Macroeconomics and financial markets

In the US NY stock market on the 23rd of the previous weekend, the Dow Jones Industrial Average fell 219 dollars (0.65%) from the previous day, and the Nasdaq Index closed 138 points (1.01%) lower.

connection:NY Dow flat, virtual currency-related stocks slightly lower, Bank of England raises unexpected interest rate | 23rd Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

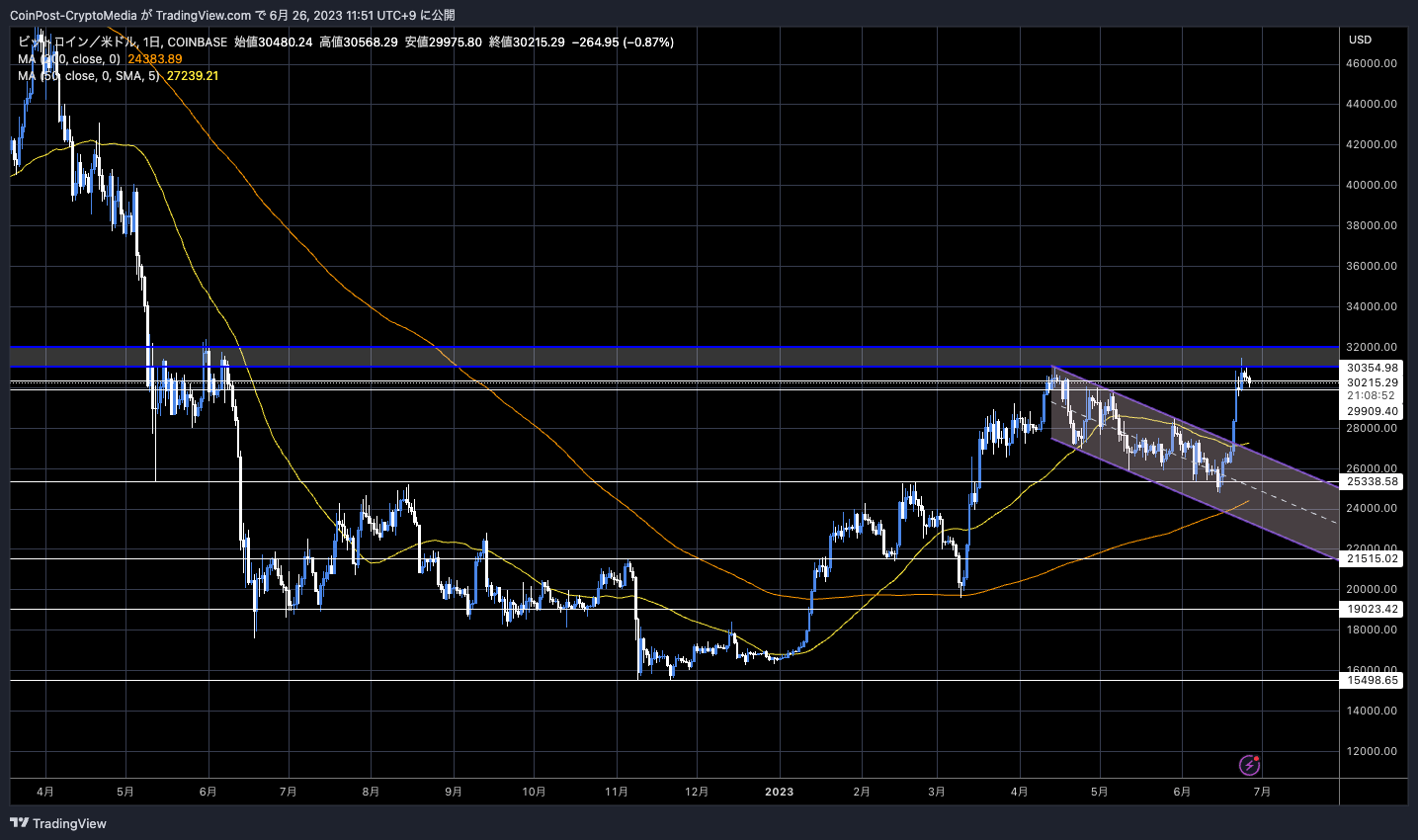

In the crypto asset (virtual currency) market, the Bitcoin price fell 2.07% from the previous day to 1 BTC = $ 29,990.

