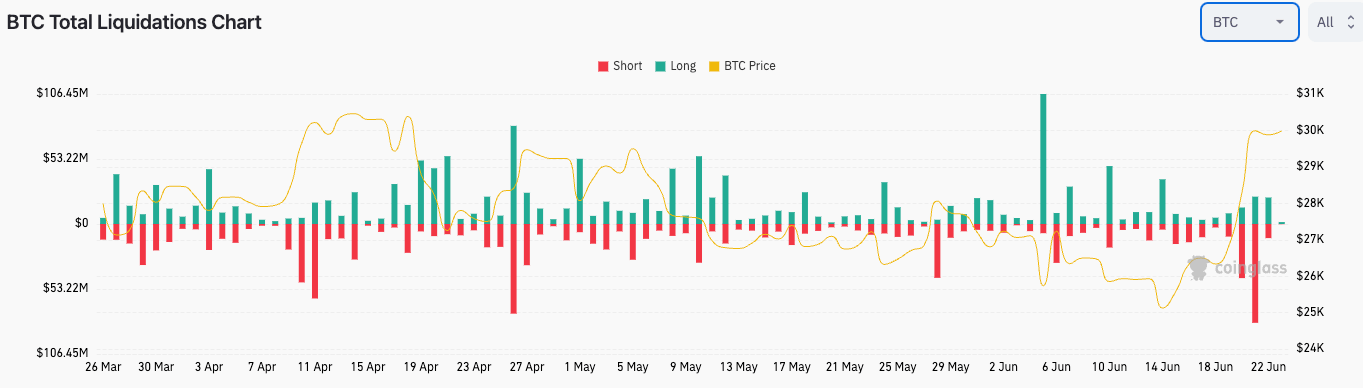

In the cryptocurrency futures market, there was a loss cut (forced liquidation) of $180 million (20 billion yen) of short positions, the largest amount in the past three months, and short covering pushed up the market.

coin glass

The year-to-date high of $31,000, which was recorded in early April, is a major resistance line (upper resistance line) that is also considered as a turning point of the previous virtual currency bubble in 2021, and the fuel for the rise has been mostly digested. Therefore, there is a possibility that they will rub each other once.

Nonetheless, there is a growing view that the trend has reversed in the short term due to factors such as the break of the descending channel. Considering the size of the material for the Bitcoin ETF (exchange traded fund) that BlackRock has applied for, is it likely to see a dip in the price range if it is adjusted?

The U.S. Nevada State Financial Institutions Authority issued a partial business suspension order to crypto asset (virtual currency) custody company Prime Trust due to concerns about financial deterioration, affecting several companies such as payment infrastructure company Stably. affected.

Concerns about asset preservation spilled over to True USD (TUSD), a stablecoin backed 1:1 by the US dollar, causing a temporary dipeg (price divergence). The issuing company, TrueUSD, has been busy alleviating concerns, such as issuing a statement that it has no exposure to Prime Trust.

Binance, the world’s largest crypto asset (virtual currency) exchange, has suspended new issuance following enforcement actions against Binance USD (BUSD) and issuer Paxos by regulators such as the U.S. SEC (Securities and Exchange Commission). Investors’ anxiety increased as they were increasing the number of TUSD currency pairs as an alternative to BUSD, which was forced to do so.

connection:Binance Increases Currency Pairs for Stablecoin TUSD

Bitcoin ETF related

The material for the future is likely to depend on the progress of the Bitcoin ETF (exchange traded fund) application by BlackRock, the largest asset management company.

When BlackRock’s application was revealed, the US SEC (Securities and Exchange Commission) filed lawsuits against Binance and Coinbase, and the designation of altcoin as a securities, which caused a stir in cryptocurrency investor sentiment. The coin price turned to a reversal offensive.

BlackRock is the world’s largest asset manager with US$8.59 trillion under management at the end of 2022. The past ETF approval record is outstanding, and expectations are high for the approval of the industry’s first physical bitcoin ETF.

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

After that, major financial institutions WisdomTree and Invesco Asset Management submitted Bitcoin ETF applications. In addition, there are speculations that Fidelity Investments, which manages 4.2 trillion, is also preparing to apply for a Bitcoin ETF.

Fidelity is also said to be interested in a competitive bid from Digital Currency Group (DGC), which is suffering from debt concerns due to the effects of the bankrupt lending subsidiary Genesis Capital, etc., and if the acquisition is realized, DGC’s bankruptcy. Not only concerns but also market concerns about debt consolidation (forced sale) related to the investment trust “GBTC” of the small company Grayscale will be dispelled.

connection:Digital Currency Group and Genesis could break up on debt repayment plans

Barriers to entry for institutional investors are also being removed.

On the 21st, the non-custodial cryptocurrency exchange “EDX Markets” will be launched, with funding from major US Wall Street companies such as Citadel Securities, Fidelity Investments, and Charles Schwab, as well as major VCs such as Sequoia Capital. was announced.

connection:EDX Markets, a virtual currency exchange funded by Wall Street Financial, opens in the United States

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin rises at important milestone, short positions cut massive losses appeared first on Our Bitcoin News.

2 years ago

119

2 years ago

119

English (US) ·

English (US) ·