BTC/USD daily

Although it climbed to $31,443, breaking the year-to-date high of $31,050 recorded in April this year, it has soared at a rapid pace over the past week, and was blocked by a major resistance line (upper resistance line) and fell back.

connection:Bitcoin hits new year-to-date high, technically suggests bull market | bitbank analyst contribution

Aksel Kibar sees $34,000 as a possible high after the Head and Shoulders (H&S) break.

$BTCUSD 31K short-term resistance before the price target is met. H&S bottom price target stands at 34K and the latest breakout from the channel was strong.

More with today’s special #cryptocurrency report

>> https://t.co/3PXD6BGq77 pic.twitter.com/6GyPt8Sl74

— Aksel Kibar, CMT (@TechCharts) June 25, 2023

WillyWoo, an on-chain analyst, pointed out that the Funding Rate and Basis were reversing in the futures market in the downtrend since April. He suggested that professional investor demand prevailed.

This move was dominated by pros accumulating against a price decline.

Chart shows futures demand, usually the instrument of pros. They aren’t lightening their bags just yet, this can change fast.

Spot demand (longer term) was insignificant pic.twitter.com/FbXOkK8S2x

— Willy Woo (@woonomic) June 22, 2023

Basis is the price difference between the spot price and the futures price. According to Woo, professional investors may be looking for alternative assets in anticipation of a long-term weakness in the DXY.

On the 23rd, the BTC price rose to $31,430 as the US SEC (Securities and Exchange Commission) approved the leveraged Bitcoin futures ETF provided by Florida-based Volatility Shares for the first time. .

It will operate as a 2x leveraged bitcoin futures contract and will start trading on the CBOE BZX exchange on June 27th. The SEC’s stance of not approving leveraged ETFs in the past, citing “inadequate investor protection mechanisms,” can be seen to be softening.

connection:U.S. SEC Approved First Leveraged Bitcoin Futures ETF

The SEC has been suing Binance and Coinbase since April this year. Risk-averse selling was dominant, with the majority of the altcoins with the highest market capitalization being designated as securities. This led to a sharp rise in the price of Bitcoin.

After that, it was revealed that three major financial companies, Valkyrie, Invesco, and WisdomTree, had applied for a Bitcoin ETF.

altcoin

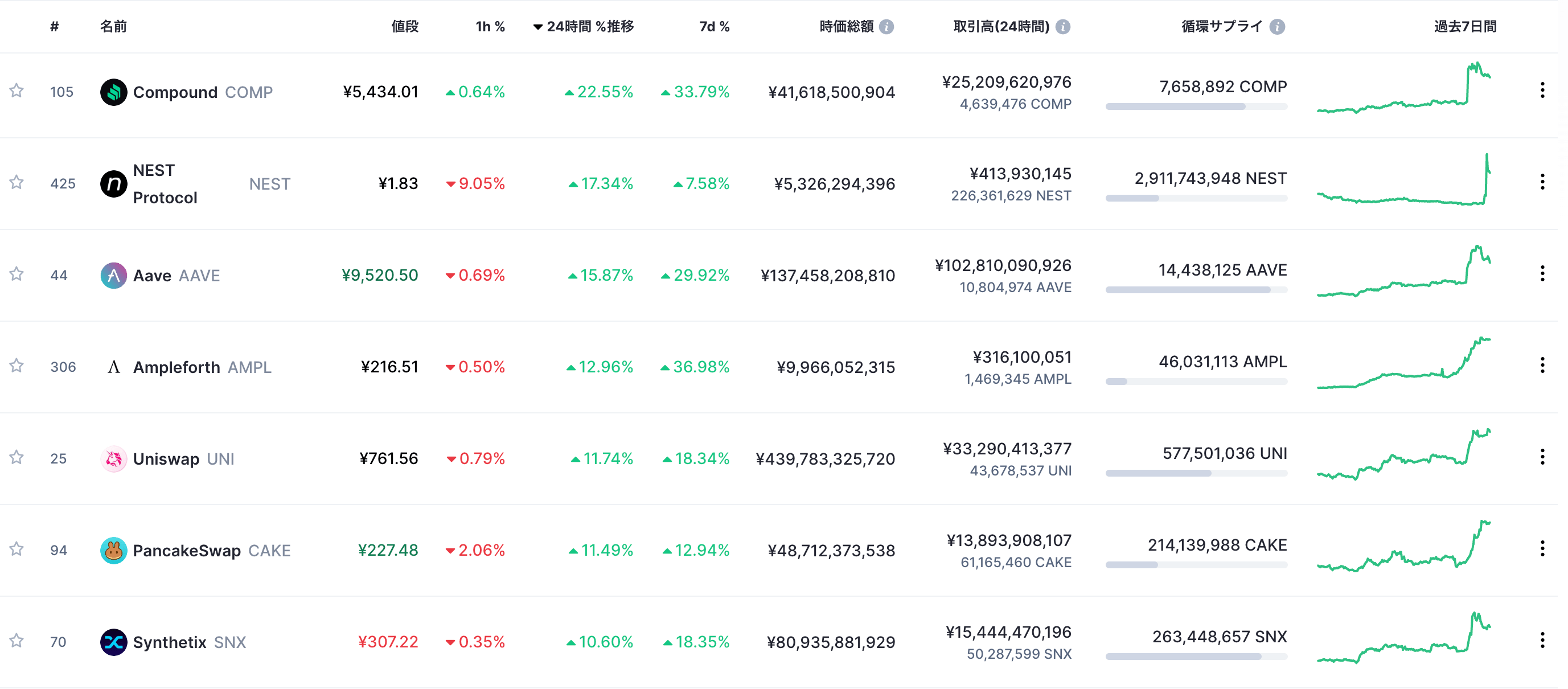

In the alt market, DeFi (decentralized finance) related stocks were searched.

Uniswap (UNI), Aave (AAVE), and Cube Finance (CRV) are high.

In the background of AAVE soaring, movements of whales (major investors) who bought the equivalent of 13.2 million dollars are also observed.

The price of $AAVE suddenly skyrocketed by ~27% in the past 5 hours, which seems to be related to the whale”0x5a80″.

Whale”0x5a80″ has accumulated 182,152 $AAVE ($13.2M) from exchanges through multiple addresses in the past 5 hours.

And holds currently 399,585 $AAVE ($29M). pic.twitter.com/vtjDFGlxIM

— Lookonchain (@lookonchain) June 25, 2023

connection:DeFi giant Aave prepares for “Polygon zkEVM” mainnet beta version = report

The U.S. SEC (Securities and Exchange Commission) has sued Binance, the largest crypto asset (virtual currency) exchange, and pointed out that Proof of Stake (PoS) currencies are unregistered securities. Interest grew rapidly.

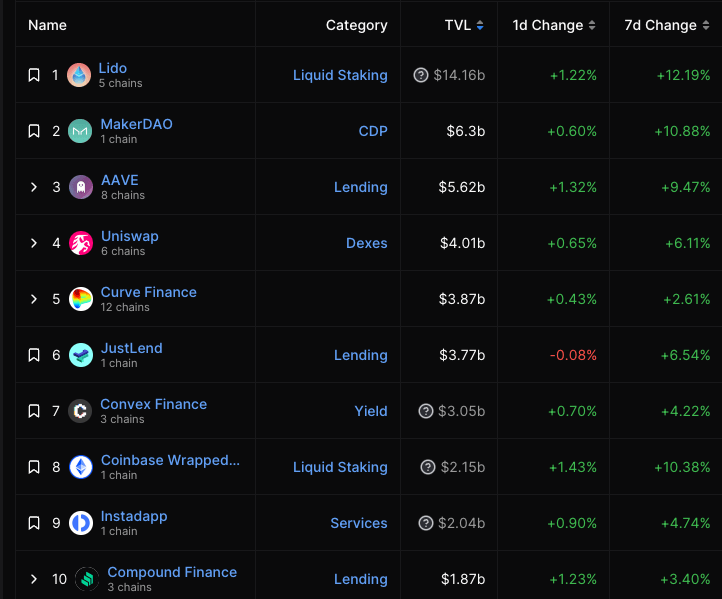

It is also reflected in “Total Value Locked (TVL)”, which indicates the total amount of funds deposited in the DeFi protocol, and Lido, MAkerDAO and AAVE all reached more than 10% compared to the previous week.

Defillama

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin rises to $ 31,400 and then falls, DeFi-related stocks are sought appeared first on Our Bitcoin News.

2 years ago

114

2 years ago

114

English (US) ·

English (US) ·